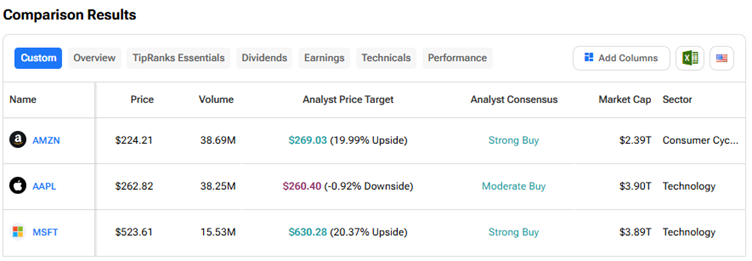

The Magnificent 7 stocks – Alphabet (GOOGL), Amazon (AMZN), Apple (AAPL), Meta Platforms (META), Microsoft (MSFT), Nvidia (NVDA), and Tesla (TSLA) are generally in focus due to their market dominance and influence on the broader market. This week, five of the Magnificent 7 stocks are scheduled to announce their September quarter earnings. Using TipRanks’ Stock Comparison Tool, we placed Amazon (AMZN), Apple (AAPL), and Microsoft (MSFT) against each other to find the most attractive Magnificent 7 stock ahead of the upcoming earnings, according to Wall Street analysts.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Amazon (NASDAQ:AMZN) Stock

Amazon stock has risen just 2.2% year to date, underperforming the other Magnificent 7 stocks. While the company’s Q2 results exceeded estimates, its third-quarter earnings guidance fell short of expectations, raising concerns about the impact of its hefty artificial intelligence (AI) investments.

The e-commerce and cloud computing giant is expected to announce its Q3 earnings on October 30. Wall Street expects AMZN to report a 10% growth in Q3 earnings per share (EPS) to $1.57, with revenue expected to rise about 12% to $178 billion. Investors will focus on the company’s Amazon Web Services (AWS) cloud business, which is benefiting from the ongoing AI boom but delivering revenue growth at a slower rate than Microsoft’s Azure and Alphabet’s Google Cloud.

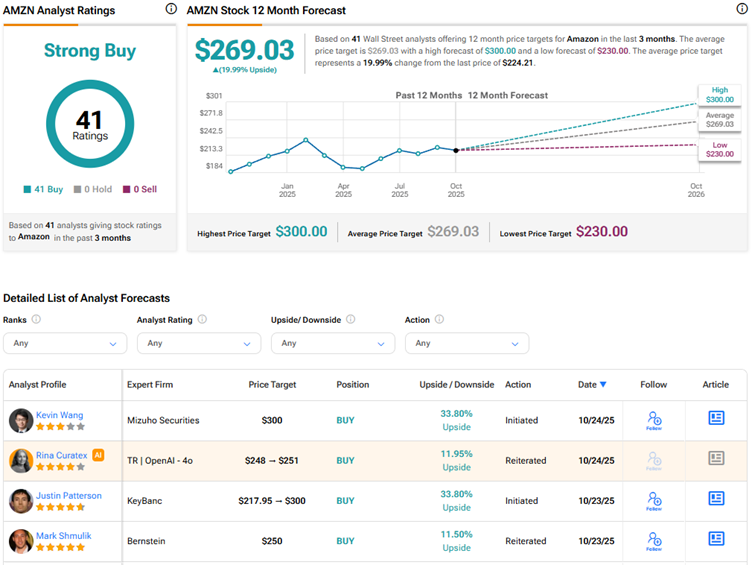

Is Amazon a Buy, Hold, or Sell?

Recently, KeyBanc analyst Justin Patterson initiated a Buy rating on Amazon stock with a price target of $300. The top-rated analyst expects advertising and grocery expansion to support the company’s growth. Patterson added that advertising is driving Amazon’s retail gains and could help the grocery business to become a bigger contributor over the medium term.

Meanwhile, Patterson contends that investors are underestimating a rebound in AWS. He noted that the slower growth in AWS compared to peers is due to scale constraints rather than lost demand. Patterson is optimistic that new data center projects such as Project Rainier, which will power AI startup Anthropic’s training clusters, could help accelerate growth in 2026. The analyst believes that AWS remains well-positioned to capture AI-driven workloads once new capacity comes online. At a valuation of 22.9x the 2027 earnings estimate, Patterson noted that AMZN stock is trading below its historical average and presents an attractive entry point.

Overall, Amazon stock scores a Strong Buy consensus rating based on 41 unanimous Buys. The average AMZN stock price target of $269.03 indicates 20% upside potential.

Apple (NASDAQ:AAPL) Stock

iPhone maker Apple is scheduled to announce its results for the fourth quarter of Fiscal 2025 on October 30. Apple stock has risen 5% year to date. While Apple bulls are optimistic about demand for the iPhone 17 and continued growth in Services revenue, other analysts are concerned about the impact of the U.S.-China trade war, regulatory woes, and slow progress on the AI front relative to rivals.

Meanwhile, Wall Street expects Apple to report 8% year-over-year growth in its Q4 FY25 EPS to $1.77, with revenue estimated to rise 7.5% to $102.1 billion.

