Workers the world over are considering the notion of artificial intelligence (AI) with a mixture of wonder and terror. Not without reason, either; this has the potential to fundamentally shake up the world of work so hard it is unrecognizable from what it is today. Tech giant Microsoft (MSFT) just offered a new study on AI at work, and investors are slightly concerned as well. They sent Microsoft shares down fractionally in Tuesday afternoon’s trading.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Microsoft researchers started up a study to determine which careers were most likely to see some kind of impact due to generative AI, and which were least likely. The study was based on 200,000 conversations between United States users and the Copilot chatbot. What it found was about what you might expect. As one commentator put it: “An AI chatbot is a pretty good interpreter. It can’t dredge a river.”

Those whose jobs have a communications bent to them—translators, historians, and yes, even us writers—are most likely to see their jobs impacted by AI. Several jobs would have no or virtually no contact with AI, including bridge and lock tenders, foundry mold and coremakers, and yes, dredge operators. The study also quietly avoided the big question: would AI be a net job creator or a net job destroyer? Both sides have weighed in, and weighed in heavily, believing that AI will either be a tool as helpful as PCs and electric lighting or a great way to get work done without actually paying people to do it.

Employees React

Meanwhile, earlier, Microsoft CEO Satya Nadella released a memo about layoffs, even while Microsoft was reaping staggering profits—$75 billion over three fiscal quarters, reports noted—and putting a lot of those profits into artificial intelligence. But Microsoft employees are wondering what is up, especially after Microsoft fired around 15,000 people this year despite those impressive profits.

Employee reactions range from, reports note, “…suspicion about impending job cuts to criticism of what is being termed as the company’s tone-deaf messaging.” Nadella’s memo pointed out that the cuts had been “…weighing heavily…” on him, but employees are questioning if the memo is just setting up more cuts to come. One even suggested Microsoft was like a “…coal mine focused solely on extracting more resources.”

Is Microsoft a Buy, Hold or Sell?

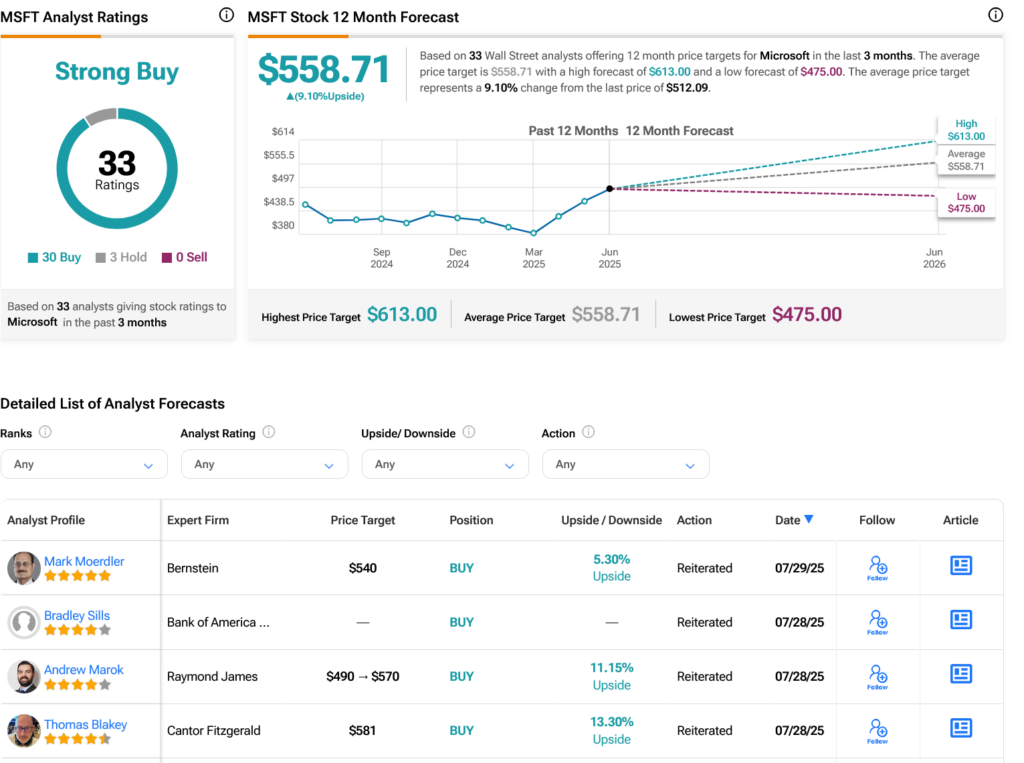

Turning to Wall Street, analysts have a Strong Buy consensus rating on MSFT stock based on 30 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 21.18% rally in its share price over the past year, the average MSFT price target of $558.71 per share implies 9.1% upside potential.