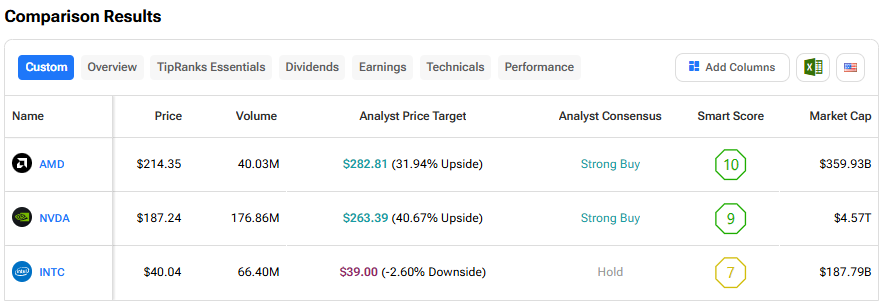

Chip stocks have been in focus as artificial intelligence (AI), robotics, and other growth areas, such as autonomous vehicles, have driven strong demand. Despite ongoing concerns about an AI bubble, several analysts remain bullish on some chip stocks due to massive AI infrastructure spending and continued demand. Using TipRanks’ Stock Comparison Tool, we placed Advanced Micro Devices (AMD), Nvidia (NVDA), and Intel (INTC) against each other to find the best chip stock, according to Wall Street.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Advanced Micro Devices (NASDAQ:AMD) Stock

Advanced Micro Devices stock has rallied more than 65% over the past year, thanks to optimism about the company’s new AI GPUs (graphics processing units) and strategic deals, including a partnership with OpenAI for the deployment of 6 GW of GPUs. Moreover, the company continues to gain further market share in the CPU (central processing unit) space.

Meanwhile, AMD is focused on capturing further growth opportunities with its new products. At the 2026 Consumer Electronics Show (CES), AMD CEO Lisa Su showcased the company’s AI chips, including its advanced MI455 AI processors. Su also unveiled the MI440X chip, developed for on-premise use at businesses. The CEO also previewed the MI500 chip, which the company plans to launch in 2027. The MI500 offers 1,000 times the performance of an older version of the processor.

Is AMD Stock a Buy or Sell Now?

Recently, Piper Sandler analyst Harsh Kumar reiterated a Buy rating on Advanced Micro Devices stock with a price target of $280. Following a pre-quiet period call, Kumar stated that he is constructive on AMD’s near and mid-term drivers, as well as its ability to execute on its technical targets, including the MI300 chip ramp and “technical traction” for the rollout of the MI400 series.

Furthermore, Kumar highlighted that AMD is investing significantly in the Helios rack, which is expected to be introduced in mid-2026. He also noted AMD’s plan to have a diverse set of customers beyond OpenAI. “Finally, AMD reiterated its focus on open standards across both networking and software,” said Kumar.

Overall, Wall Street has a Strong Buy consensus rating on Advanced Micro Devices stock based on 27 Buys and nine Holds. The average AMD stock price target of $282.81 indicates about 32% upside potential.

Nvidia (NASDAQ:NVDA) Stock

Nvidia is one of the major beneficiaries of the AI boom, which has sparked a massive demand for its GPUs and boosted its revenue and earnings. NVDA stock has risen more than 25% over the past year, despite concerns about rising competition in the AI chip space, valuation fears, and uncertainty related to China sales, even as H200 is seeing strong demand.

Most analysts covering Nvidia stock remain optimistic about its growth story, driven by its dominant position in the AI chip space, strategic deals, and continued innovation.

Notably, in his keynote address at the 2026 CES event, Nvidia CEO Jensen Huang unveiled the Rubin platform, the successor to the company’s Blackwell architecture. Huang also introduced Alpamayo, an open reasoning model family for autonomous vehicle development. The CEO has previously highlighted that robotics, including autonomous cars, is the second-most important growth area for the company after AI.

