Social media platform Snap Inc.’s (SNAP) stock has declined about 21% so far this year, as investors are concerned about growing competition and a potential decline in advertising dollars amid a challenging macro environment, sparked by tariff wars. While the owner of Snapchat has been taking several initiatives, including integrating AI (artificial intelligence) features on its platform, analysts are cautious ahead of the company’s Q1 results on April 29 due to the potential impact of tariffs and weak consumer sentiment on ad budgets.

Wall Street expects Snap to report a loss per share of $0.13 for Q1 2025 compared to a loss per share of $0.19 in the prior-year quarter. Analysts expect Q1 earnings to be supported by a 13% growth in revenue to $1.35 billion.

Analysts Tread Carefully Ahead of Snap’s Q1 Results

Ahead of the results, HSBC analyst Mohammed Khallouf reduced his price target for Snap stock to $8.10 from $10.60 and maintained a Hold rating. Given the ongoing macro pressures, the 5-star analyst lowered his revenue growth forecasts by 300-500 basis points for FY25 and by 200-300 points for FY26 for social media and AdTech names under his firm’s coverage to better reflect a more sluggish near-to-medium-term global ad demand outlook.

Likewise, TD Cowen analyst John Blackledge reiterated a Hold rating on SNAP stock but lowered his price target to $10 from $12. The 5-star analyst reduced his 2025 and longer-term estimates to reflect a tough macro environment, as indicated by worsening consumer sentiment in TD Cowen’s proprietary U.S. consumer survey for March. Blackledge expects Snap to report a 12% Direct Response (DR) growth based on his positive digital ad check, which indicated robust advertiser growth.

Furthermore, he anticipates that Snap+ will capture 45% of the incremental revenue growth this year. Blackledge expects continued momentum for the DR advertising business this year, fueled by platform improvements. Overall, the analyst expects SNAP’s Q1 revenue to rise 11.8% to $1.34 billion, daily active users (DAUs) to increase 8.8% to 459 million, and average revenue per user (ARPU) to grow 2.7%, driven by gains across regions.

According to Main Street Data, Snap’s DAUs grew 9.4% in Q4 2024 to 453 million.

Is SNAP a Good Stock to Buy?

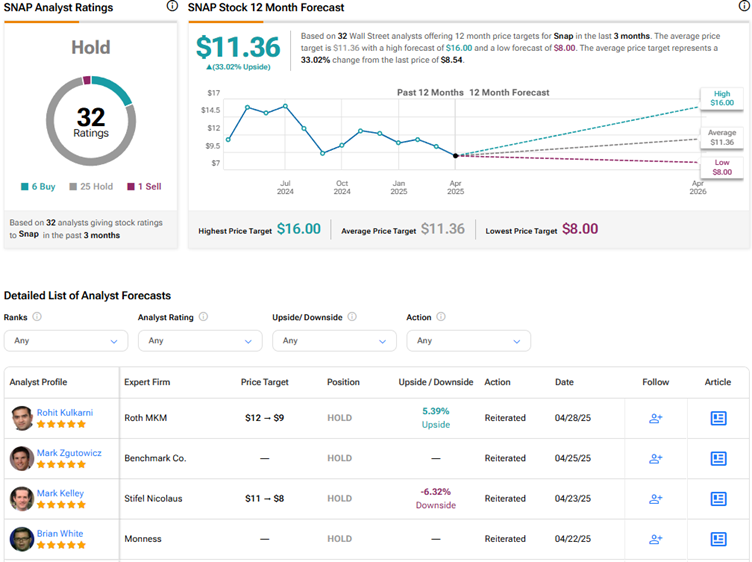

Amid the ongoing pressures and intense competition, Wall Street is sidelined on SNAP stock, based on six Buys, 25 Holds, and one Sell recommendation. The average SNAP stock price target of $11.36 implies 33% upside potential.