Pharmaceutical giant Amgen (AMGN) revealed a major $650 million expansion of its U.S. manufacturing footprint. The move will help boost drug production at the company’s existing biologics manufacturing facility in Juncos, Puerto Rico. Also, it involves integrating advanced technologies into Amgen’s operational process.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This latest investment builds on recent large-scale capital expenditures in the U.S., such as a $600 million science and innovation center in California, a $900 million manufacturing expansion in Ohio, and a $1 billion investment in North Carolina.

“This expansion underscores Amgen’s commitment to U.S. biomanufacturing and to strengthening the resilience of our global supply chain,” stated Robert A. Bradway, Amgen’s Chairman and CEO.

AMGN Investment Follows Tariff Threat

Amgen’s investment aligns with the Trump administration’s push to bring pharmaceutical manufacturing back to the United States. Starting October 1, 2025, Trump said he would impose a new 100% tariff on companies not building U.S. facilities.

In a post on Truth Social on Thursday, Trump stated that any “branded or patented Pharmaceutical Product” would face the tariff unless the manufacturer is actively building a manufacturing plant in the United States.

Is Amgen a Good Stock to Buy?

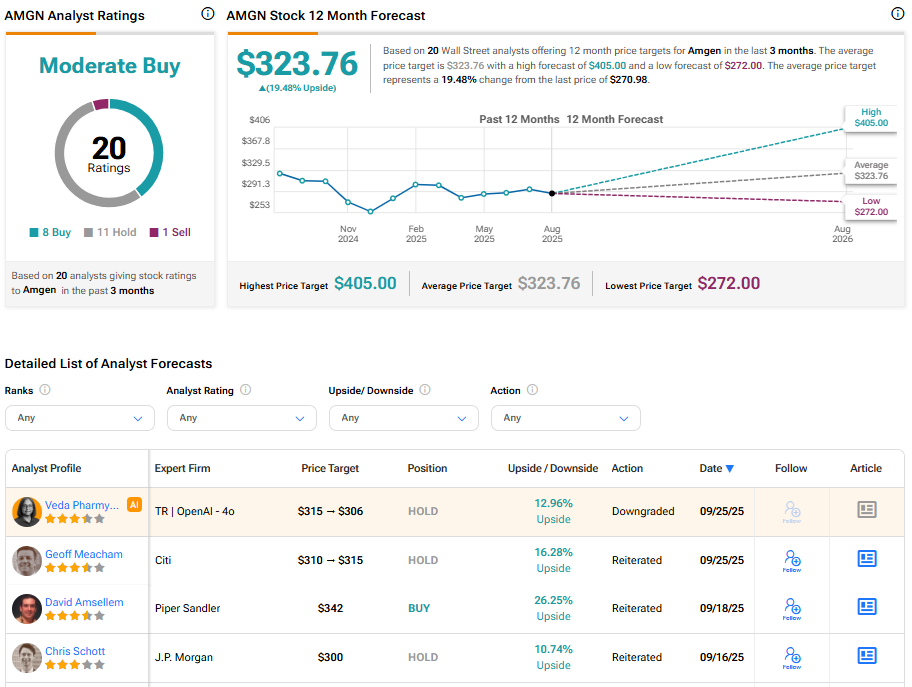

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AMGN stock based on eight Buys, 11 Holds, and one Sell assigned in the past three months. Further, the average Amgen price target of $323.76 per share implies 19.51% upside potential.