Amazon (AMZN) and Microsoft (MSFT) are two of the biggest players in Big Tech, both benefiting from long-term trends like cloud computing, AI, and digital services. So far in 2025, Amazon’s stock is up about 6%, while Microsoft has posted a stronger gain of roughly 16%. As 2026 approaches, investors are looking for the right balance between growth and stability. In this article, we compare AMZN and MSFT to see which stock could be the smarter buy heading into 2026.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Amazon or Microsoft: A Quick Comparison

- Amazon is driven by e-commerce scale and the growth of its high-margin AWS cloud business, with added upside from advertising and AI services.

- Microsoft is powered by recurring enterprise software revenue, expanding Azure cloud adoption, and strong AI integration across its product ecosystem.

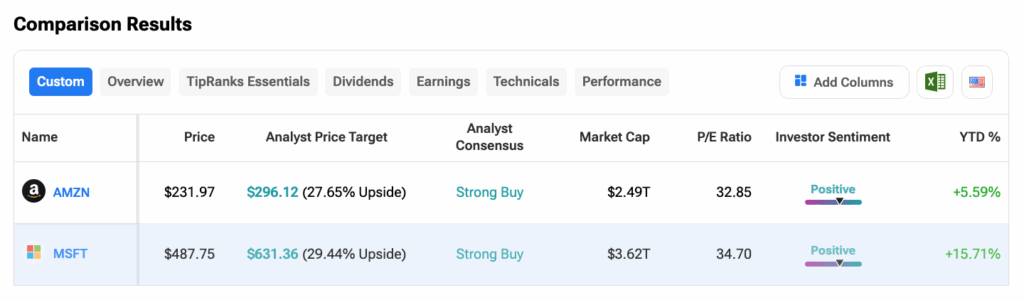

Using the TipRanks Stock Comparison Tool, we have compared Amazon and Microsoft against each other on different parameters.

Let’s take a closer look at these two stocks.

Amazon (NASDAQ:AMZN)

Amazon’s bullish case for 2026 is driven by its multiple growth engines. AWS remains a key profit driver as cloud and AI demand continue to expand, while its core e-commerce business benefits from scale, faster delivery, and improved margins. AWS performance obligations, which reflect future revenue commitments for AWS services, totaled $200 billion as of September 30, 2025. In addition, Amazon’s fast-growing advertising business adds a high-margin revenue stream, positioning the company for steady growth and stronger cash flow heading into 2026.

On Wall Street, Wedbush’s five-star-rated analyst Scott Devitt has the Street-high price target of $340 for AMZN. Devitt is bullish on Amazon’s multi-year strategic partnership with OpenAI. He stated that the agreement strengthens Amazon’s cloud strategy and builds on its existing partnership with Anthropic, where AWS already serves as the primary cloud provider. Overall, he views the OpenAI partnership as another positive step for Amazon.

