Apple (AAPL) stock suffered on Friday as analysts blasted the company after its Q2 2025 earnings report. As a quick reminder, the iPhone maker posted adjusted earnings per share of $1.65 alongside revenue of $95.36 billion. These results were better than Wall Street’s adjusted EPS and revenue estimates of $1.62 and $94.54 billion. However, the company also warned of a $900 million tariff headwind in its current quarter.

Apple stock was hit with two downgrades this morning as analysts reacted to its latest earnings report. First up was Jefferies, which dropped AAPL shares to an Underperform rating. Rosenblatt also downgraded the company’s stock, taking it from a Buy to a Neutral rating.

Rosenblatt analysts were critical of Apple’s iPhone strategy. They said the company needs to revamp the iPhone with AI to create a “sharp acceleration” in sales. Without this, it calls Apple a “well-run company, with OK-muted growth.” That might not be enough to maintain its trading premium in an uncertain economy and regulatory environment.

AAPL Stock Price Target Updates

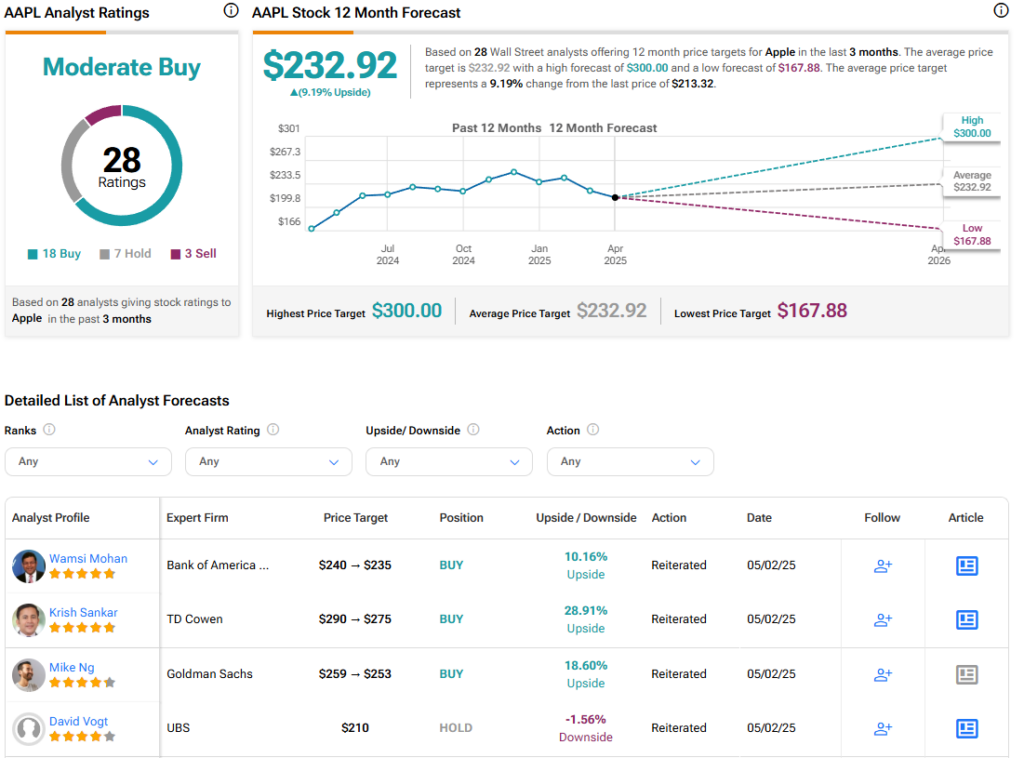

Apple also saw several analysts update their price targets for its shares after its Q2 results. For example, Rosenblatt’s downgrade came with a price target reduction from $223 to $217. On that same note, four-star Goldman Sachs analyst Mike Ng lowered his price target from $259 to $253, five-star TD Cowen analyst Krish Sankar cut his from $290 to $275, and five-star Bank of America analyst Wamsi Mohan dropped his from $240 to $235.

It wasn’t all price target cuts for Apple after its earnings report. D.A. Davidson’s four-star analyst Gil Luria increased his price target for AAPL from $230 to $250 after its earnings report.

Is AAPL Stock a Buy, Sell, or Hold?

Turning to Wall Street, the analysts’ consensus rating for Apple is Moderate Buy, based on 18 Buy, seven Hold, and three Sell ratings over the last three months. With that comes an average price target of $232.92, representing a potential 9.19% upside for AAPL stock. These ratings and price targets could change as more analyst updates roll in after earnings.