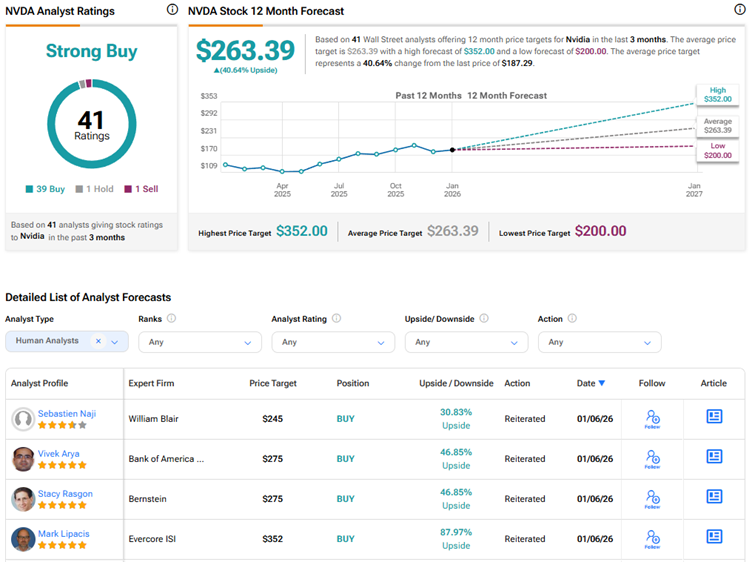

Is NVDA Stock a Buy, Sell, or Hold?

Following the company’s updates at the CES event, Bernstein analyst Stacy Rasgon reiterated a Buy rating on Nvidia stock with a price target of $275, saying “Rubin in full production, and looks like a monster.” Rasgon added that the Rubin platform’s shipping is expected to commence in the second half of 2026.

The 5-star analyst highlighted the strengths of the Rubin platform compared to Blackwell, such as 5x higher inference performance, 3.5x higher training performance, 2.8x higher memory bandwidth, and 2x higher NVLink bandwidth per GPU. Rasgon noted that during the event, CEO Huang repeatedly highlighted the massive magnitude of current demand. Overall, Rasgon is bullish on Nvidia and expects 2026 to be “a very good year” for the company, thanks to robust GB300 ramp transitions to Rubin and the stock’s attractive valuation.

Currently, Wall Street has a Strong Buy consensus rating on Nvidia stock based on 39 Buys, one Hold, and one Sell recommendation. The average NVDA stock price target of $263.39 indicates 40.6% upside potential.

Intel (NASDAQ:INTC) Stock

Intel stock has jumped more than 100% over the past year, driven by several positive developments. Mainly, the significant investment by the U.S. government and the strategic deal with Nvidia boosted investor sentiment about Intel’s turnaround. The chipmaker has struggled in recent years due to a lack of innovation and strategic missteps, losing ground to rivals like AMD.

While investor sentiment has improved, several Wall Street analysts remain cautious on Intel, as they believe that the turnaround at the troubled semiconductor company might take a long time. They are also concerned due to execution risk and the impact of intense competition.

Meanwhile, at the CES trade event, Intel launched the Panther Lake AI chip for laptops, called the Core Ultra Series 3 processors. It is the first compute platform built on the company’s 18A manufacturing process.

Is Intel a Good Stock to Buy Now?

Interestingly, on Monday, Melius Research analyst Ben Reitzes upgraded Intel stock to Buy from Hold and increased the price target to $50 from $44. One of the reasons for the 4-star analyst’s rating upgrade was the company’s 14A node, a new chip technology expected to be released in 2027. Reitzes sees the possibility that Nvidia and Apple (AAPL) could consider producing chips on Intel’s 14A node by 2028/2029, which could drive INTC stock higher.

Reitzes is also positive about Intel due to an improved view of the company’s foundry business and its packaging assets, which are seeing higher demand amid shortages.

Overall, Wall Street has a Hold consensus rating on Intel stock with 19 Holds, six Buys, and six Sell recommendations. The average INTC stock price target of $39 indicates a 2.6% downside risk from current levels.

Conclusion

Wall Street is bullish on Nvidia and AMD stocks but sidelined on Intel. Analysts see higher upside potential in Nvidia stock than in the stocks of the other two chip companies. Their optimism is supported by NVDA’s leading position in the AI chip space, continued demand for its GPUs, and strong fundamentals.