Amazon’s robotaxi unit Zoox has recalled 258 vehicles over an unexpected braking issue that can increase the risk of a crash. In a filing with the National Highway Traffic Safety Administration, Zoox said had recalled certain Automated Driving Systems (ADS) equipped with software versions released prior to November 5, 2024.

In certain driving scenarios, such as when a motorcyclist rapidly approaches the rear of the vehicle or a cyclist enters a nearby crosswalk, the vehicle may brake hard unexpectedly, Zoox said. The company said it has already fixed the problem with an update to the ADS software.

Zoox Aims to Grow in 2025

It comes just as Zoox is looking to “significantly” grow operations and commercialize the robotaxi business in 2025. The firm hopes to begin offering rides to the public “quite soon,” co-founder and Chief Technology Officer Jesse Levinson told CNBC in an interview earlier this year.

The company, which was purchased by Amazon for $1.3 billion in 2020, has been testing its purpose-built robotaxis on public roads since early 2023. It differs from Alphabet’s (GOOGL) Waymo in that from day one it developed its vehicles not to have a human driver, rather than retrofitting older vehicles.

Driverless vehicles have been a lot harder to develop than many investors hoped. Tesla (TSLA) has notably failed to really deliver on its ambitions for its robotaxi business.

That said, Waymo continues to expand. It announced a deal last year with Uber (UBER) to bring its robotaxi services to Austin and Atlanta in 2025, while it also plans to expand to Miami next year.

Is AMZN Stock a Buy?

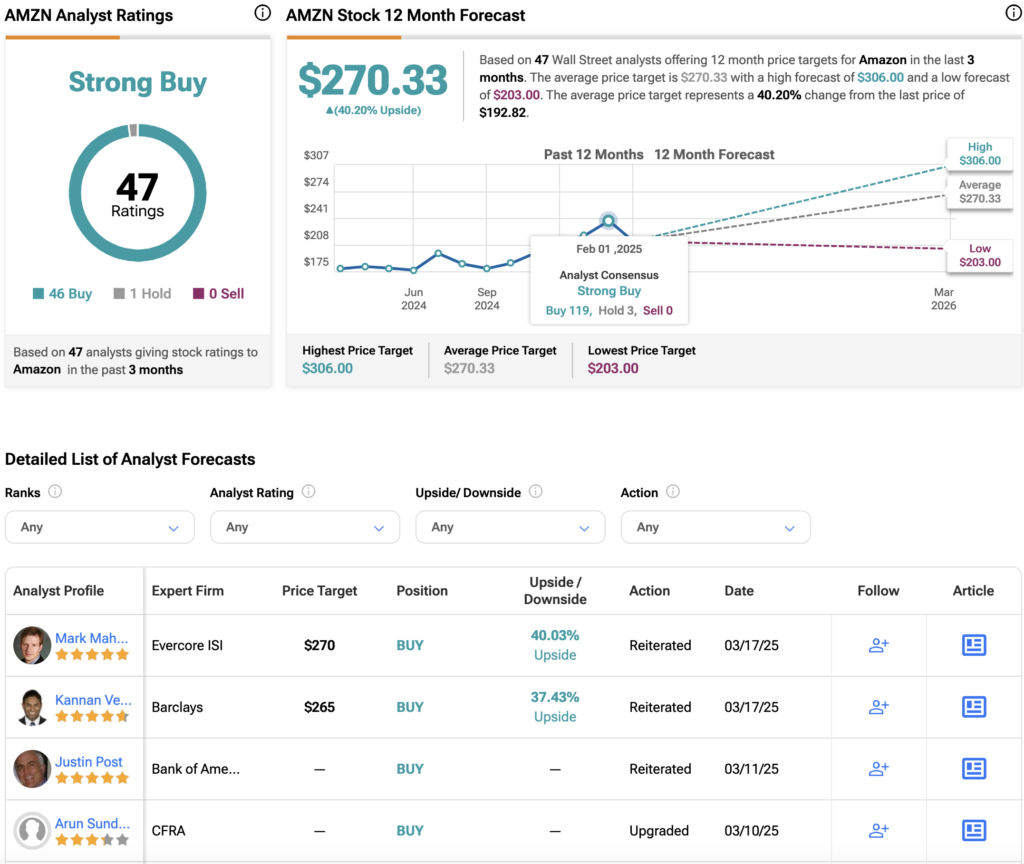

AMZN has a consensus Strong Buy rating among 47 Wall Street analysts. That rating is based on 46 Buy and one Hold recommendations issued in the last three months. The average price target on AMZN stock of $270.33 implies 40% upside from current levels.

Questions or Comments about the article? Write to editor@tipranks.com