Amazon (AMZN) has just hit new all-time highs, but there appears to be further upside potential. The e-commerce and cloud giant’s Q3 earnings report highlighted significant momentum across both its retail and Amazon Web Services (AWS) segments, alongside notable profitability improvements. Also, free cash flow is surging, and it looks likely to more than double by 2026, providing a solid foundation for the stock’s bullish case. Given the potential for continued upside, I remain bullish on AMZN stock.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Strong Top-line Growth, Margin Expansion in Retail Division

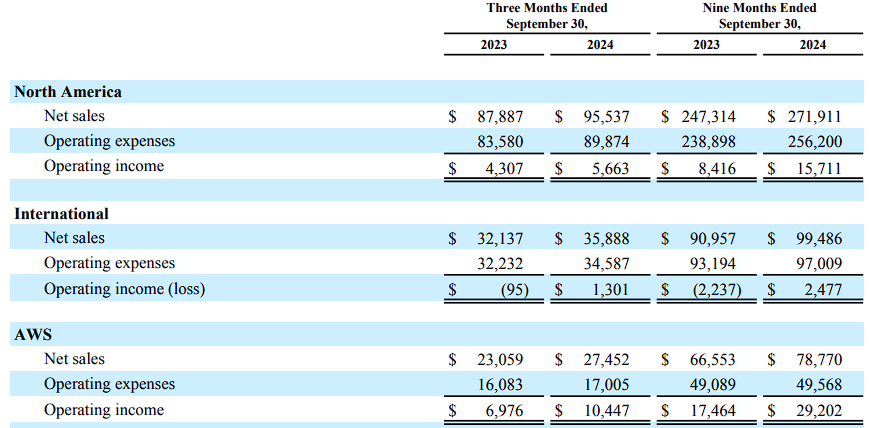

Before diving into Amazon’s free cash flow, allow me to first review its performance in the retail and AWS divisions that fueled its growth, starting with retail. Impressively. Amazon’s retail division saw accelerated growth in Q3, with North American sales rising 9% year-over-year to $95.5 billion and international sales up 12% to $35.9 billion. These figures surpassed the previous quarter’s 9% and 7% growth rates, respectively.

As outlined in the post-earnings call, the division’s growth was driven by improved logistics capabilities and broader product offerings. Management noted that the success of Prime events, such as Prime Day and Prime Big Deal Days, significantly contributed to these results, with customers saving over $5 billion across more than 50 million deals. Further, the recent expansion of Amazon’s Prime benefits, including free grocery deliveries, helped attract new customers and strengthen existing relationships.

In addition, the retail division has increasingly contributed to Amazon’s profitability, marking a shift in the company’s bottom line potential. In North America, retail operating margins increased by 100 basis points to 5.9%, while international margins turned positive, coming in at 3.6%, up from a negative 0.3% last year. The boost in margins can be attributed to Amazon’s logistics optimization, such as enabling inventory management through regional fulfillment centers, which helped reduce shipping costs and increase delivery speed.

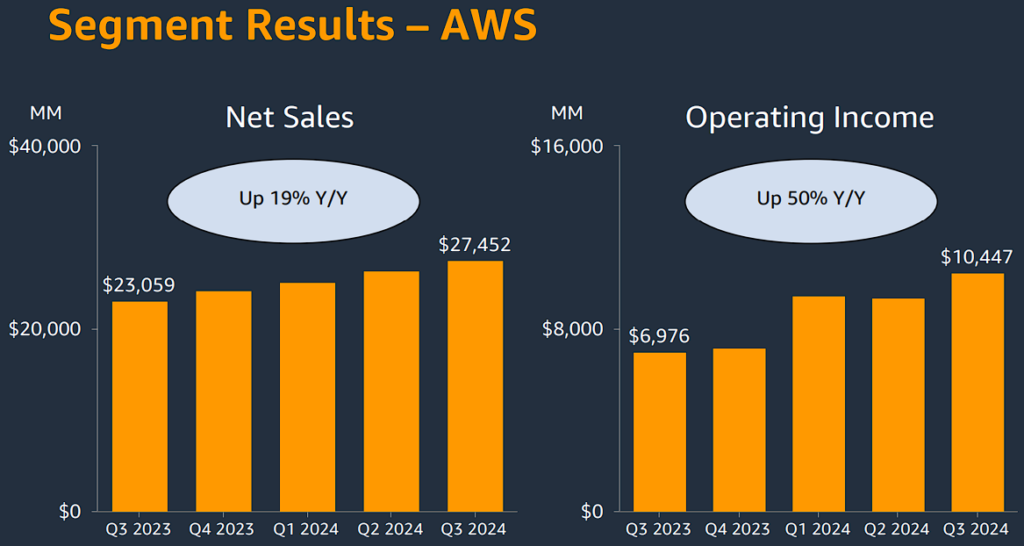

AWS Remains Resilient with No Signs of Slowdown

Now, let’s shift gears to AWS, Amazon’s cloud computing division, which remains a growth powerhouse with no signs of slowing. AWS revenues grew by 19% year-over-year to $27.5 billion, maintaining a solid pace of growth in line with the previous quarter. According to management, AWS’ success was fueled by strong customer demand for generative AI services and cloud solutions. The company signed major deals with Capital One, Booking.com, and Sony, among other notable firms. I think this highlights AWS’s strong entry into the snowballing machine learning and generative AI space and its appeal to top-tier customers as the industry shifts in this direction.

