Advanced Micro Devices (AMD) stock surged more than 77% in 2025, and top Wall Street analysts are predicting a further 32% jump in 2026. AMD has benefited from the artificial intelligence (AI) revolution, driven by high-performance computing (HPC), data-center demand, and AI-accelerated workloads. However, macro weakness, geopolitical tensions, and competitive price pressures could pose downside risks.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

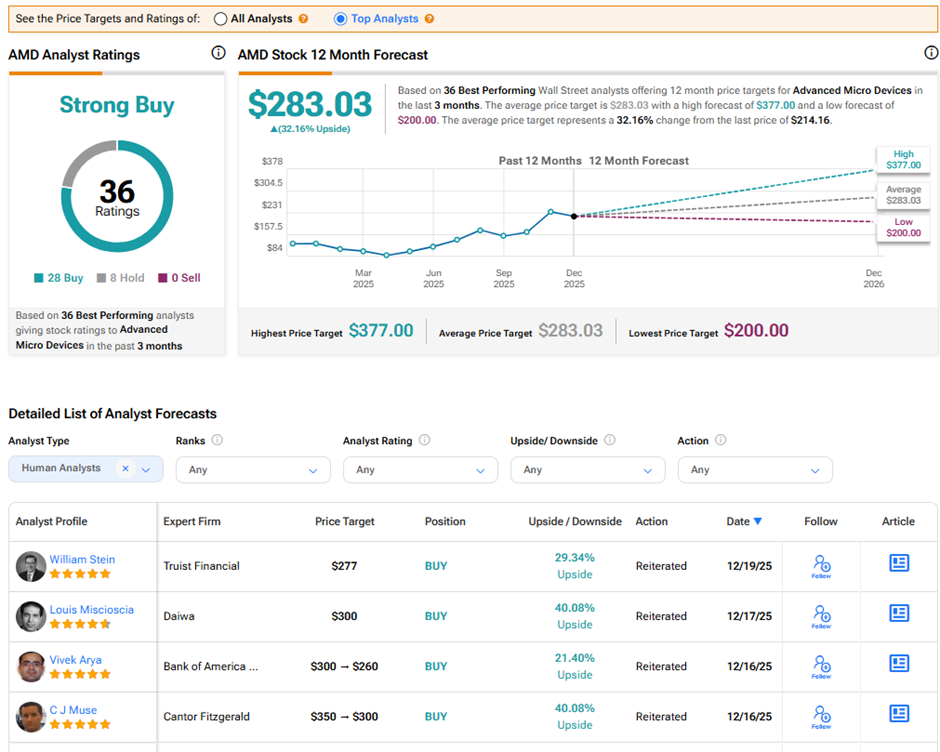

On TipRanks, top analysts have awarded AMD stock a Strong Buy consensus rating, with 28 Buys and eight Hold ratings. The average Advanced Micro Devices price target of $283.03 implies 32.2% upside potential over the next twelve months.

AMD trades around $214 per share, down 19.8% from its 52-week high of $267.08 reached on October 29, 2025, amid pre-earnings enthusiasm and high earnings expectations. It is worth noting that AMD currently trades at a price-to-sales (P/S) ratio of 7.87x, much lower than its immediate larger rival Nvidia (NVDA) trading at 22.28x.

What Top Analysts Say About AMD’s Future

Truist Financial analyst William Stein has a Buy rating and $277 price target, implying 29.3% upside potential. The five-star analyst recently updated his price targets across the semiconductor and AI groups after setting 2027 estimates, and noted that funding AI infrastructure remains a challenge. Yet, Stein sees AI infrastructure semis as cheap relative to their growth and expects more upside pressure to estimates for the group going into 2026. He expects the AI spending boom to continue in 2026.

Bank of America Securities analyst Vivek Arya has a $260 price target, which implies 21.4% upside. Arya views 2026 as the midpoint of an 8-to-10-year upgrade of IT infrastructure for faster AI workloads. He added that stock volatility may persist due to AI returns and hyperscaler cash flows, but this could be balanced by quicker growth from large language model (LLM) builders and AI factories.

Meanwhile, Cantor Fitzgerald analyst C J Muse has a $300 price target, implying 40% upside potential. The five-star analyst argued that the SOX (the Philadelphia Semiconductor Index) is likely to move higher after beating the S&P 500 index (SPX) in 2025, helped by the AI-driven demand for compute, networking, memory, and equipment. He added that cyclical factors may create mixed signals, but macro backdrop and growing AI infrastructure spending support a long SOX position and overweight bets on AI-related stocks into 2026.

Is AMD Stock a Buy in 2026?

Analysts expect the AMD rally to continue into 2026, supported by data-center growth for its Ryzen/EPYC processors and AI accelerators, new product developments, and stronger integration into AI infrastructure and cloud deployments.