E-commerce leader Amazon (AMZN) got a Buy rating from five-star Bank of America Securities analyst Justin Post. With that comes a $230 price target, representing a potential 7.31% upside for AMZN shares. What’s behind the analyst’s bullish stance on Amazon?

Protect Your Portfolio Against Market Uncertainty

- Discover companies with rock-solid fundamentals in TipRanks' Smart Value Newsletter.

- Receive undervalued stocks, resilient to market uncertainty, delivered straight to your inbox.

Post argues that the e-commerce giant’s robot developments are “instrumental to improving Amazon’s cost structure.” He predicts it could cover 34% of the company’s total costs, as robotic workers would reduce labor costs, minimize employee injuries, and increase warehouse utilization. Amazon has shown its dedication to this with the opening of a next-generation Fulfillment Center that features additional robotic workers.

Amazon’s warehouse robots aren’t the only reason Post is excited about AMZN stock. He also highlighted the company’s advancements in autonomous vehicles and drones. These will help the company deliver packages to customers, cutting down on the cost of human labor.

Amazon Continues Focus on AI Assistance

It’s not just robots that Amazon is interested in. The retail company also continues to make advancements in AI development. Its latest effort on this front includes the use of AI to create “pause ads” that are relevant to users. The goal here would be creating ads on the fly that can match the context of what’s happening during a video. This could enhance the user experience, rather than interrupt it, all while netting the company additional ad revenue.

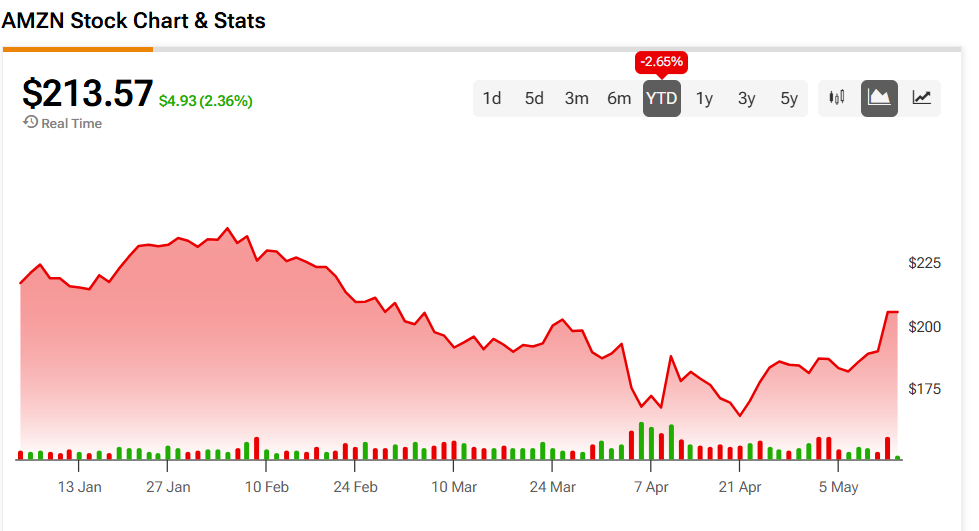

Investors appeared receptive to this idea as AMZN stock was up 2.36% on Tuesday morning. However, the stock remains down 2.65% year-to-date.

Is AMZN Stock a Buy, Hold, or Sell?

Turning to Wall Street, the analysts’ consensus rating for Amazon is Strong Buy, based on 46 Buy and one Hold ratings over the past three months. With that comes an average AMZN stock price target of $239.90, representing a potential 12.42% upside for the shares.