Similar to the retail division, AWS’s profitability has also improved tremendously. AWS’s operating income grew to $10.4 billion, representing a 38% margin, up from 30% last year. The margin expansion in AWS was possible due to cost control measures, which included extending the useful life of server equipment and improving the efficiency of data center infrastructure. Also, management’s focus on optimizing resource allocation and maintaining a controlled hiring pace helped the division contribute to the bottom line.

AMZN’s Free Cash Flow Set to Double by 2026

Due to the profitability improvements we just covered in both retail and AWS, along with a tighter handle on capital expenditures, Amazon’s free cash flow has gained impressive momentum. For the trailing 12 months, free cash flow has surged by 123%, reaching $47.7 billion, driven by capex reductions, a sharp focus on efficiency in fulfillment and data centers, and investments in AWS, which has proven to deliver higher margins.

Looking forward, this trend is expected to continue, with Wall Street consensus estimates projecting that free cash flow will reach $43.6 billion this year, then advance to $68.5 billion in 2025, and hit a mind-bending $92.1 billion by 2026. Besides for such explosive growth in free cash flow reflecting Amazon’s operational strength, it also suggests the potential for significant capital returns in the future. Further, trading at 23.8 times the projected 2026 free cash flow, the stock still seems relatively reasonably valued. For this reason, I believe the stock’s bullish momentum is set to be sustained despite the stock’s already prolonged gains.

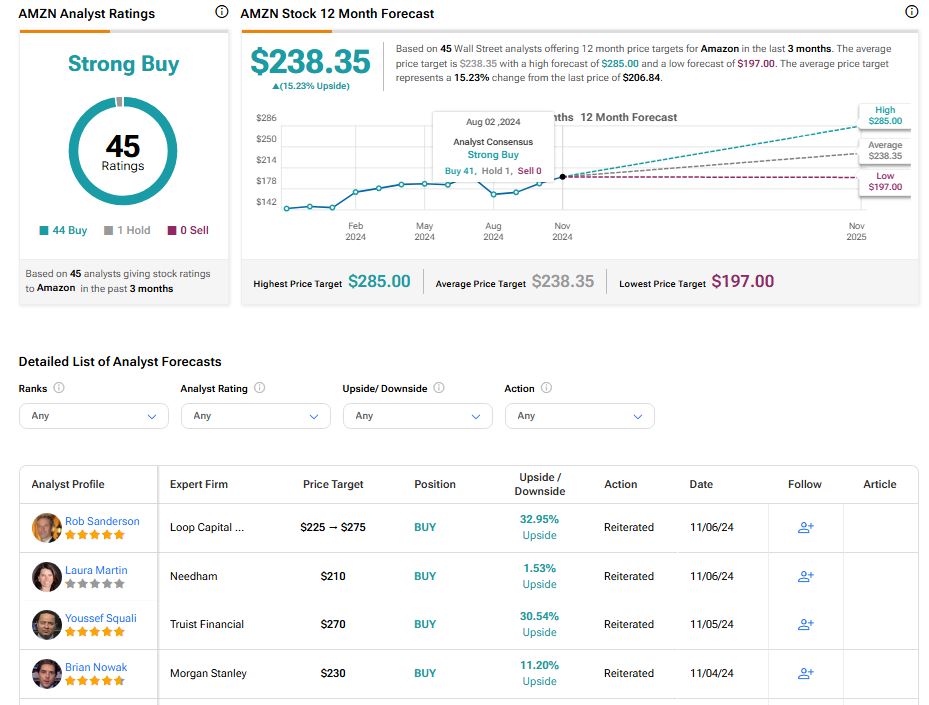

Is AMZN Stock a Buy?

Despite Amazon trading near all-time highs, Wall Street maintains a Strong Buy consensus rating on the stock. This is based on 44 Buys and one Hold assigned in the past three months. At $238.35, the average Amazon stock price target suggests 15.23% upside potential.

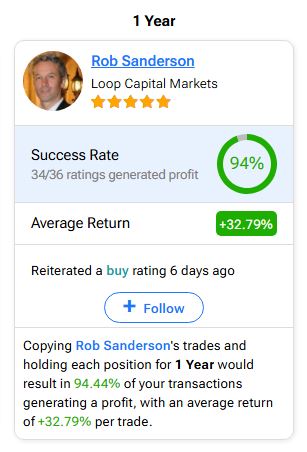

If you’re undecided about which analyst to follow for trading AMZN stock, the most prosperous one over the past year is Rob Sanderson, representing Loop Capital Markets. He has achieved an average return of 32.79% per AMZN stock recommendation and a 94% success rate. For more details, click on the image below.

Takeaway

Overall, I believe that Amazon’s outstanding performance across its retail and AWS segments, which led to strong top and bottom line gains, lays a robust foundation for sustained free cash flow growth.

As Amazon scales its retail operations and more key customers show interest in its ever-advancing AWS capabilities, we will likely continue to see continued margin expansion. In the meantime, the stock’s valuation doesn’t seem rich given these prospects, supporting a scenario in which sustained gains from its current levels remain achievable.