E-commerce and cloud giant Amazon (NASDAQ:AMZN) looks set to ascend to the next decade of growth. When I gave Amazon a Buy rating last year, the AWS segment was facing macro headwinds. I was optimistic that they were only temporary and that AWS would rebound. The recent Q4 results proved just that. The stock has since gained 70%+, but I continue to be bullish on AMZN based on reaccelerated growth across AWS (fueled by AI), e-commerce, and its advertising business, as well as margin and cash-flow expansion.

Claim 70% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Q4 Earnings Beat Driven by Robust Momentum Across All Segments

On February 1, Amazon reported strong Q4 results driven by robust momentum across all revenue segments, including E-Commerce (record holiday shopping season), Advertising, and Cloud. Adjusted earnings of $1.00 per share handily beat analysts’ estimate of $0.80. Also, the figure was a huge 3,233% higher than last year’s figure of a mere $0.03 per share.

Further, net sales jumped 14% year-over-year to $170 billion. Region-wise, North America sales grew 13% year-over-year, with International segment revenue growth at 17% (in constant currency).

The major focus of the Q4 results was AWS (Amazon Web Services), which witnessed a reasonable rebound. AWS net sales grew 13% year-over-year to $24.2 billion. Further, there was a significant operating margin expansion from 24.3% in the prior-year quarter to 29.6% currently. Particularly noteworthy is that operating income jumped 383% year-over-year to $13.2 billion, and the operating margin jumped to 7.8% compared to only 1.8% a year ago.

It’s not just the margin expansion that impressed investors in Q4, it was a huge jump in cash flows that reassured investors that Amazon’s fundamentals remain intact. Q4 free cash flows grew to $36.8 billion compared to cash outflows of $11.6 billion a year ago. Margin expansion, coupled with robust free cash flows, implies strong returns for investors in the years to come.

What’s more, the company gave out a better-than-expected Q1 outlook regarding its operating income. Operating income guidance of $8-12 billion ($10 billion at the midpoint) came in ahead of the $8.8 billion consensus estimate and is also much higher compared to $4.8 billion generated in the first quarter of 2023. It’s no wonder then that the impressive earnings have taken the stock price around 8% higher, getting closer to its all-time high of ~$188 seen in 2021.

It’s worth noting, however, that Q1 sales are expected to grow between 8-13% year-over-year and be in the range of $138-143.5 billion, just slightly below the consensus estimate of $142.1 billion

Here’s another thing worth noting: cashing in on the stock price rally, Amazon’s Founder and Executive Chairman, Jeff Bezos, recently sold $6 billion worth of AMZN shares in multiple trades. In fact, the company disclosed that Bezos has enabled a trading plan that will allow him to sell a whopping 50 million shares worth around $9 billion before January 31, 2025.

AWS Will Drive Future Returns; AI Will be the Propeller

AI and cloud computing will continue to complement and spur demand for each other. Further, the cloud optimization observed in 2023 due to recessionary fears is now over, and cloud computing is once again experiencing significant growth across the industry, as evidenced by reports from various companies. Amazon’s AWS now reportedly stands at the cusp of a $100 billion annual run rate.

AWS is a cloud computing business that provides options to enterprises to scale up or down based on demand. Amazon’s AWS continues to be the market leader in cloud computing. Microsoft’s Azure is the chief competitor of AWS and Microsoft’s (NASDAQ:MSFT) outstanding cloud numbers during its recent earnings call reaffirm a bright future for everything cloud.

During the earnings call, CEO Andrew Jassy highlighted, “In the scheme of a $100 billion annual revenue run rate business, it’s still relatively small, much smaller than what it will be in the future, where we really believe we’re going to drive tens of billions of dollars of revenue over the next several years.”

Further, the AWS backlog is increasing at a fast pace. Management also highlighted that AWS is snowballing with an increased international footprint in more countries. Moreover, newer partnerships, especially in generative AI, will foster accelerated growth in the coming years. This gives us the long-term roadmap for the growth of AWS, further catapulted by AI.

Amazon’s Valuation Isn’t Expensive, Either

As Amazon houses multiple businesses under its radar, I believe the EV/EBITDA ratio is the best metric to evaluate the stock’s valuation. Being an industry leader, the company has historically traded at high multiples. At present, however, Amazon stock is trading at around 13.7x EV/EBITDA (on a forward basis) compared to its own five-year historical average of 21x. This implies a huge 35% discount.

For the sake of comparison, Amazon is trading at a price-to-sales (P/S) ratio of 3.1x. In contrast, cloud computing and tech giant Microsoft trades at a P/S of 13.2x, while social networking company Meta Platforms (NASDAQ:META) trades at a P/S of 8.9x.

Therefore, I believe the stock is trading at an attractive valuation and presents a great buying opportunity, given the strong growth potential across various verticals.

Is Amazon Stock a Buy, According to Analysts?

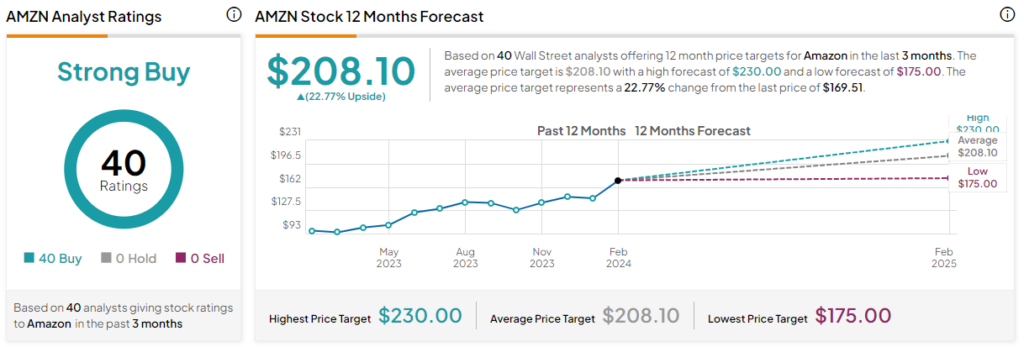

The Wall Street community is clearly optimistic about Amazon stock, with a majority having raised their price targets on the stock post-earnings. Overall, the stock commands a Strong Buy consensus rating based on 40 unanimous Buy ratings. The average AMZN stock price target of $208.10 implies a 22.8% upside potential from current levels.

Conclusion: Consider AMZN Stock for Its Long-Term Growth

Amazon stock was one of the most battered stocks in the tech crash of 2022. The stock lost half of its market cap, mainly due to the double trouble of e-commerce deceleration and a cloud computing slowdown. However, bygones are bygones. Q4 Cloud numbers were reassuring and hint that AWS is set to lead Amazon’s growth story in the coming years, further driven by AI tailwinds.

Additionally, there are other areas of profitable growth, including e-commerce, Amazon Prime memberships, as well as a strong advertising business. On top of that, profit margins are expected to expand materially, aided by cost-cutting initiatives. Amazon’s recent results instill confidence in investors once again that it is ready to embark on multiple years of growth ahead. Therefore, I will buy the stock at current levels.