Biopharmaceutical company, Amgen (NASDAQ:AMGN) reported adjusted earnings for the third quarter of $4.96, up by 6% year-over-year and above analysts’ consensus estimate of $4.68 per share. The company generated revenues of $6.9 billion in Q3, an increase of 4% year-over-year, in line with analysts’ estimates.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Amgen also disclosed that it will take a hit of $650 million in terms of an impairment charge after discontinuing the development of an experimental prostate cancer treatment, known as AMG 340.

Looking forward, management raised its revenues forecast and now expects revenues in the range of $28 billion to $28.4 billion in FY23, up from its prior projection of $27.4 billion. Adjusted earnings are likely to be between $18.20 and $18.80 per share.

Is AMGN a Good Stock to Buy?

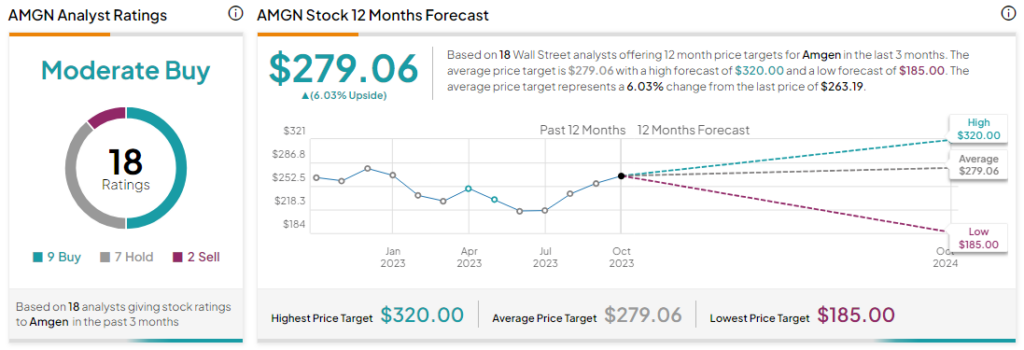

Analysts are cautiously optimistic about AMGN stock with a Moderate Buy consensus rating based on nine Buys, seven Holds and two Sells. The average AMGN price target of $279.06 implies an upside potential of 6% at current levels.