Shares of AMD (AMD) are down at the time of writing after Wolfe Research downgraded the semiconductor company due to slower-than-expected growth in data center GPU revenue. In a client note, five-star analyst Chris Caso said that there are challenges ahead for AMD and highlighted modest quarterly growth projections from original design manufacturers. Indeed, Caso believes that “the set-up into earnings is difficult for AMD.”

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

He estimated that data center GPU revenue will be between $1.5–2.0 billion for Q4 2024 and approximately $7 billion for 2025, which is significantly below the expectations of $10 billion and Wolfe’s previous $10.8 billion estimate. Based on these checks, Caso downgraded AMD to Peer Perform from Outperform and removed the prior price target of $210.

Interestingly, though, while Caso is concerned about weak PC demand, gaming sector struggles, and limited recovery in embedded products for the first half of the year, he pointed to a bright spot: AMD’s upcoming MI350 AI accelerator. Set to launch later this year, the new product is expected to be a major redesign and a significant upgrade over the MI325, which could potentially act as a catalyst for the company. It’s worth noting that Caso has so far enjoyed a 60% success rate on his stock ratings, with an average return of 23.4% per rating.

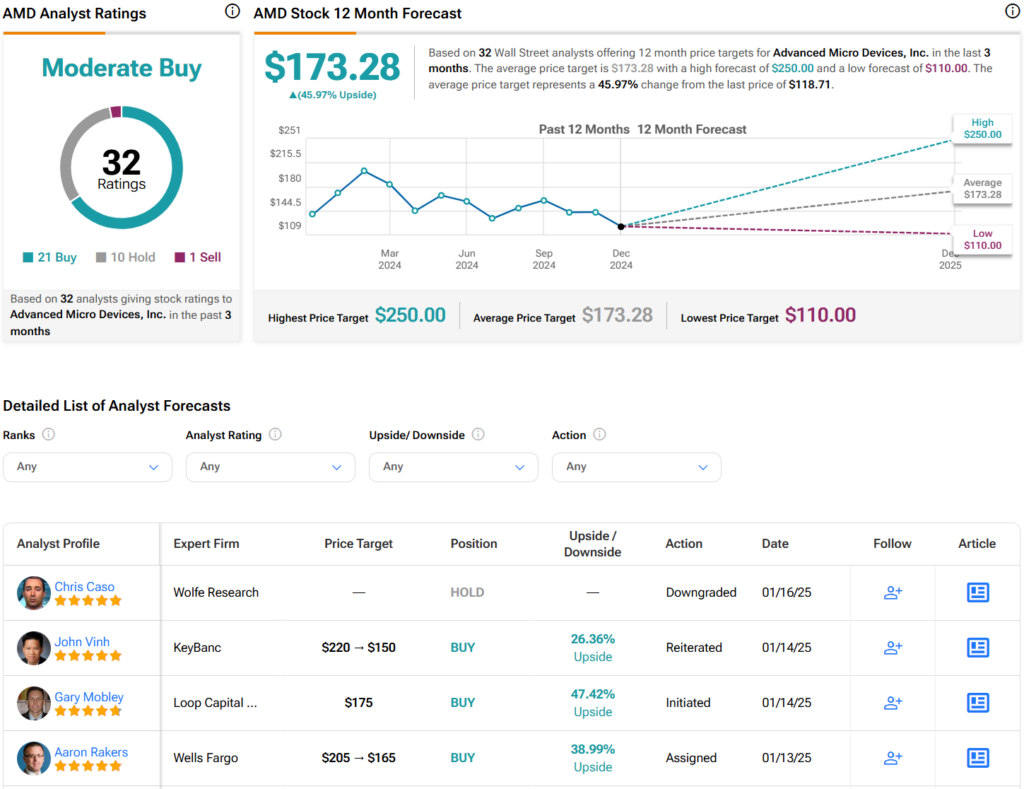

Is AMD a Buy, Sell, or Hold?

Overall, analysts have a Moderate Buy consensus rating on AMD stock based on 21 Buys, 10 Holds, and one Sell assigned in the past three months, as indicated by the graphic below. After a 26% decline in its share price over the past year, the average AMD price target of $173.28 per share implies 46% upside potential.