Back in June, Andy Jassy, the CEO of tech giant Amazon (AMZN), told employees that AI agents would soon become part of everyday life. In fact, AI companies have been releasing their own shopping agents, which are tools that help users find products, compare prices, and make purchases, all without visiting retail websites like Amazon. Instead, AI handles everything in a chat window. Importantly, McKinsey estimates that agentic commerce could reach $1 trillion in U.S. retail sales by 2030.

Claim 70% Off TipRanks This Holiday Season

- Unlock hedge-fund level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

But while this creates opportunity, it also threatens Amazon’s margins and customer loyalty. This is because when shoppers use ChatGPT to buy something, OpenAI (PC:OPAIQ) collects a fee, and retailers lose control over the transaction. As a result, Amazon has been on the defensive so far. More precisely, it has blocked dozens of AI bots from crawling its site. It even sued Perplexity for unauthorized scraping and has kept key data, such as customer reviews and sales rankings, out of competitors’ reach.

At the same time, Amazon is building its own tools and quietly testing how much access to give AI agents on its smaller platforms like Zappos. Nevertheless, with Morgan Stanley (MS) analysts predicting that nearly half of U.S. shoppers will use AI agents by 2030, Amazon must decide carefully whether to fight or join the shopping agent trend, as it has the most to lose if it doesn’t adapt effectively.

Is Amazon a Buy, Sell, or Hold?

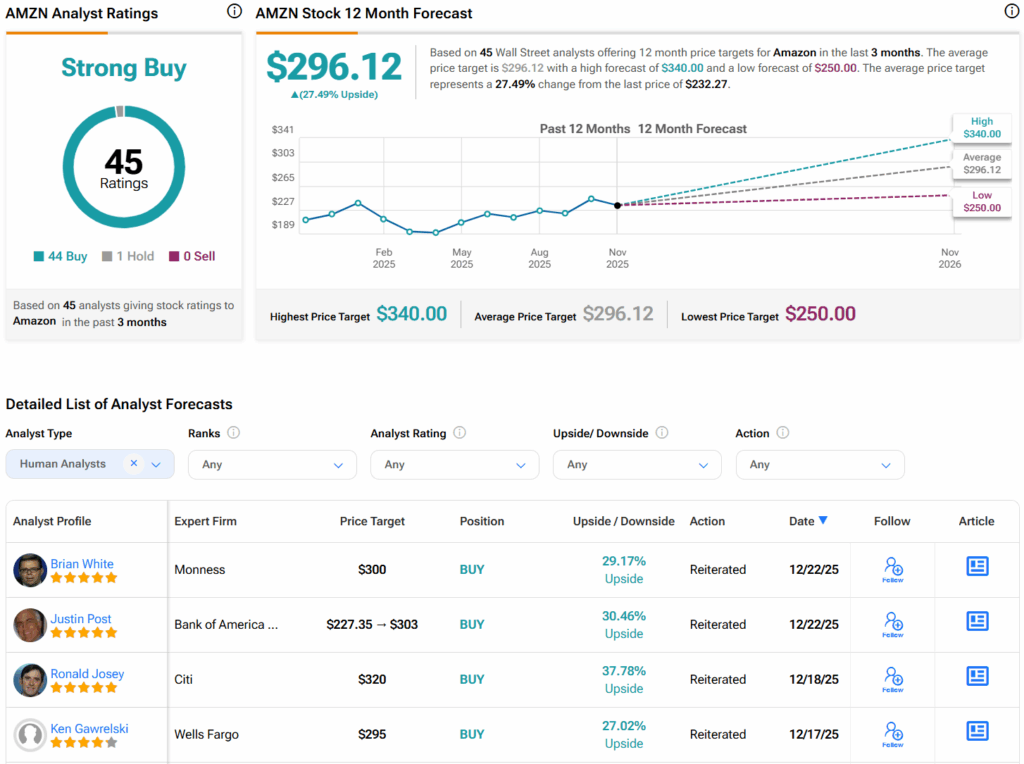

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMZN stock based on 44 Buys and one Hold assigned in the past three months, as indicated by the graphic below. Furthermore, the average AMZN price target of $296.12 per share implies 27.5% upside potential.