Amazon stock (AMZN) just took a hit as analysts rethink their forecasts. Several analysts have slashed their forecasts in the past two weeks, with tariff worries and new spending plans weighing heavy on the stock. The market’s still optimistic long-term, but near-term sentiment? Not so much.

Raymond James Downgrades Amazon and Lowers Price Target

First up, Raymond James cut Amazon’s rating from Strong Buy to Outperform and chopped its price target to $195 from $275. The firm flagged two big issues: tariff headwinds and Amazon’s aggressive $15 billion investment in rural delivery infrastructure. That kind of spending could pressure profits at a time when margins are already feeling squeezed. Raymond James analysts wrote, “We see increased capital expenditures putting near-term strain on Amazon’s free cash flow, especially with global trade tensions heating up.”

Jefferies Trims Target but Holds Its Ground

Jefferies kept its Buy rating but dropped the price target from $250 to $240. The firm sees potential, but short-term risks like tariffs and macro weakness forced the adjustment. Jefferies analysts said, “While we remain confident in Amazon’s long-term positioning, we expect ongoing macro pressures to cap growth in the next two quarters.”

Bank of America & Bernstein Hold Steady

Meanwhile, Bank of America hasn’t budged. The firm stuck with its $225 price target and Buy rating. But even BofA acknowledged the tariff risk. “Rising geopolitical tensions present a meaningful overhang,” BofA analysts noted, though they added, “Amazon’s diverse revenue streams give it resilience other retailers lack.” They see value in Amazon compared to peers but flagged the trade war as something investors can’t ignore.

Bernstein also held their ground. Analyst Mark Shmulik maintained a Buy rating on Amazon today and set a price target of $275.00.

Is Amazon Stock Expected to Rise?

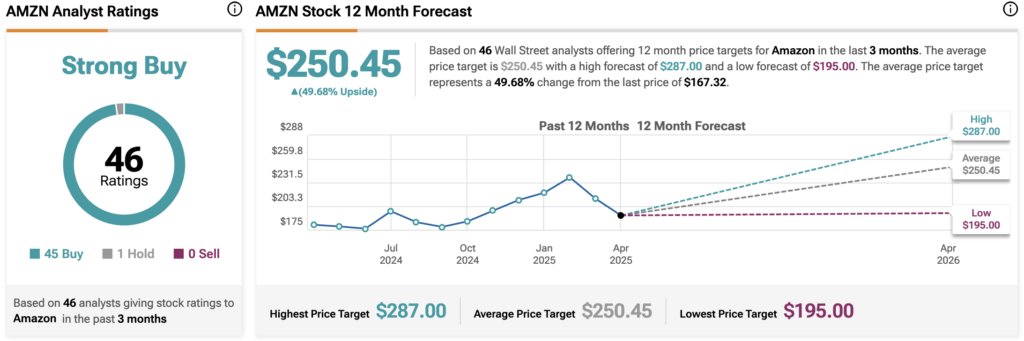

Despite the downgrade noise, analysts still lean bullish overall. According to TipRanks, analysts remain bullish about AMZN stock, with a Strong Buy consensus rating based on 45 Buys and one Hold. Over the past year, AMZN as decreased by more than 5%, and the average AMZN price target of $250.45 implies an upside potential of 49.7% from current levels.

Amazon earnings land on May 1, and the AMZN stock could swing in either direction. Tariff risks, delivery investments, and consumer demand will be the key themes to watch. If those headwinds get worse? Expect more cuts. But if Amazon surprises on the upside? This dip might just be a buying opportunity.