For energy stock Enbridge (TSE:ENB), it may be mostly located in Canada, but its future is pretty solidly located in its neighbor to the south – the United States. Enbridge has something of an “America First” investment strategy, reports noted, but it did not enthuse investors. Enbridge shares were down fractionally in Friday morning’s trading.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

Enbridge’s roots are Canadian, through and through. In fact, noted the reports, Enbridge got its start with a dozen gas streetlamps in Toronto, some of which are still there to this day, found in the St. Lawrence Market. But despite the clearly Canadian roots, Michele Harradence, president of gas distribution and storage at Enbridge, made it pretty clear its investment focus was on the United States.

Harradence described how investment in Canada was “sputtering,” how it was badly impeded by a “…tangle of regulatory knots, an unwelcoming tax climate, and tepid, fragmented incentives that cannot compete with those that are on offer right next door.” In fact, given the administration that will be in place in just a couple of months, more incentives might well be on offer as the Trump administration looks to back up its plans of “drill, baby, drill.”

Putting Its Money Where Its Mouth Is

It may sound odd that a Canadian company would have an America-first investment strategy, but we have already seen it in action. Just days ago, word emerged about Enbridge’s involvement in a solar project in Texas. The Sequoia solar project, as it is known, costs around $1.1 billion dollars and generates around 815 megawatts. Further, the move will be supported by long-term agreements to buy the power generated by the project from companies like AT&T (T) and Toyota (TM).

Enbridge is also working on the Fox Squirrel Solar project, now in its second phase. That one will provide 250 megawatts of power to the Pennsylvania/New Jersey/Maryland grid, noted a Power Technology report.

Is Enbridge a Good Stock to Buy?

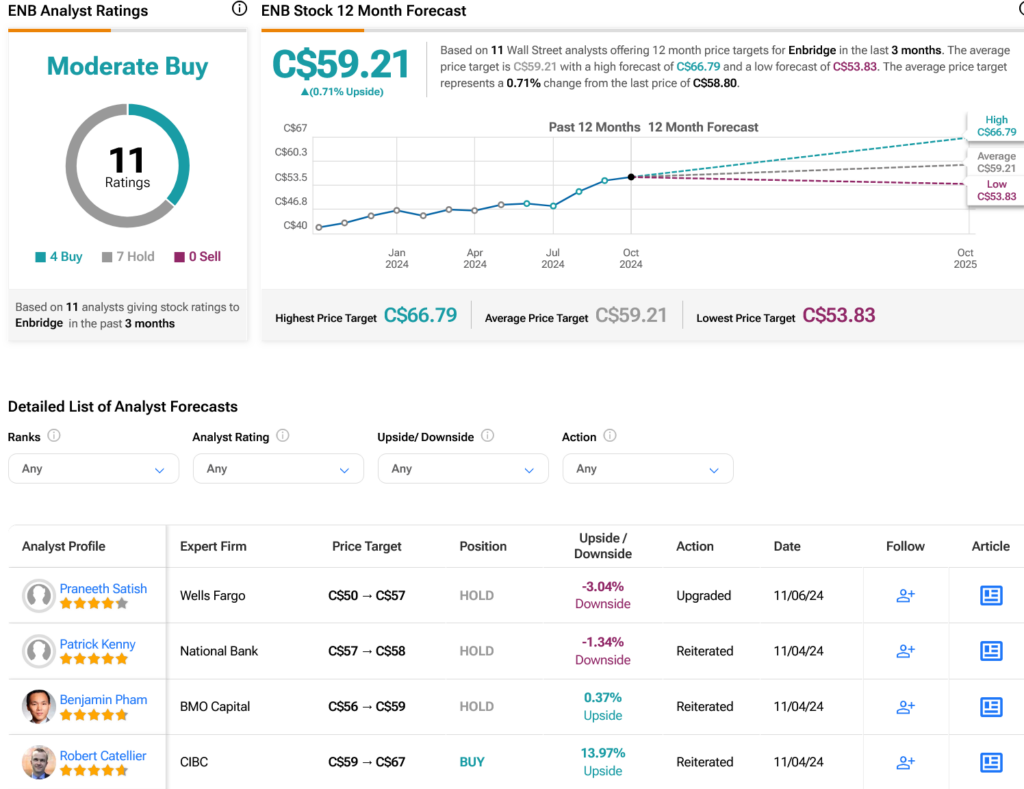

Turning to Wall Street, analysts have a Moderate Buy consensus rating on TSE:ENB stock based on four Buys and seven Holds assigned in the past three months, as indicated by the graphic below. After a 37.26% rally in its share price over the past year, the average TSE:ENB price target of C$59.21 per share implies 0.71% upside potential.