American Express (NYSE:AXP) isn’t the flashiest stock, but it has a place in many portfolios. Investors seeking stability, an impressive dividend growth rate, and gains that can keep up with the market may want to consider this stock.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The fintech company profits from credit and debit card transactions. These cards have been ingrained into global economies, offering steady cash flow. Although I do not have a position in this stock due to my investment goals, I am bullish on it. AXP stock has many attributes that make it worth considering.

American Express Offers Financial Strength

American Express delivered impressive revenue and net income growth in the fourth quarter of 2023. Revenue jumped by 11% year-over-year, while net income grew 23% year-over-year. The fintech company delivered record revenue and profits in 2023.

AXP’s proprietary card network exceeded 140 million, thanks to a 12.2 million increase last year. American Express also shared 2024 guidance, which suggests that revenue will increase by 9% to 11% year-over-year. EPS is expected to range from $12.65 to $13.25 in 2024. The fintech firm’s 2023 diluted EPS came to $11.21. Based on the guidance range, diluted EPS is expected to grow by 12.8% to 18.2% year-over-year.

American Express’s press release offered another insight that suggests stable revenue and net income growth in the years to come. The company’s long-term vision is to generate 10% year-over-year revenue growth and diluted EPS growth in the mid-teens.

The Valuation

American Express shines with its 20.4x P/E ratio and 17.8x forward P/E ratio. Meanwhile, Visa (NYSE:V) and Mastercard (NYSE:MA) have P/E ratios of 36.4 and 40.9, respectively. Those two fintech companies have higher profit margins than American Express, but all three have been achieving similar growth rates for revenue and net income.

The relatively low valuation gives American Express a good margin of safety for investors who are seeking less risk. American Express has this valuation while aiming to deliver year-over-year diluted EPS growth in the mid-teens for several years.

If the fintech company realizes this goal, shares will look like a bigger bargain than they already are. The stock has gained 40% over the past year and has more than doubled over the past five years. It has momentum. Its valuation and financial strength are catalysts that can enable future growth.

AXP’s Impressive Dividend Growth

American Express has a higher dividend yield than the other credit card giants. The stock currently has a 1.22% dividend yield and has maintained a double-digit growth rate for several years. The corporation recently announced a significant 17% year-over-year dividend hike, and its dividend has doubled since 2018.

At this rate, it’s possible for current American Express investors to see their dividend payouts double from the current payout before 2030. A 21.26% dividend payout ratio supports further dividend hikes. The company can realistically double its dividend right now, but it wouldn’t be the most prudent move for American Express. The corporation puts its money to use via acquisitions, buybacks, and other investments.

Some dividend growth stocks have high growth rates but yield well below 1%. Visa and Mastercard fit this category. Receiving a 1.26% yield right away makes American Express a superior dividend growth stock and one of the best choices for investors who seek those types of stocks.

Is AXP Stock a Buy, According to Analysts?

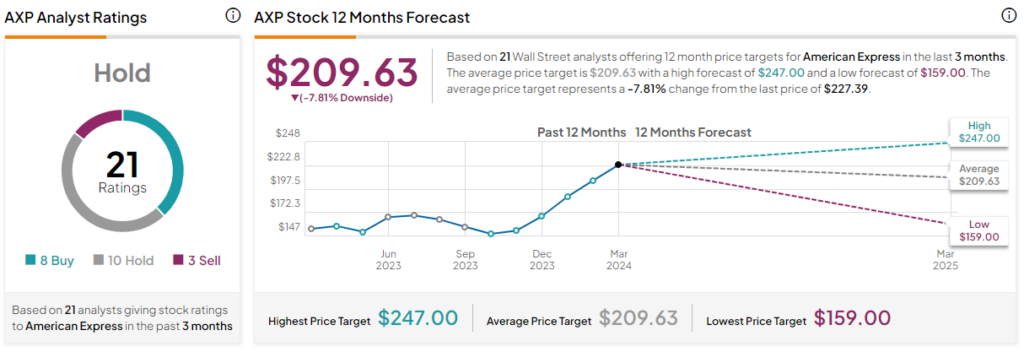

Analysts rate American Express stock as a Hold. This is based on eight Buys, 10 Holds, and three Sells assigned in the past three months. The average American Express stock price target of $209.63 implies 7.8% downside potential. The lowest price target of $159 implies 30% downside, while the highest price target of $247 suggests 8.7% upside.

The Bottom Line on American Express Stock

American Express offers stability and market-beating returns. The stock has outperformed the S&P 500 (SPX) over the past five years while growing its dividend payouts for its investors. This dividend growth stock looks poised to reach new highs and deliver high cash flow in the future.

The company’s business model depends on consumer spending, and while people’s spending will ebb and flow based on economic conditions, they will continue to use their credit and debit cards. These cards are easier to use than taking out cash, and cardholders receive rewards for using their cards.

Overall, American Express is a boring stock that can perform well in the long run while having limited losses during slower economic cycles. The fintech company only lost roughly 10% of its value in 2022, while many high-flying growth stocks lost 50% of their value or more. It looks like a great fit for conservative investors who value having a margin of safety with their investments.