Intel (NASDAQ:INTC) shares have fallen by ~11% since President Trump’s ‘Liberation Day’ announcement of unprecedented tariffs, which triggered a wave of market volatility as trade partners threatened retaliation. While the broader market faced massive pressure over the past week, the S&P 500 bounced back today with a 2.5% gain.

‘Misery loves company,’ the saying goes – and at least this time, Intel investors could take some comfort in knowing that the bloodbath was widespread. This marked a shift from most of 2024 when INTC shareholders were forced to sit on the sidelines (green with envy) as many of their AI-powered peers shot into the stratosphere.

The past few months, however, have been a different story. Markets have been reeling in 2025, and even the industry-dominating Nvidia has lost 24% of its value year-to-date. By comparison, Intel’s losses of 2.5% since January 1st don’t seem so bad.

So, amid a storm of tariffs, could Intel be quietly positioning itself for a comeback? Investor Yiannis Zourmpanos foresees a silver lining.

“Tariffs are quietly rewriting the chip war, and Intel stands to gain the most, leveraging U.S. reshoring, defense contracts, and domestic fabs,” notes the investor.

Zourmpanos believes that Trump’s policies will generate a preference for U.S.-made semiconductors, particularly when it comes to more sensitive tasks required by the U.S. government’s security establishment. These defense-related contracts tend to be both higher-margin and more stable.

In addition, Zourmpanos predicts plenty of industry players in the private sector will be wary of depending on foreign-based suppliers, and will therefore look to shift their procurement and supply chains stateside.

On that note, Nvidia and AMD, whose supply chains are in China and Taiwan, could face some serious headwinds – potentially giving Intel a leg up. The investor also suggests that a weaker dollar, which has been dropping, could help with Intel’s exports.

“These fundamentals can help Intel gain market share in both AI PC and data center segments while building market momentum for its US-based foundry business,” adds Zourmpanos.

While the full implications of Trump’s tariff play remain unknown, the investor argues that they offer a compelling reason to take another look at INTC.

“Amid volatility and transformation, this underdog may offer an asymmetric upside the market hasn’t fully priced in,” concludes Zourmpanos, who rates INTC a Buy. (To watch Zourmpanos’ track record, click here)

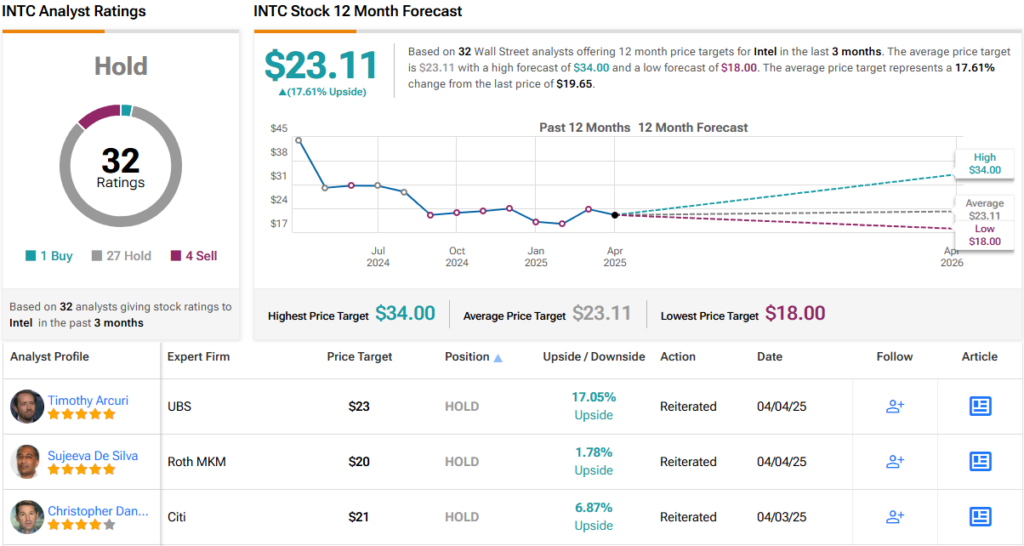

Wall Street, on the other hand, isn’t quite convinced. The stock carries a consensus Hold rating, with 27 analysts sitting on the fence, compared to just 1 Buy and 4 Sell recommendations. The average 12-month price target stands at $23.11, implying a potential upside of around 18% — but for now, most analysts are staying cautious. (See INTC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured investor. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.