Amgen (AMGN) stock declined about 2% in the extended trading session yesterday after the company reported mixed Q2 results. AMGN reported strong top-line growth, driven by the acquisition of Horizon Therapeutics, completed in October 2023. However, higher merger-related costs weighed on profits.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

AMGN is a biopharmaceutical company that develops human therapeutics for serious illnesses.

AMGN: Q2 Snapshot

Amgen reported Q2 revenue of $8.39 billion, exceeding analyst estimates by $40 million and reflecting a 20% year-over-year increase. The company’s robust product sales growth of 20% was partially offset by a 3% decline in net selling prices. Excluding the impact of the Horizon acquisition, product sales climbed 5%.

Meanwhile, adjusted EPS of $4.97 declined 1% year-over-year and missed analyst estimates by a penny. Amgen’s profit was hurt by higher operating expenses, including amortization costs from the Horizon deal and other integration-related expenditures.

Revised Full-Year Guidance

Amgen revised its full-year outlook. The company now expects revenue between $32.8 billion and $33.8 billion this year, raising the lower end of the range by $300 million.

For the bottom line, AMGN narrowed the EPS guidance to $19.10 to $20.10 from the previous outlook of $19.00 to $20.20.

Top Analyst Bullish on AMGN Stock

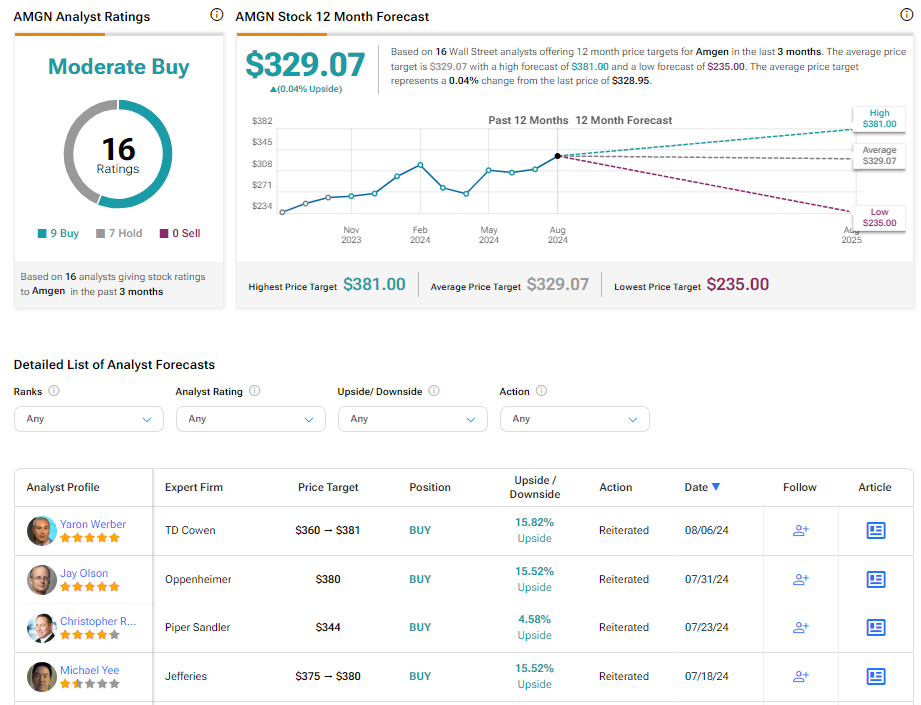

Following the Q2 earnings release yesterday, five-star analyst Yaron Werber of TD Cowen reiterated a Buy rating on Amgen stock and raised the price target to $381 (15.82% upside potential) from $360. The analyst is impressed by the company’s strong Q2 performance, successful drug launches, and expected benefits from the Horizon acquisition.

Werber has an average return of 16.93% and a success rate of 83% on AMGN (to watch Werber’s track record, click here).

Is AMGN Stock a Good Buy?

On TipRanks, Amgen has a Moderate Buy consensus rating based on nine Buy and seven Hold ratings. The analysts’ average price target on AMGN stock of $329.07 implies a limited upside potential of 0.04%. Shares of the company have gained 10.3% over the past three months.