Amazon (AMZN) fell short of Q2 sales expectations but showed strong growth in its Amazon Web Services (AWS) cloud business. While I view the stock as fairly valued overall, broader market concerns and potential price corrections could lead to short-term declines. Nonetheless, I remain bullish on AMZN’s long-term potential but warn that short-term traders may face additional downside.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

Amazon’s Q2 Financial Results and Valuation

Amazon Q2 results shows the recent correction in AMZN’s share price, but I see the possibility for further downside over the next few quarters. That said, I consider AMZN stock fairly valued.

Let’s examine Amazon’s financial and see why it’s fairly valued:

On August 1, Amazon released its second-quarter results, sending its shares down by almost 9% in one day. Amazon experienced slower growth in its online retail sales. This slowdown was attributed to cautious consumer spending and growing competition from budget retailers like PDD Holdings’ (PDD) Temu and China’s Shein, which offer low-priced products directly from China.

Consequently, Amazon’s net sales increased by about 10% year-over-year to $148 billion in Q2, but missed analysts’ expectations of $148.56 billion. Also, its Q3 sales forecast fell short of Wall Street’s consensus.

In addition, the company’s high capex related to AI has raised concerns about short-to-medium-term ROI (return on investment). While AWS delivered a 19% year-over-year increase in revenue in the second quarter, advertising sales grew 20% but did not meet expectations.

Now, Let’s take a look at Amazon’s valuation; its TTM P/E (trailing 12 months price-to-earnings) GAAP ratio has dropped to 40x from nearly 60x six months ago. This presents a significant value opportunity, especially given Wall Street’s consensus forecast of 23% EPS (earnings per share) growth for Fiscal 2025 and 27.5% for Fiscal 2026. While broader market pressures might affect performance, the current valuation still seems appealing and accounts for these concerns.

Amazon’s TTM P/S (price-to-sales) ratio has declined to 2.92x from 3.34x a month ago, reinforcing my belief that the stock is a buy. This is particularly compelling given Wall Street’s consensus that the company will sustain revenue growth similar to Fiscal 2024 over the next two years.

Speaking of profitability, Amazon boasts impressive net margins in retail, driven by its economies of scale and advanced technology infrastructure. Its current net income margin stands at 7.35%. I expect further expansion in margins as the company scales up its use of artificial intelligence (AI), robotics, and automation. This potential for growth is a key reason I remain bullish on AMZN, even if the stock experiences further short-term declines.

AI Costs and Economic Pressures

Amazon has notably ramped up its capital expenditures, especially in AI and cloud infrastructure. The company plans to invest $100 billion in data centers over the next decade to bolster AI computing. In the near term, this increased spending is likely to put pressure on the company’s profit margins. Also, the AI arms race, which involves major tech firms like Google (GOOGL) and Meta Platforms (META), presents an additional headwind.

However, in the long run, I believe this substantial investment will significantly enhance margins and improve the company’s cost competitiveness.

Meanwhile, macroeconomic pressures, high inflation, and interest rates in the U.S. could lead to stagnation or even a medium-term recession. This uncertainty suggests that Amazon’s stock might face further declines before bottoming out. However, these conditions present potential long-term buying opportunities.

Is AMZN Stock a Buy, According to Analysts?

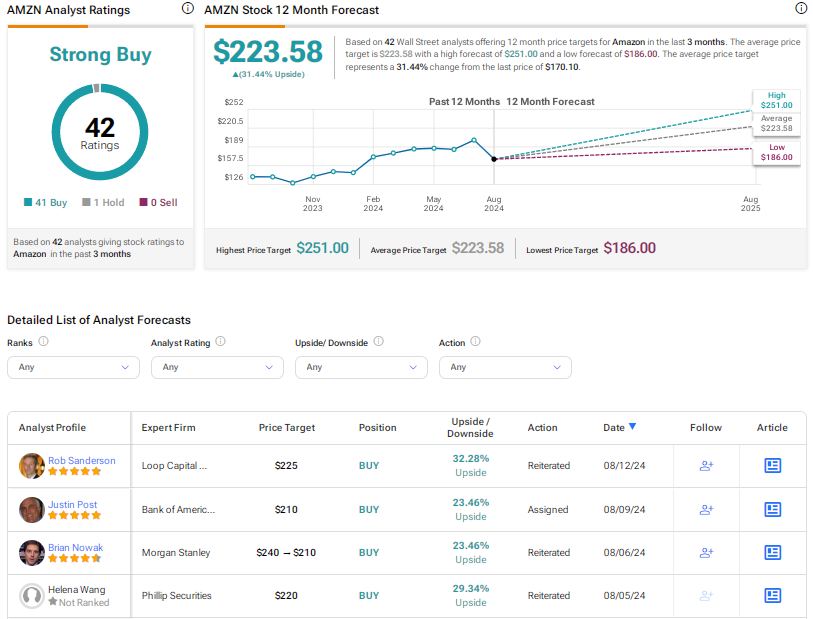

Turning to Wall Street, the average analyst price target for AMZN is $223.58, which indicates 31.44% upside potential. Amazon is a Strong Buy on Wall Street, with 41 Buys and one Hold rating.

See more AMZN analyst ratings.

Conclusion

Based on my analysis, Amazon is a Buy due to its robust long-term growth prospects, despite short-term recession fears. The company’s investment in AI is expected to boost margins over time.

Wall Street sees growth potential in AMZN stock, but the impact of broader macroeconomic pressures on the technology sector could alter forecasts. Amazon’s Q2 underperformance relative to expectations suggests the possibility of further disappointments, especially if market conditions worsen. Given the stock’s current undervaluation, any near-term volatility is seen as a potential buying opportunity.