Tech giants Amazon (NASDAQ:AMZN) and Salesforce (NYSE:CRM) are gearing up to invest in a new luxury retail company, Saks Global, the Wall Street Journal reported. This move comes when the luxury retail sector faces challenges from high inflation and changing consumer demand.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

New Luxury Retail Company: Saks Global

HBC, the parent company of Saks, is set to acquire its competitor, Neiman Marcus, in a $2.65 billion deal. Saks is a luxury department store chain. This acquisition will form a new luxury retail entity named Saks Global. The boards of both Saks and Neiman have approved the transaction, with an announcement expected soon.

Amazon and Salesforce will each take a minority stake in the new company. Amazon will focus on providing technology and logistics support. Salesforce will help with the integration and adoption of AI. Both Amazon and Salesforce already have business relationships with Saks. This new investment will further deepen their existing partnerships.

While Amazon and Salesforce are set to hold minority stakes in Saks Global, let’s examine the Street forecasts for these tech companies.

Is AMZN a Buy Right Now?

Amazon has taken several initiatives to streamline its operations, improve delivery speed, expand its offerings, and boost efficiency. It developed regional hubs that have reduced shipping distances and operational costs. Moreover, the company is investing in AI and integrating the technology into its products.

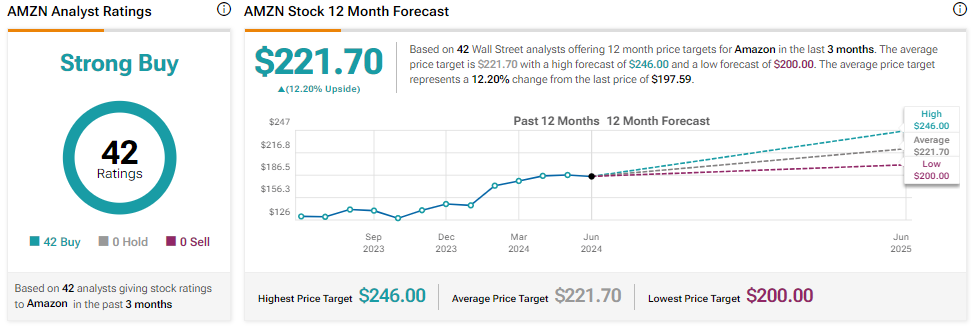

All these positives keep Wall Street analysts bullish about AMZN’s prospects. AMZN stock has 42 unanimous Buy recommendations for a Strong Buy consensus rating. The analysts’ average AMZN stock price target is $221.70, implying 12.20% upside potential from current levels. AMZN stock is up about 30% year-to-date, outperforming the S&P 500’s (SPX) 15.5% gain.

Is CRM a Buy, Hold, or Sell?

CRM has been expanding its portfolio and targeting growth avenues through acquisitions. Further, the launch of its generative AI tools, focus on cost reductions, and improving profitability are positives.

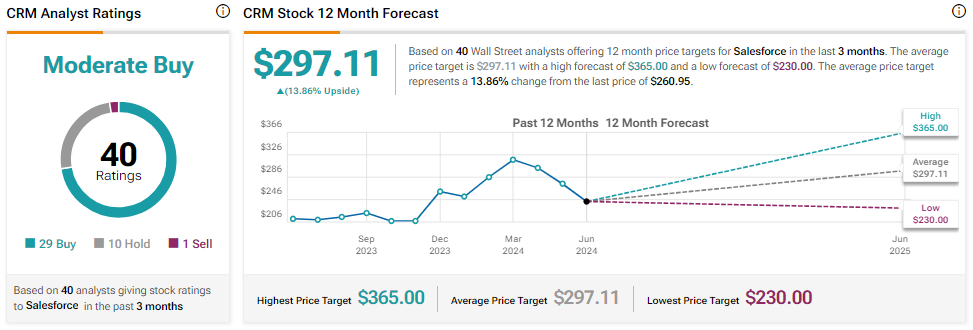

However, CRM is battling a slow-demand environment where enterprises are tightening their IT budgets. Thus, analysts are cautiously optimistic about CRM’s prospects. With 29 Buys, 10 Holds, and one Sell recommendation, CRM stock has a Moderate Buy consensus rating.

Analysts’ average price target on CRM stock is $297.11, implying 13.86% upside potential from current levels. CRM stock has underperformed the broader market this year and is trading in the red.