Four-star Bank of America Securities analyst Jessica Reif Ehrlich warned clients that several factors could weigh on Disney (DIS) in its Fiscal Q1 2025 earnings report. According to the analyst, the company’s Experiences segment will suffer as wage increases and preopening expenses for new cruise lines hit profits.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Natural disasters are another issue that could impact Disney in its latest earnings report. The company is still suffering the effects of two hurricanes last year that disrupted its business. Additionally, the Los Angeles wildfires may bring employee housing and business disruption issues, even if Disney wasn’t hit directly by the catastrophe.

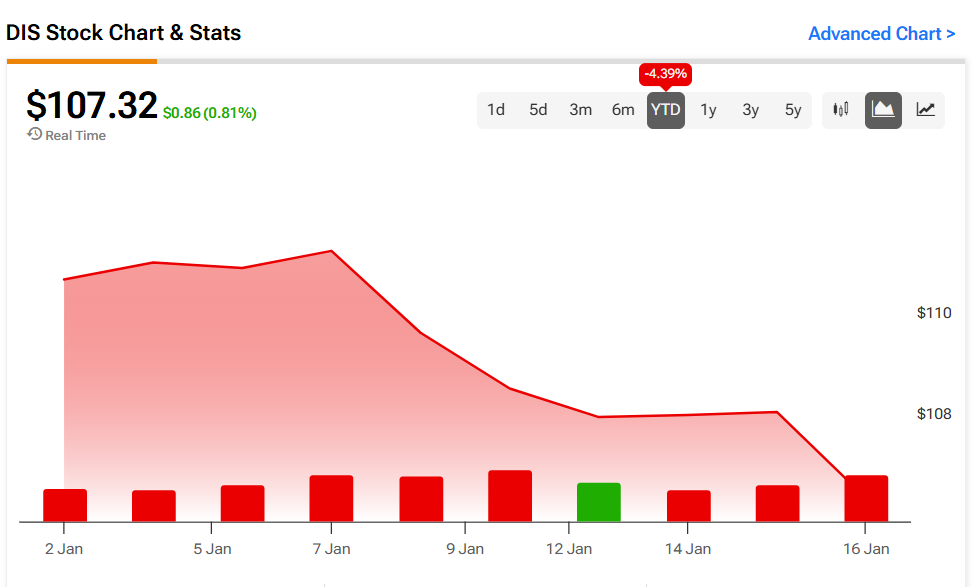

Despite these potential headwinds, Enrlich remains bullish on Disney shares. The analysts assigned a Buy rating to the stock alongside a $140 price target, representing a potential 30.17% upside for DIS shares. Investors will note that Disney stock is up 0.81% as of this writing but is down 4.39% year-to-date.

What to Expect from Disney in Fiscal Q1

Disney is set to release its Fiscal Q1 2025 earnings report on Feb 05, 2025. Wall Street expects the entertainment company to report earnings per share of $1.46 during the quarter. They also predict revenue of $24.69 billion for the period.

Looking at Disney’s earnings history, the company has beat earnings per share estimates in seven of the last eight quarters. However, revenue has consistently lagged estimates with the company missing them in all of its previous eight quarters.

Is DIS Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus for Disney is Strong Buy based on 17 Buy and five Hold ratings over the last three months. With that comes an average price target of $126.84, a high of $147, and a low of $108. This represents a potential 18.1% upside for DIS shares.