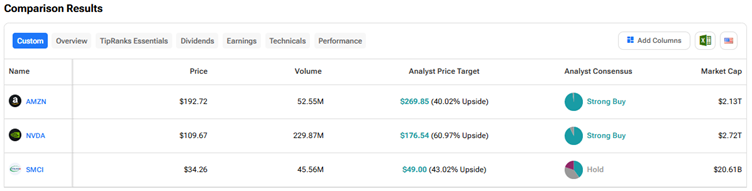

The emergence of China’s artificial intelligence (AI) startup DeepSeek, growing competition, and concerns over the impact on demand and spending due to a potential economic slowdown amid tariff wars and macro challenges have adversely impacted AI stocks this year. Nonetheless, analysts remain bullish on several AI stocks, thanks to the attractive long-term opportunities in the AI market. Using TipRanks’ Stock Comparison Tool, we placed Amazon (AMZN), Nvidia (NVDA), and Super Micro Computer (SMCI) against each other to find the best AI stock, according to Wall Street analysts.

Amazon.com (NASDAQ:AMZN)

Amazon has been leveraging AI to enhance its business across e-commerce, AWS (Amazon Web Services), and advertising. In particular, the e-commerce and cloud computing company’s AWS business is expected to gain the most from AI tailwinds.

The AWS division is benefiting from a rise in AI workloads from various customers. Notably, AWS is a higher-margin division compared to Amazon’s retail business, and the enhanced AI prospects will help the unit contribute robust profits.

Amazon is taking several initiatives to capture the massive opportunities in the AI space. For instance, the company launched the Trainium chips, which are purpose-built by AWS for AI training and inference to deliver high performance while reducing costs. Moreover, Amazon has boosted its 2025 capex to $100 billion from $83 billion last year, with most of the spending being allocated to AWS for supporting the demand for its AI services.

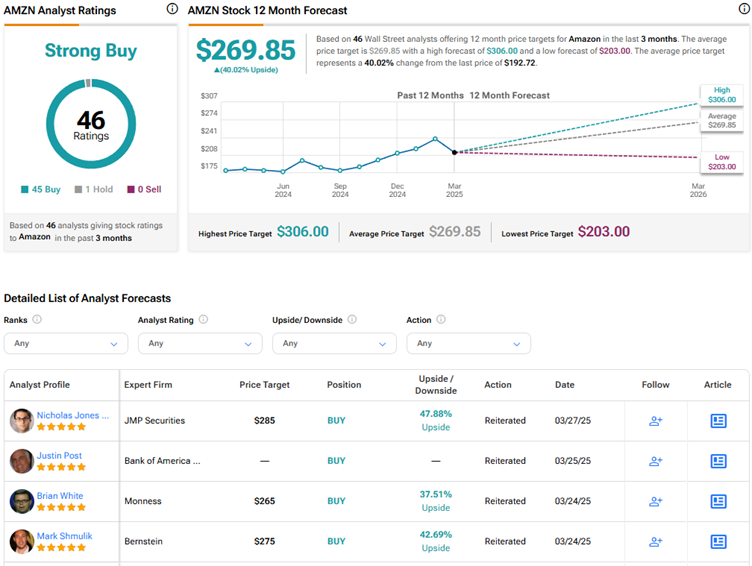

Is AMZN Stock a Buy, Hold, or Sell?

Recently, Monness analyst Brian White reiterated a Buy rating on Amazon stock with a price target of $265. The 5-star analyst is bullish on Amazon for a number of reasons that reinforce the company’s strategic positioning and growth potential. White believes that despite some short-term challenges, AWS is well-positioned to capitalize on the long-term growth trends in AI.

White noted that Amazon has already gained from generative AI by training large language models and is now poised to benefit from an increase in inferencing activity, which is expected to exceed training in terms of scale and ensure a promising future for AWS.

Additionally, AWS and other cloud service providers are expected to be major beneficiaries of the significant capital expenditures in AI infrastructure. Overall, White is bullish on AMZN stock due to company-specific factors and the broader industry trends in AI and cloud services.

Wall Street has a Strong Buy consensus rating on Amazon stock based on 45 Buys and one Hold recommendation. The average AMZN stock price target of $269.85 implies 40% upside potential. Amazon stock is down 12% so far this year.

https://www.tipranks.com/stocks/amzn/forecastSee more AMZN analyst ratings

Nvidia (NASDAQ:NVDA)

After enjoying a strong rally last year, Nvidia stock has declined more than 18% so far in 2025. Despite its robust financials, the semiconductor giant is under pressure due to growing competition, ongoing trade wars, and the risk of additional chip export restrictions.

Regardless of Nvidia’s exposure to sales from China, several analysts remain bullish on the company’s prospects based on the strong demand for its advanced GPUs (graphic processing units) from American hyperscalers and other AI-focused companies. Moreover, Nvidia’s Blackwell platform and continued innovation are expected to drive future growth.

Is NVDA a Good Stock to Buy?

Following Nvidia’s GTC event, Truist Securities analyst William Stein reiterated a Buy rating on NVDA stock with a price target of $205. The analyst said that he believes the constructive outlook provided by the company at the event. Stein added that while Nvidia didn’t quantify customer build plans, it revealed enough details to adopt an increasingly “growthy view” for the next couple of years.

In particular, the bullish view about Nvidia is backed by emerging models that already need significantly greater compute, the company’s product roadmap to meet those needs, and very near-term customer orders that indicate spending is still accelerating.

Overall, Nvidia stock scores a Strong Buy consensus rating based on 39 Buys and three Holds. The average NVDA stock price target of $176.54 implies about 61% upside potential.

Super Micro Computer (NASDAQ:SMCI)

AI server maker Super Micro Computer’s stock has been on a roller coaster ride over the past year. After rallying due to optimism about the company’s AI offerings, SMCI stock was hit by accusations of accounting fraud, the resignation of its auditor, and the delay in the filing of financial reports. The company recently became current with its SEC filings, removing a major concern about a potential delisting.

SMCI bulls have expressed optimism about the company’s AI tailwinds and partnership with Nvidia and believe that concerns related to delayed filings are a matter of the past. However, bears are wary of the growing competition and the stock’s elevated valuation.

Is SMCI Stock a Good Buy?

Earlier this week, Goldman Sachs analyst Michael Ng downgraded Super Micro Computer stock to Sell from Hold and lowered the price target to $32 from $40, citing increasing competition in the AI server market, margin pressures, and valuation concerns. The analyst said that while SMCI stock is the best-performing stock in Goldman’s Hardware coverage based on year-to-date movement, he thinks that the risk-reward is now unfavorable due to downside risks on valuation, competition, and gross margins.

Ng also highlighted certain concerns, including growing rivalry in the AI server market, partially due to less product differentiation following research and development investments made by competitors to capture the large market opportunity. The analyst also noted declining gross margins as one of the reasons for the rating downgrade. Specifically, he expects gross margins to fall in Fiscal 2025-2027 owing to the Blackwell product transition, supplier and customer pressure, and rising competition.

Wall Street has a Hold consensus rating on SMCI stock based on four Buys, four Holds, and two Sell recommendations. At $49, the average SMCI stock price target implies about 43% upside potential. SMCI stock has risen 12.4% year to date.

Conclusion

Wall Street is bullish on Amazon and Nvidia stocks but sidelined on Super Micro Computer. Currently, they see higher upside potential in NVDA stock than in the other two AI stocks. Despite the ongoing challenges, analysts are optimistic about Nvidia due to the robust demand for its advanced GPUs that are required for building AI models.