With chip stock Intel (INTC) teaming up with fellow chip stock Nvidia (NVDA), there have been a lot of people wondering about the impact this will have on a variety of markets, including cryptocurrency. And as it turns out, the new Intel – Nvidia alliance might have some far-reaching effects. But investors are not even sort of happy, as evidenced by the fact that Intel shares are down over 3% in Tuesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 55% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Of course, getting Intel and Nvidia together means big things for artificial intelligence (AI). The potential to combine central processors (CPUs) with graphics processors (GPUs) represents a major potential advance in AI infrastructure and training large language models. This led to remarks from BitMind co-founder Ken Jon Miyachi, who noted, “It signals an AI industry consolidating to gain strategic advantages over competitors…while ensuring onshore U.S. manufacturing, which is a strong move from Nvidia given the importance the current administration has put on domestic manufacturing.”

Meanwhile, there are also implications for cryptocurrency, as Nvidia—which has long been a major force in crypto mining—will now have access to a major foundry operation located on American soil. And one that has been in need of major new clients since it got started. That gives Nvidia a great potential win going forward, and one for Intel as well.

“Intel Can’t Be Allowed to Fail”

CNBC analyst Jim Cramer once again took a step up about Intel, and declared in downright stark terms: “Intel can’t be allowed to fail.” Why not? There is simply too much at stake. Cramer noted that Intel was “…a great semiconductor company that’s been left behind by the AI revolution,” but it “…needs money to get back in the game.”

And while it may seem odd that Intel is courting its competitors for that necessary money, Cramer regards it as “…natural.” And it does make a certain amount of sense; when a company invests in Intel, it might be able to broker a deal with repayment at least partially in product. Electronics makers might be able to get their Intel chips a lot less expensively going forward, and that could be good news in and of itself.

Is Intel a Buy, Hold or Sell?

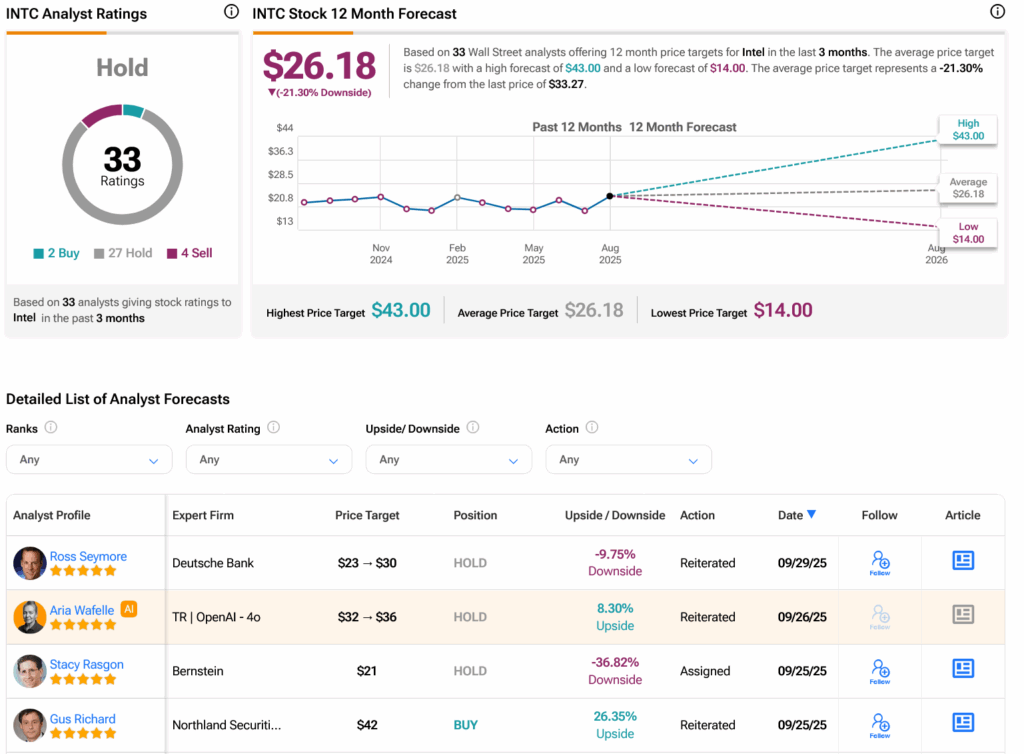

Turning to Wall Street, analysts have a Hold consensus rating on INTC stock based on two Buys, 27 Holds and four Sells assigned in the past three months, as indicated by the graphic below. After a 51.96% rally in its share price over the past year, the average INTC price target of $26.18 per share implies 21.3% downside risk.