Amazon (AMZN) stock slipped on Friday alongside reports that the e-commerce company plans to lay off workers soon. The scale of the layoffs is currently unknown, but the company has started its internal review of workers to determine ongoing employment. This shouldn’t come as a surprise, as many companies often reduce their workforces at the start of a new year.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

While some companies have filed WARN notices about their 2026 layoffs, Amazon hasn’t done so. That makes sense, as the company typically doesn’t file these until after employees have been notified. Amazon is able to do this as it offers severance pay or garden leave to employees, which gives them advance notice or pay. Handling layoffs this way allows Amazon to delay the WARN filing.

According to recent reports, Amazon is expected to lay off anywhere from 1,000 to 2,500 employees, compared to the roughly 1.1 million it employs in the U.S. These layoffs will likely be announced this month, as the company pares down its workforce for 2026.

Amazon Stock Movement Today

Amazon stock was down slightly in pre-market trading on Friday, following a 1.96% rally yesterday. The stock has gained 6.7% year-to-date and 12.49% over the past 12 months.

AMZN stock has experienced muted trading today, as roughly 513,000 shares have changed hands this morning. For the record, the company’s three-month daily average trading volume is around 33.39 million units.

Is Amazon Stock a Buy, Sell, or Hold?

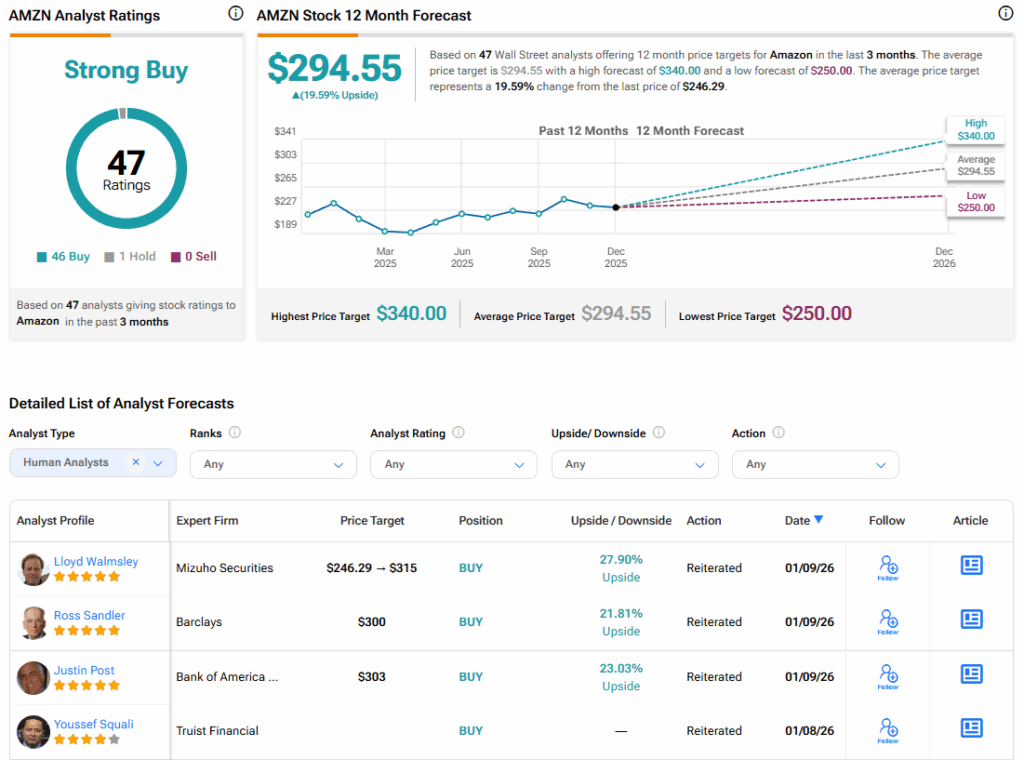

Turning to Wall Street, the analysts’ consensus rating for Amazon is Strong Buy, based on 46 Buy and a single Hold rating over the past three months. With that comes an average AMZN stock price target of $294.55, representing a potential 19.59% upside for the shares.