American Express (AXP) is set to release its third quarter 2024 financials on October 18. Wall Street analysts expect the company to report earnings of $3.37 per share, representing a 2% increase year-over-year. However, revenues are expected to fall by 3% from the year-ago quarter to $16.68 billion, according to data from TipRanks.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

AXP is a leading global financial services company, known for its credit card, travel, and banking products. It focuses on providing payment solutions, loyalty rewards, and premium services to both consumers and businesses worldwide.

Interestingly, Amex has missed EPS estimates only once out of the last five quarters.

Insights from TipRanks’ Bulls & Bears Tool

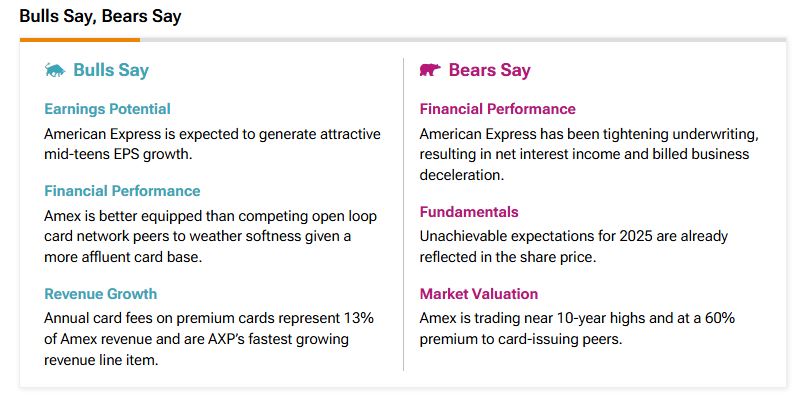

According to TipRanks’ Bulls Say, Bears Say tool shown below, bullish analysts highlight several positive factors for AXP. They believe the company has strong earnings potential, with expectations of achieving mid-teens EPS growth. In terms of financial performance, bulls contend that Amex is financially better equipped than its open-loop card network rivals to handle economic downturns, thanks to its wealthier cardholder base. Moreover, premium card fees, which make up 13% of its revenue, are the company’s fastest-growing source of income, driving its revenue growth.

However, challenges remain. Bears argue that American Express has tightened its underwriting standards, leading to slower growth in net interest income and billed business. Additionally, they believe the company’s fundamentals are overestimated, with lofty 2025 expectations already factored into the current share price.

Options Traders Anticipate a Large Move

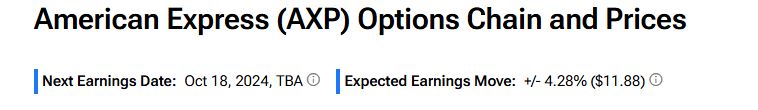

Using TipRanks’ Options tool, we can see what options traders are expecting from the stock immediately after its earnings report. The expected earnings move is determined by calculating the at-the-money straddle of the options closest to expiration after the earnings announcement. If this sounds complicated, don’t worry, the Options tool does this for you.

Indeed, it currently says that options traders are expecting a 4.28% move in either direction.

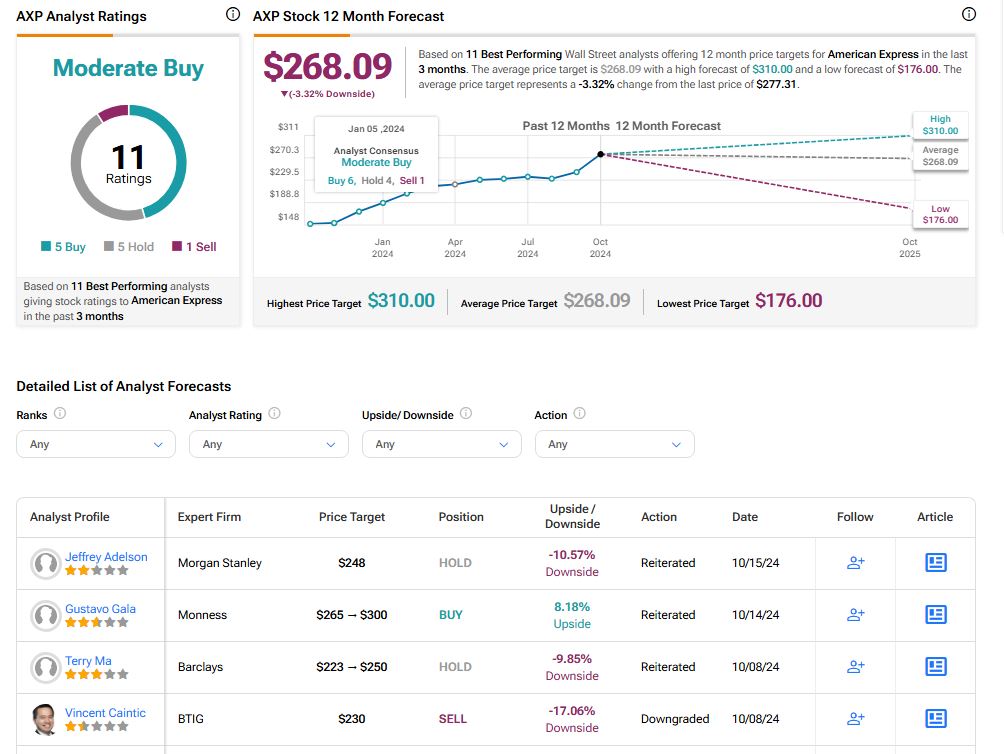

What Is AXP Stock Price Forecast?

Turning to Wall Street, AXP has a Moderate Buy consensus rating based on five Buys, five Holds, and one Sell rating assigned in the last three months. At $268.09, the average American Express price target implies 3.32% downside potential. Shares of the company have gained about 50% year-to-date.