Amazon (NASDAQ:AMZN) finally broke the $2 trillion market cap club after recently soaring to hit a new all-time high this week. With shares near $200 on the back of some powerful growth drivers (AI is just one of them), perhaps AMZN stock’s run to $3 trillion may not take as long as the move from $1 trillion to $2 trillion. Even near highs, I’m as bullish as ever on the e-commerce and public cloud play, especially as it gains some of its disruptive edge back.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Amazon stock has been on a red-hot run, soaring nearly 85% in just two short years. That said, with shares only recently reaching new heights, the firm still lags behind many of its Magnificent Seven peers in performance over the past five years.

Undoubtedly, the painful crash of 2022 left a huge scar on the stock chart. It took a year and a half just to recover from the 55% drawdown. Now that Amazon is slightly above where it was during its 2021 peak, I think the stock looks as timely as ever. With such a firm that’s tied to consumer and enterprise spending via the e-commerce and web services businesses, respectively, perhaps AMZN is one of the more discretionary-focused Magnificent Seven members—one that’s far better to buy on strength than on weakness.

As consumer and enterprise spending bounces back while Amazon looks to enhance existing products with AI, perhaps Amazon stock’s “quiet” rally could have the most legs going into the second half of the year.

Whether we’re talking about Alexa’s upcoming AI upgrades or Amazon’s push to offer cheap Chinese goods to compete with Shein and PDD Holdings’ (NASDAQ:PDD) Temu, Amazon seems ready for the next wave of disruption.

AI Alexa Is Coming, and Amazon Wants Users to Pay Up for It

It’s not just Siri that needs an overhaul. Amazon’s Alexa is also long overdue for a big generative AI upgrade. And going into year’s end, we may see Alexa become a personalized AI assistant that rivals the capabilities of Apple (NASDAQ:AAPL) Intelligence.

Of course, only time will tell how Alexa+ stacks up against Apple and ChatGPT. Regardless, Amazon will need to outdo Apple in a big way if it’s to charge a fee for its AI services while Apple allows its users to enjoy Apple Intelligence for free, provided they have an eligible device (iPhone 15 Pro and beyond or a tablet or Mac with the M-series chip). For those hesitant to upgrade their iPhones, perhaps a personalized Alexa on steroids is enough to scratch one’s AI itch.

Given that Amazon has been on the cutting edge of AI with its Bedrock service and a rumored ChatGPT rival codenamed “Metis” that’s in the works, perhaps Amazon is the new underappreciated AI play following Apple stock’s latest AI-induced surge.

Additionally, Amazon seems to already be using its AI to bolster productivity in its finance divisions. Indeed, it’s not only the warehouse where Amazon can use AI to reduce labor costs. In any case, it’s a mistake to discount the e-commerce behemoth’s AI capabilities as it nears the launch of its smartest consumer-facing innovations yet.

Amazon Fires Back at Temu and Shein

Amazon is poised to get a piece of the craze surrounding cheap Chinese goods and fashions sold at Temu and Shein, at least according to a recent report issued by The Information. Undoubtedly, the appetite for extremely low prices, even at the expense of quality, is alive and well amid inflation. Whether or not the boom in ultra-cheap goods shipped from China is more than just a fad, Amazon’s recent entry into the scene seems like a low-risk move and one that could entail considerable growth.

Like Temu and Shein, Amazon’s new service will ship goods from China at close to rock-bottom prices. Even if Amazon can’t match prices for comparable goods, offering better shipping speeds may just give Amazon a leg up over its Chinese rivals.

Goods ordered on Temu or Shein can take a while (think weeks) to arrive. With Amazon’s relentless focus on getting goods out the door far faster than rivals, perhaps the disruptors in Temu and Shein stand to get disrupted.

In any case, it will be interesting to see how Amazon’s Temu-like service fares once it goes live. If it’s not a hit, it’s no big deal. But if it grabs some of that Temu business, look for AMZN stock to make up for the time it lost back in 2022.

Though AMZN stock has moved higher following the news, shares are still on the cheap side of the past-year range, now going for 55.6 times trailing price-to-earnings (P/E).

Is AMZN Stock a Buy, According to Analysts?

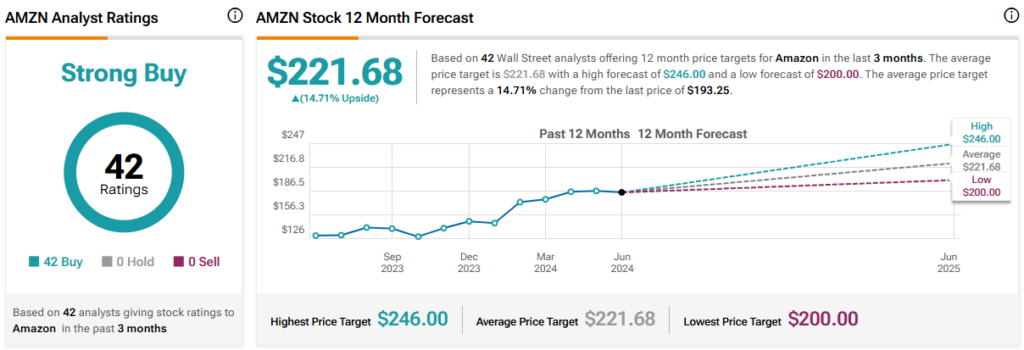

On TipRanks, AMZN stock comes in as a Strong Buy. Out of 42 analyst ratings, there are 42 unanimous Buy recommendations. The average AMZN stock price target is $221.68, implying upside potential of 14.7%. Analyst price targets range from a low of $200.00 per share to a high of $246.00 per share.

The Bottom Line

Amazon’s long-awaited breakout is here, but there’s probably room to run as the e-commerce juggernaut leverages AI to extend its rally. Combined with a new e-commerce business that competes directly with Chinese rivals Temu and Shein, perhaps AMZN stock isn’t getting as much respect from investors, especially if the consumer is ready to start spending again seriously.