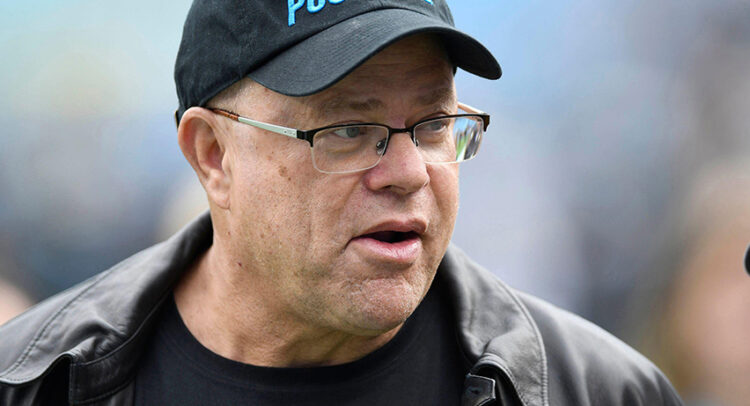

David Tepper is widely seen as one of Wall Street’s true heavyweights. He co-founded Appaloosa Management back in 1993, built a personal fortune of $23.7 billion, and now runs a $17 billion fund made up mostly of his own capital after spending the past decade returning money to clients.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

But to be honest, you don’t have to have Tepper’s pedigree to be able to offer one of his recent insights. “We’re not at cheap levels in this market,” Tepper said in an interview, and when asked about the current state of the market, he added that he’s “constructive because of the easing right now but also miserable because of the levels.”

Those levels likely indicate that Tepper is becoming more selective with his stock choices. This can be seen in his attitude toward AI chip makers Advanced Micro Devices (NASDAQ:AMD) and Intel (NASDAQ:INTC). Tepper scooped up shares of one of these names during Q3, but at the same time, got rid of his entire stake in the other.

So, let’s find out which chip giant Tepper now clearly favors, and for a broader view of these AI stocks’ prospects, we’ve opened up the TipRanks database to also have a look at general analyst sentiment.

AMD

AMD’s AI game can so far be split into two distinct halves. The CPU stalwart was considered an early frontrunner when AI became a big thing roughly 3 years ago, but its luster faded pretty quickly, as it soon became evident the company trailed segment leader Nvidia by some distance. Nvidia was quick to make the pivot toward AI, offering a full ecosystem of software, developer tools, and tightly integrated hardware that gave it a clear head start. AMD, by comparison, lacked the overall infrastructure that companies desired. That gap left AMD on the sidelines for a while, even as interest in AI surged and Nvidia became the default choice for most industry players.

But as the Lisa Su-led company has shown before when closing the gap to Intel in the CPU space, it should not be underestimated. AMD has gotten to work on aggressively pushing into high-performance computing and positioning its upcoming high-performance AI accelerator Instinct MI450 as an alternative to Nvidia’s offerings. The combination of its chip roadmap and ongoing data center demand for AI makes the company’s positioning in the AI chip space look increasingly robust.

Meanwhile, the company has secured sizable wins with OpenAI and Oracle, and over the next three to five years, it sees data center sales topping $100 billion.

Tepper has obviously been keeping a close watch on what’s happening here and must feel confident AMD will pull off its lofty ambitions. During Q3, via Appaloosa Management, he opened a new position in AMD, purchasing 950,000 shares, currently worth almost $209 million.

AMD’s improved positioning has been the catalyst for a strong run-up, with the stock having gained 82% year-to-date. Raymond James analyst Simon Leopold acknowledges the surge but sees plenty of opportunity for further upside.

“Fundamentals need to catch up, and we believe they will,” said the 5-star analyst. “The newest wins with OpenAI and HUMAIN for ~1 GW could be worth $15B in 2026. These grow to over 2 GW in 2027. AMD appears poised for continued server and PC share gains, too. Additionally, the OpenAI deployment may serve as an important endorsement for potentially encouraging other model builders and hyperscalers to adopt AMD GPUs. The AI TAM is large enough to support multiple chip suppliers, and AMD will be among the participants.”

Quantifying his stance, Leopold puts an Outperform (i.e., Buy) rating on AMD shares, backed by a Street-high price target of $377, a figure that points toward 12-month returns of ~72%. (To watch Leopold’s track record, click here)

Elsewhere on the Street, the stock claims an additional 27 Buys and 10 Holds, for a Moderate Buy consensus rating. Going by the $284.67 average price target, a year from now, shares will be changing hands for a 29% premium. (See AMD stock forecast)

Intel

Intel is a fabled name in tech and was once the U.S.’s biggest chip firm. In fact, during the dot-com boom, it briefly became the world’s most valuable company. That, however, was a quarter century ago, and Intel’s current status is far less lofty.

The company has spent much of the past decade ceding ground in CPUs and the PC chip market, while rival AMD has pushed ahead with faster architectures and a more compelling roadmap. Missteps in manufacturing and product delays amidst leadership issues only amplified the perception that Intel was no longer the chip giant of yore.

Today, with new CEO Lip-Bu Tan at the helm, the company is trying to stage a comeback through an ambitious foundry strategy and a renewed focus on AI-centric chips. After several failed attempts to reverse its fortunes, sentiment has started to improve. The new CEO has pushed through sharp cost cuts and a broad operational overhaul, and the company has landed a series of deals that have gone over well with investors. Nvidia is putting $5 billion into jointly developing datacenter and PC chips, SoftBank has invested $2 billion, and the U.S. government has taken a 9.9% stake worth about $8.9 billion to support its foundry push.

Intel also delivered a solid Q3, reporting $13.7 billion in revenue and topping analyst expectations by $560 million. Adjusted EPS came in at $0.23, beating estimates by $0.22.

The stock has reacted positively to all the above, doubling so far this year. But maybe Tepper thinks the company will struggle to make further headway. In fact, during Q3, his fund sold the entirety of its INTC holdings – a total of 8 million shares.

We’ll check in again with Raymond James’ Simon Leopold, who also sees a difficult path ahead for this chip giant.

“An improved balance sheet and new management provide reasons for hope, but execution risk remains substantial, while Intel lags pure play foundry competitors like TSMC and Samsung Foundry on several fronts,” Leopold explained. “Shares are trading well-above median historic earnings multiples, and our sum-of-the-parts suggests that shares are fairly valued. Management has raised the possibility of separating the foundry business, which makes a sum-of-the-parts valuation helpful… Shares currently trade at P/E of ~64x NTM consensus EPS, which is near the all-time high.”

Bottom line, Leopold rates INTC as Market Perform (i.e., Neutral), with no fixed price target in mind.

Most other analysts are staying on the sidelines as well, giving the stock a Hold consensus rating based on 25 Holds, 6 Sells, and just 3 Buys. Based on the $36.07 average price target, the shares are currently viewed as ~10% overvalued. (See INTC stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analyst. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.