Amazon (AMZN) is working on a new brand of AI chips that, if successful, could position the company as a rival to Nvidia (NVDA). According to a report from The Financial Times, the tech giant has invested heavily in Annapurna Labs, a subsidiary specializing in microelectronics and building Amazon’s new custom semiconductors. This marks a clear effort by Amazon to reduce its reliance on Nvidia’s technology.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Since the launch of ChatGPT ignited the current AI boom, no company has come close to challenging Nvidia’s dominance. However, a company with Amazon’s resources is well positioned to compete, which could impact Nvidia’s market share and stock.

What’s Happening with Nvidia Stock Today?

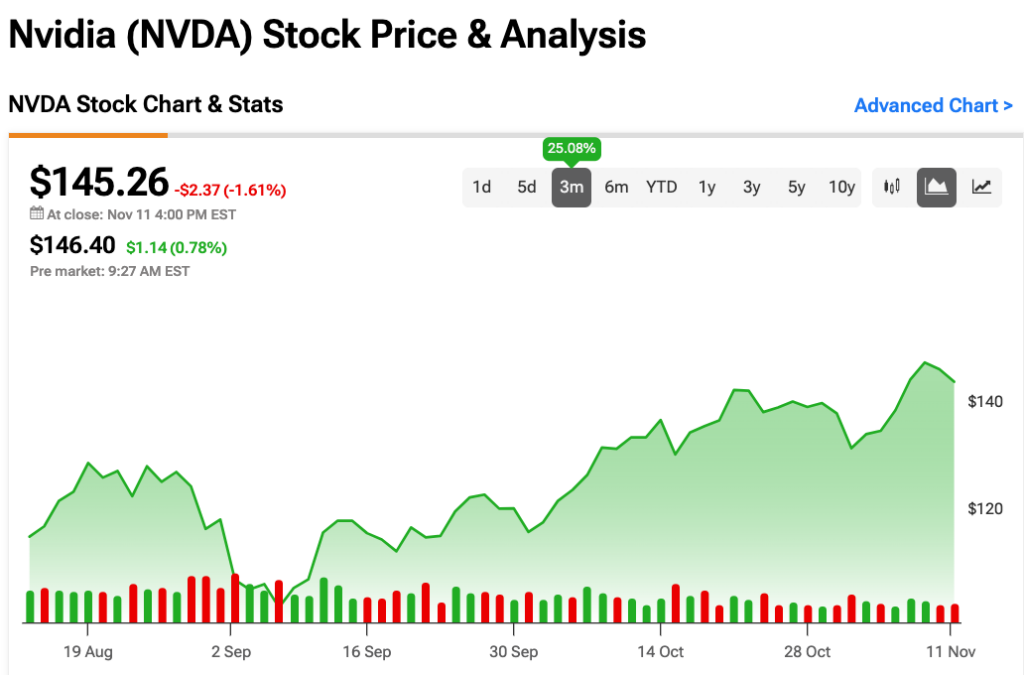

While Nvidia stock is slipping today, that can likely be attributed to general market momentum, not Amazon’s news. Both stocks are in the red, with NVDA down 2% and AMZN down 1%. Both stocks have struggled over the past week due to volatile market conditions. But overall, Nvidia has slightly outpaced Amazon over the past quarter, rising 25% while Amazon has only risen 21%.

Now, however, Nvidia may be about to face a unique challenge. If Amazon succeeds in pioneering its own brand of AI chips, it could mean Nvidia will lose a key partner and customer. Depending on how quickly Amazon can scale its chip-building operations, it could potentially start supplying chips to other Nvidia clients.

As The Financial Times notes, Nvidia anticipates that its capital spending will reach $75 billion in 2024, “with the majority on technology infrastructure.” On a recent earnings call, CEO Andy Jassy stated that he expects spending to be even higher in 2025, indicating Amazon’s full commitment to its chip development projects.

Wall Street Remains Highly Bullish on Nvidia Stock

The prospect of Amazon entering the chip race hasn’t impacted Wall Street sentiment towards Nvidia. Analysts have a Strong Buy consensus rating on NVDA stock based on 38 Buys and three Holds assigned in the past three months, as indicated by the graphic below. After a 200% rally in its share price over the past year, the average NVDA price target of $157.27 per share implies a 7% upside potential.

See more NVDA stock analyst ratings

Yesterday, multiple analysts, including Harsh Kumar of Piper Sandler and Timothy Arcuri of UBS (UBS) increased their NVDA stock price targets. While Amazon’s chip progress may pose problems for Nvidia in the future, it is clear that for now, Wall Street is not worried.