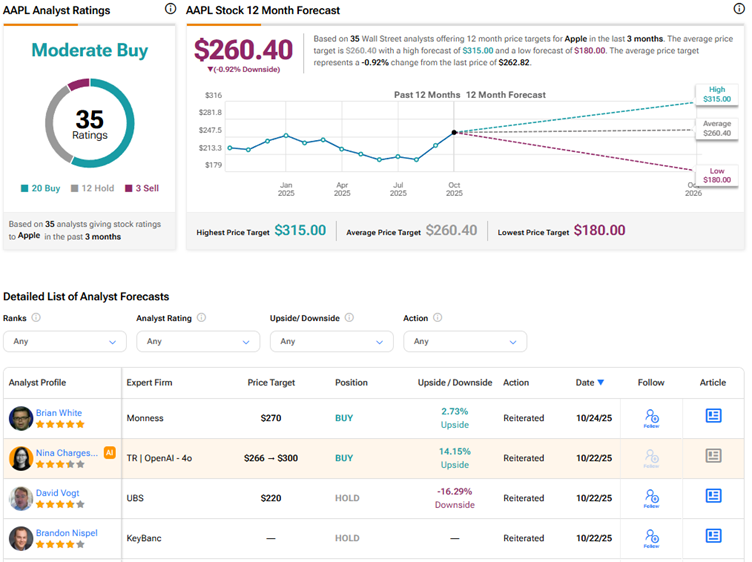

Is Apple a Good Stock to Buy?

Ahead of Q4 FY25 earnings, Wells Fargo analyst Aaron Rakers reiterated a Buy rating on Apple stock and raised his price target to $290 from $245. Rakers expects the company to report EPS of $1.79 on revenue of $102.4 billion. The 5-star analyst believes investors will focus on Apple’s potential AI roadmap amid debate over whether the company is lagging its rivals in this field.

Rakers is bullish about Apple’s ability to ultimately capitalize on the AI wave and integrate more powerful AI features across the company’s devices, supported by its “strong ecosystem and its famous intuitive design language.” The analyst also expects Apple’s Q4 FY25 results to reassure investors about its ability to sustain double-digit growth in its Services business.

Currently, Wall Street has a Moderate Buy consensus rating on Apple stock based on 20 Buys, 12 Holds, and three Sell recommendations. The average AAPL stock price target of $260.40 indicates that shares are fully priced at current levels.

Microsoft (NASDAQ:MSFT) Stock

Microsoft stock has advanced by more than 24% year to date. The tech giant is scheduled to announce its results for the first quarter of Fiscal 2026 on October 29. Wall Street expects MSFT to report EPS of $3.67, reflecting an 11.2% year-over-year growth. Revenue is projected to grow by about 15% to $75.37 billion.

Notably, the company’s Azure cloud computing business is viewed as one of the key beneficiaries of the ongoing AI wave. Microsoft is also expected to gain from the strong momentum in the adoption of its Copilot AI assistant. Investors will focus on MSFT’s ability to sustain the growth in its Azure business, update on efforts to address capacity constraints, and the momentum in AI-driven growth to justify its high capex.

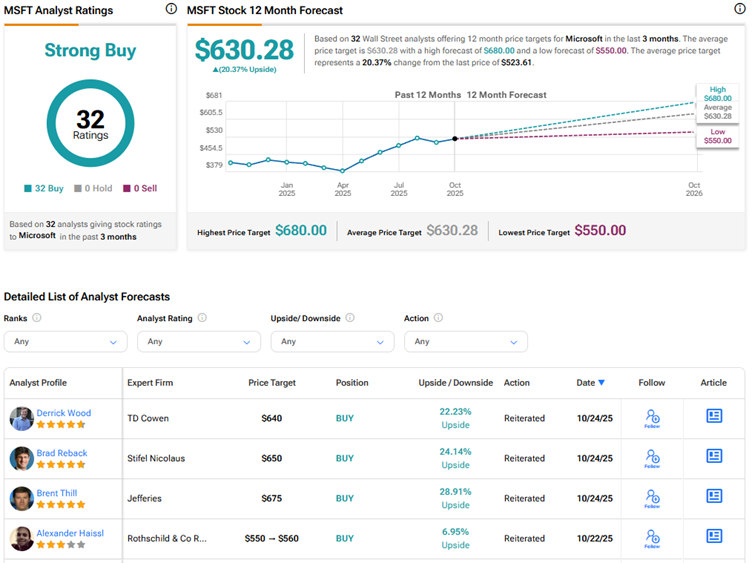

What Is the Price Target for Microsoft Stock?

Recently, TD Cowen analyst Derrick Wood reiterated a Buy rating on Microsoft stock with a price target of $640. The 5-star analyst highlighted that checks suggest Azure data center activity has “started to heat back up” over the last month, which reflects upbeat AI demand signals and upside to Azure growth over the medium term.

Wood expects Microsoft to deliver solid Q1 results and provide healthy Q2 FY26 guidance, especially for Azure. The analyst expects 37% growth (constant currency) in Azure, in line with the Street’s expectations.

With 32 unanimous Buys, Microsoft stock earns Wall Street’s Strong Buy consensus rating. At $630.28, the average MSFT stock price target indicates 20.4% upside potential.

Conclusion

Currently, Wall Street is highly bullish on Amazon and Microsoft stocks, and cautiously optimistic about Apple. Heading into the September quarter earnings, analysts see around 20% upside potential in both Amazon and Microsoft stocks. Both companies are expected to continue to gain from AI tailwinds. Investors will mainly focus on growth in Amazon’s AWS business and Microsoft’s Azure and other cloud services to assess whether the elevated investments made by these tech giants are yielding the desired results.