Despite signs of an economic slowdown and rising geopolitical uncertainty, U.S. holiday sales are forecast to surpass $1 trillion for the first time this year, according to the National Retail Federation.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The leading voice of America’s nearly four million retailers says that despite everything that’s currently going on in the U.S. and wider world, consumers will remain resilient and continue spending money on gifts and other festive items during the year-end holidays.

The National Retail Federation forecasts that retail sales will increase at an annual pace of 3.7% to 4.2% between Nov. 1 and Dec. 31, translating into $1.01 trillion to $1.02 trillion in sales. That outlook is positive for leading retailers and e-commerce companies such as Amazon (AMZN), Walmart (WMT), and Costco Wholesale (COST).

Tariff Impacts

The National Retail Federation’s holiday 2025 forecast is bullish and aggressive compared to other predictions for consumer spending in the final two months of the year. Consulting firm Deloitte is forecasting slower holiday sales growth in a range of 2.9% to 3.4%. In 2024, holiday spending in the U.S. increased 4.3%.

Many forecasters are also warning of tariff impacts this Christmas season. Online lending marketplace LendingTree (TREE) just released a report estimating that import tariffs will increase holiday costs for Americans by $40.6 billion this November and December.

Is AMZN Stock a Buy?

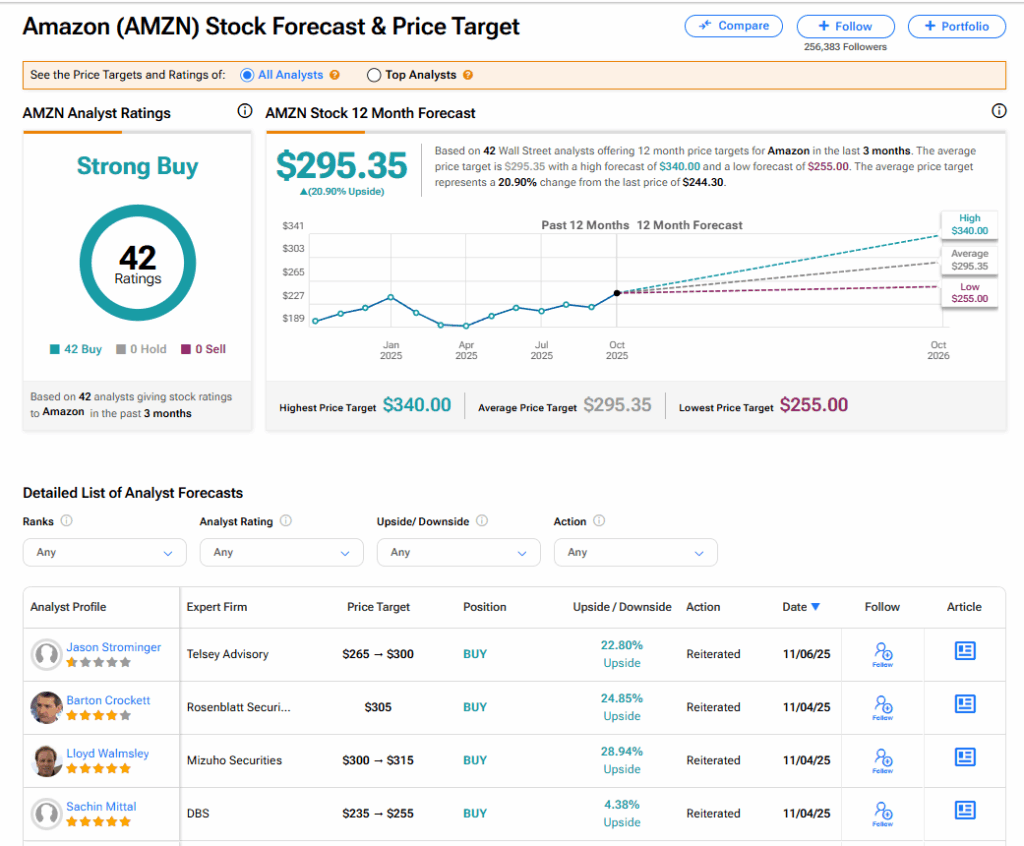

AMZN stock has a consensus Strong Buy rating among 42 Wall Street analysts. That rating is based on 42 Buy recommendations assigned in the last three months. The average AMZN price target of $295.35 implies 20.90% upside from current levels.