Amgen (AMGN), a leading biotechnology company known for developing therapies in oncology, cardiovascular disease, and inflammation, is diving headfirst into the booming obesity drug market. The company’s latest venture focuses on MariTide, a promising weight loss injection. This injection could substantially boost Amgen’s revenue. MariTide has shown early signs of success. This positions Amgen to grab a slice of the multi-billion-dollar GLP-1 drug market. Analysts expect this market could reach $100 billion by 2030. Amgen’s MariTide could play a crucial role in achieving that growth.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Amgen Seizes Obesity Drug Opportunity to Drive Growth

Other Big Pharma companies like Eli Lilly (LLY) and Novo Nordisk (NVO) dominate the weight-loss market. Their drugs, such as Zepbound, Mounjaro, Wegovy, and Ozempic, are key players. Amgen, however, is looking to make its mark. Jefferies analyst Michael Yee points out that MariTide could differentiate itself with its monthly dosage. It would provide an edge over weekly alternatives. “The market wants to see that the injection enables 20% weight loss,” Yee said. He drew a direct comparison to other leading treatments.

Global demand for obesity treatments is on the rise. Amgen is positioning itself to benefit significantly from this trend. The company has been conservative with its earnings guidance in recent years. But the success of MariTide could potentially increase the company’s total sales by about 19%. Analyst estimates predict that by 2030, Amgen’s sales could reach $46.5 billion. MariTide will contribute a significant portion to that revenue.

Amgen’s MariTide Could Hit $10 Billion in Annual Sales

Even with risks around the early-stage nature of MariTide, experts like Jason Ware are optimistic. Jason Ware is the chief investment officer at Albion Financial. He believes the drug could hit $10 billion in annual sales. This would help Amgen recover from its recent market slump. Shares have fallen 14% from their peak. However, as the company looks to expand into the obesity market, analysts predict Amgen’s future earnings could exceed expectations. According to Ware, the stock could surge to over $450 by the end of next year.

In conclusion, Amgen’s strategic move into obesity treatments has the potential to drive long-term growth. It could position the company as a major player in the pharmaceutical sector.

Is Amgen Stock a Good Buy?

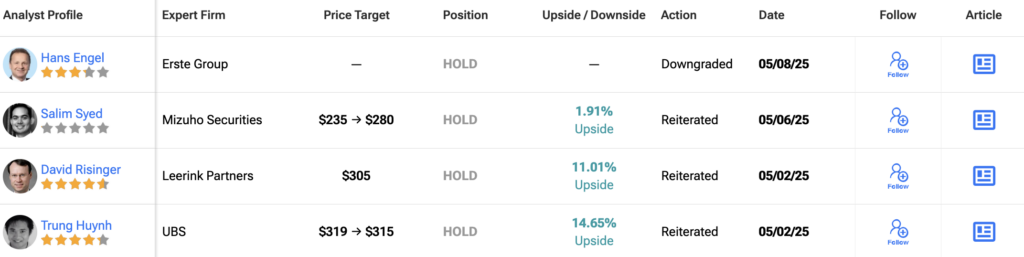

On TipRanks, Amgen (AMGN) currently holds a Moderate Buy consensus rating from 19 analysts. The stock has a split recommendation: nine analysts have rated it a Buy, nine have given it a Hold, and only one analyst has rated it a Sell. The average price target for Amgen stock stands at $326.06, which represents an 18.67% upside from its current price of $274.76.

Looking for a trading platform? Check out TipRanks' Best Online Brokers , and find the ideal broker for your trades.

Report an Issue