Shares of American Outdoor Brands (NASDAQ: AOUT) tanked 7.7% in after-hours trading on Thursday as the provider of outdoor products and accessories delivered disappointing fiscal Q1 results.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

American Outdoor’s revenues dropped 28.1% year-over-year to $43.7 million in Q1, missing Street estimates of $1.4 million. Adjusted earnings came in at $0.01 versus analysts’ expectations of $0.08 per share.

However, the company’s management remained “pleased” with its Q1 results “which reflect our ability to deliver net sales growth of over 31% above our pre-pandemic levels of fiscal 2020 .”

AOUT’s management refrained from giving any specific fiscal guidance.

However, Andrew Fulmer, American Outdoors’ CFO stated, “Consumer spending patterns over the balance of our fiscal year have yet to be determined, and we believe that retailers and distributors continue to be extremely cautious with regard to their inventory levels. That said, we also believe our brands are performing well and in alignment with recent consumer outdoor participation trends. As a result, we believe our revenue for fiscal 2023 could exceed pre-pandemic fiscal 2020 revenue by as much as 25%.”

Is American Outdoor Brands a Good Stock to Buy?

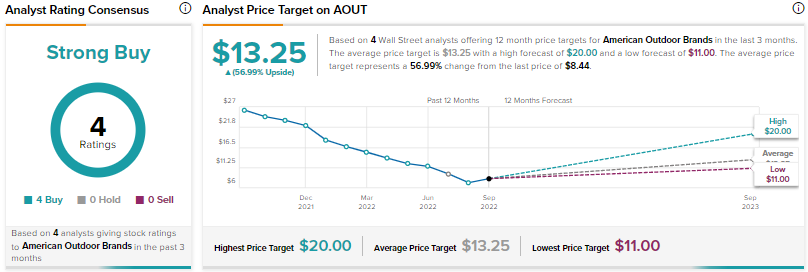

Judging by the consensus analysts’ rating on TipRanks, AOUT certainly seems a good stock to buy as it scores a Strong Buy consensus rating based on a unanimous four Buys.

AOUT’s average price target of $13.25 implies that the stock has an upside potential of around 57%