As 2025 comes to an end, Amazon (AMZN) stock is lagging the broader market. The stock is up about 6% so far this year, well behind the S&P 500’s (SPY) roughly 18% gain, as AWS growth slowed and AI profits have taken longer to show up. Job cuts announced in October further added pressure. Still, Wall Street’s top analysts remain bullish on Amazon’s longer-term outlook and believe the setup into 2026 may be improving.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Why Top Analysts Remain Upbeat About AMZN Stock

Several top analysts argue that Amazon’s long-term story remains intact. They believe that AWS growth has slowed, but it has not stalled, and AI demand is still rising.

Five-star analyst Mark Mahaney of Evercore ISI has named Amazon a “top pick” for 2026. He expects a rebound in AWS growth, strong demand for Trainium AI chips, and steady gains in advertising. He also sees potential upside from the gradual rollout of Alexa+. Mahaney describes Amazon as a long-term compounder, supported by steady sales growth, improving margins, and the chance for stronger free cash flow over the next two years.

Also, Goldman Sachs analyst Eric Sheridan kept a Buy rating and a $290 target. He believes that cloud growth can pick up again as AI demand matures. He expects AWS revenue to grow at more than 20% a year over the next few years.

At the same time, a few Top analysts are focused on Amazon’s growing role in AI infrastructure. At JPMorgan, five-star analyst Doug Anmuth continues to see around 31% upside in the stock. He pointed to Amazon’s $38 billion cloud deal with OpenAI, which could support AWS demand as AI use expands.

Bank of America analyst Justin Post also reiterated a Buy rating, with a $303 price target. He cited reports that Amazon may invest more than $10 billion in OpenAI, a move he believes could shift more AI workloads to AWS and highlight the strength of Amazon’s in-house chips.

Is Amazon Stock a Buy Now?

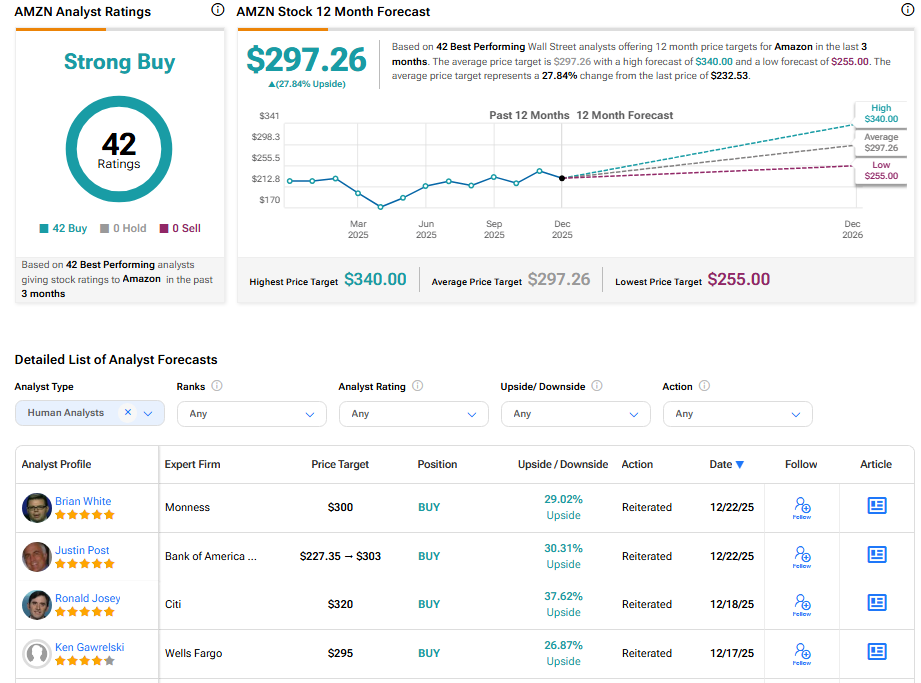

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMZN stock based on 42 Buys assigned in the past three months, as indicated by the graphic below. Furthermore, the average AMZN price target of $297.26 per share implies 27.8% upside potential.