E-commerce giant Amazon.com, Inc. (NASDAQ: AMZN) offers online retail shopping services and cloud computing services.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

The company is striving to achieve long-term growth by investing in expansion and streamlining operations. Since sales growth has slowed down post-pandemic, rapid expansion is expected to result in higher demand.

International Expansion

According to a recent Business Insider report, Amazon plans to launch an online marketplace in five new countries by early next year. These countries include Belgium, Chile, Colombia, Nigeria, and South Africa.

The slowdown in business is anticipated to continue this year due to uncertainty in the economic environment, and therefore, Amazon has reduced hiring, subleased its warehouses, and restricted delivery network expansion. As a result, the new move might help Amazon effectively utilize the excess capacity of warehouses.

The new Belgium marketplace is expected to sell goods valued at 3.94 billion euros by 2027, the company estimates.

Currently, Amazon has marketplaces in 20 different countries, with relatively low market penetration in emerging markets such as South America and Africa.

No comments were released by the Amazon spokesperson.

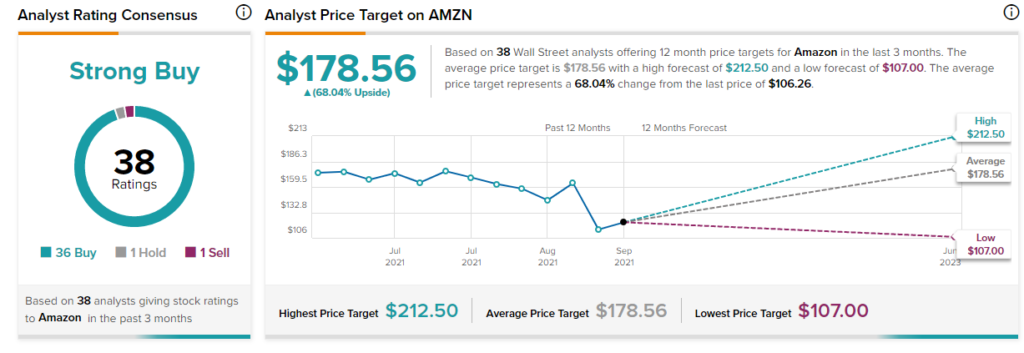

Wall Street’s Take

Recently, Truist Financial analyst Youssef Squali reiterated a Buy rating on Amazon with a price target of $175 (64.69% upside potential).

According to Squali, while Amazon faces challenges such as tough year-over-year comparisons, rising cost pressure, and a slowdown in the economy, these challenges have already been factored into the company’s current price.

Consensus among analysts is a Strong Buy based on 36 Buys, one Hold, and one Sell. The average Amazon price target of $178.56 implies 68.04% upside potential from current levels. Shares have lost 38.47% over the past year.

Also, TipRanks’ Stock Investors tool shows that investors currently have a Very Positive stance on Amazon, with 8% of investors maintaining portfolios on TipRanks increasing their exposure to AMZN stock over the past 30 days. Furthermore, 0.9% of these individuals have reduced their holdings in the recent week.

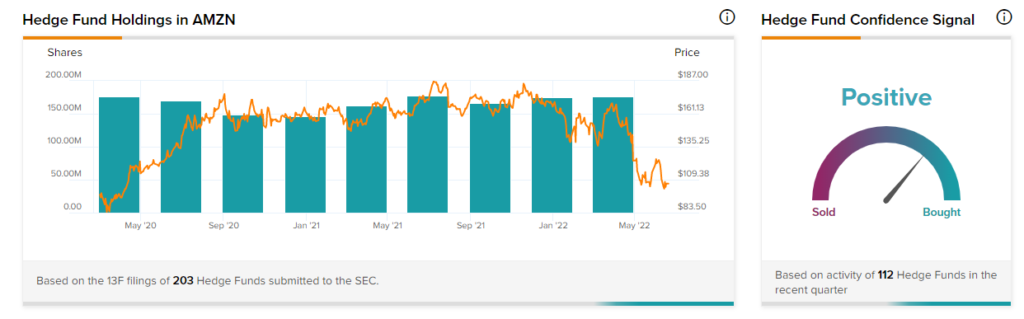

Hedge Funds

TipRanks’ Hedge Fund Trading Activity tool shows that confidence in Amazon is currently Positive, as the cumulative change in holdings across all 112 hedge funds that were active in the last quarter was an increase of 1.5 million shares.

Concluding Remarks

Given the company’s solid fundamentals and promising long-term prospects, investors view Amazon’s current price as an attractive entry point. Furthermore, analysts see significant upside potential in the stock.