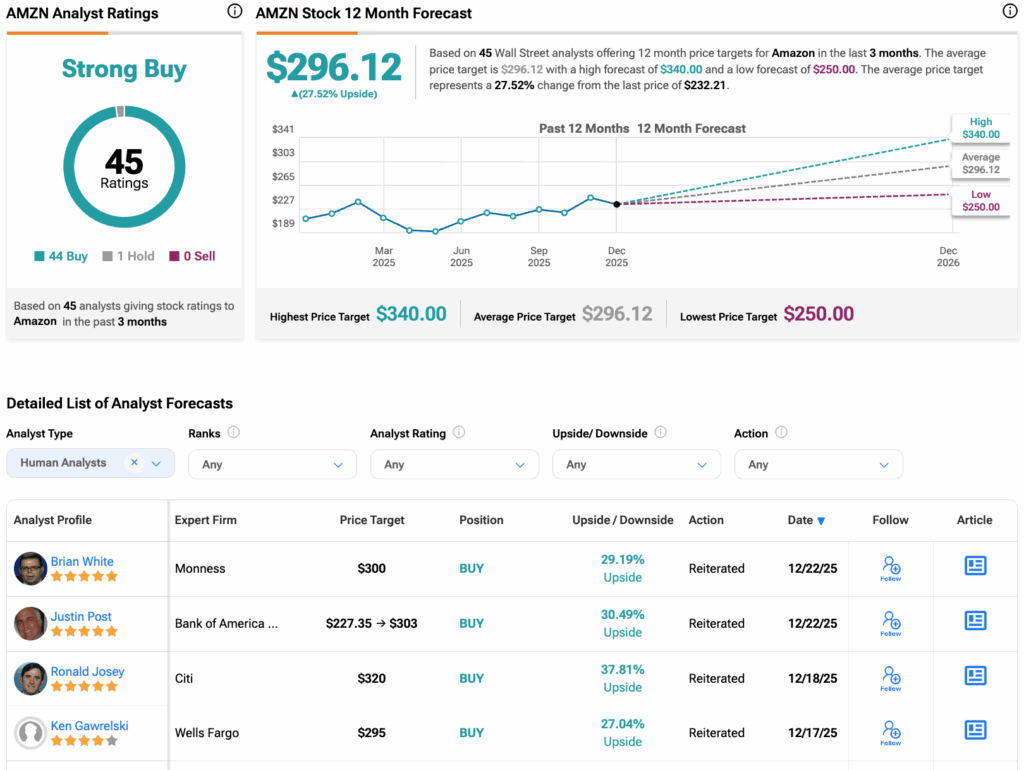

AMZN Stock Forecast

Overall, AMZN stock has a Strong Buy rating from analysts backed by 44 Buys and one Hold assigned over the last three months. Meanwhile, Amazon’s average stock price target of $296.12 implies an upside of 27.52% from current levels.

Microsoft (NASDAQ:MSFT)

Microsoft’s bullish case for 2026 rests on its strong position across cloud computing, AI, and enterprise software. In its most recent quarter, Microsoft’s commercial remaining performance obligations surged 51% to $392 billion, highlighting how the company’s growing focus on AI is driving Azure’s expansion. While higher AI infrastructure costs remain a challenge, strong cloud revenue and ongoing innovation in AI tools continue to position Microsoft for long-term growth as demand for AI accelerates.

On Wall Street, Wells Fargo’s analyst Michael Turrin has the highest price target on MSFT stock of $700. Turrin remains more confident in the durability of Azure’s growth, citing strong bookings trends. He now expects Azure’s growth to remain relatively steady through fiscal 2026, ending at 35%, up slightly from its prior estimate of 34%.

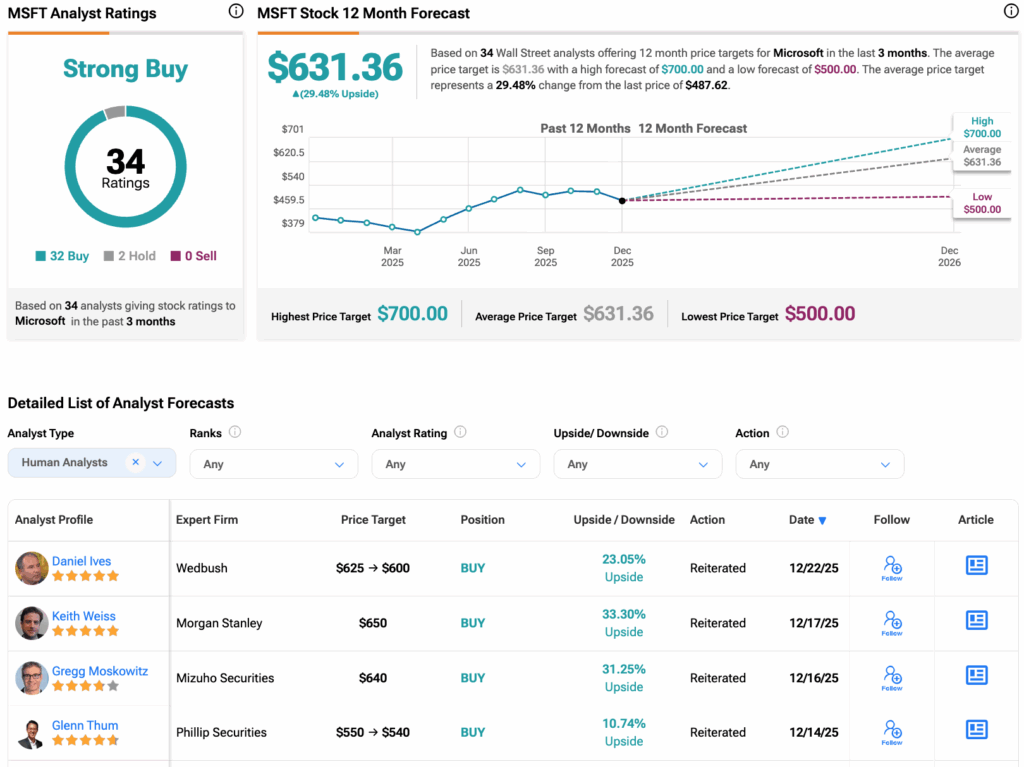

Microsoft Stock Forecast

Overall, MSFT stock has a Strong Buy rating from analysts backed by 32 Buys and two Holds. Microsoft’s average stock price target of $631.36 implies an upside of almost 30% from current levels.

Conclusion

Both AMZN and MSFT are rated Strong Buy by analysts and offer similar upside of around 30% from current levels. Amazon provides upside from AWS, advertising, and improving retail margins, making it attractive for growth-focused investors. Microsoft offers a more balanced profile with steady cloud growth, deep AI integration, and reliable cash flows, which may suit investors seeking stability heading into 2026.