Advanced Micro Devices (AMD) stock has risen more than 32% year-to-date, driven by optimism about the company’s new GPUs (graphics processing units) capturing artificial intelligence (AI)-led opportunities and solid second-quarter results. However, AMD stock is down 4.8% over the past month amid rising competition in the chip market, with Nvidia (NVDA) announcing a $5 billion investment in rival Intel (INTC) and the growing demand for Broadcom’s (AVGO) custom AI chips, highlighted by the $10 billion order from a new customer. Wall Street is currently cautiously optimistic on AMD stock, with the average price target indicating continued upside.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Analysts’ Views on AMD Stock

Following the Nvidia-Intel deal, Bank of America analyst Vivek Arya provided an interesting take on the impact of this collaboration on AMD. The 5-star analyst contends that the deal might not be as negative as it appears currently for AMD, as it increases the chance of success for Intel’s x86 architecture, especially in the enterprise sector, benefiting AMD as well, given that Intel shares this architecture with AMD.

Moreover, Arya pointed out that chip collaborations generally take several years before reaching the market, giving AMD time to maintain momentum without an immediate challenge. Additionally, he sees the risk of Intel getting distracted in managing multiple stakeholders—SoftBank (SFTBY), Nvidia, and the U.S. government—which could impact its focus and execution. Finally, he highlighted that Intel’s dependence on Nvidia for GPU technology indicates that its own desktop CPU graphics fix remains incomplete, leaving AMD better positioned in that segment in the near term.

Arya has a Buy rating on AMD stock with a price target of $200 based on a P/E multiple of 33x 2026 non-GAAP EPS, near the high end of the historical valuation range. However, yesterday, Arya did raise concerns about the impact of Nvidia’s $100 billion investment in OpenAI on AMD. He feels that this agreement on the surface raises the competitive risks for other vendors, including Broadcom and AMD.

Meanwhile, Stifel analyst Ruben Roy, who has a Buy rating on AMD stock, sees the Nvidia-Intel deal as a “modest negative” for the company. That said, the 5-star analyst noted that the timing of when the new integrated systems of Nvidia and Intel will reach the market remains unclear.

Is AMD Stock a Buy, Hold, or Sell?

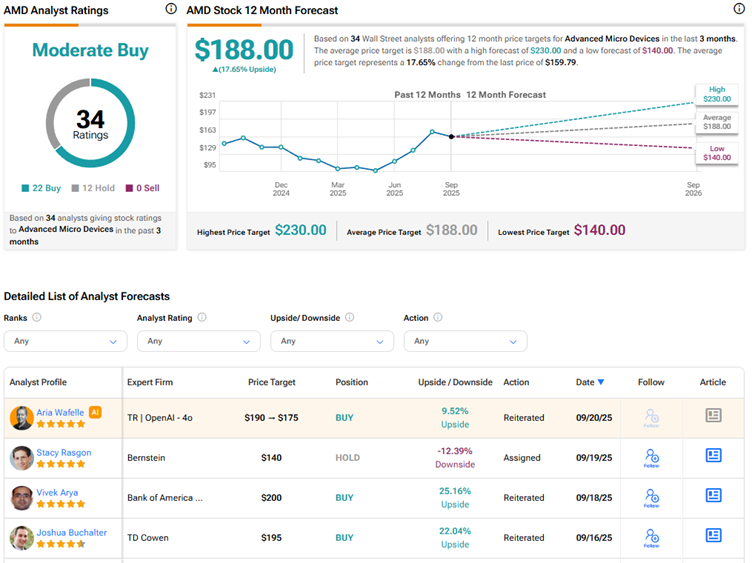

Given the growing competition in the chip market, Wall Street has a Moderate Buy consensus rating on Advanced Micro Devices stock based on 22 Buys and 12 Holds. The average AMD stock price target of $188 indicates 17.7% upside potential from current levels.