E-commerce behemoth Amazon.com (AMZN) is betting big on AI (artificial intelligence), with a planned $100 billion in capital expenditures in 2025. Amazon’s CEO Andy Jassy announced the potential capex spend in the Q4 earnings call yesterday, calling it a “once-in-a-lifetime type of business opportunity.” Most of that capex would go toward AI for AWS (Amazon Web Service), the company’s cloud computing arm.

Maximize Your Portfolio with Data Driven Insights:

- Leverage the power of TipRanks' Smart Score, a data-driven tool to help you uncover top performing stocks and make informed investment decisions.

- Monitor your stock picks and compare them to top Wall Street Analysts' recommendations with Your Smart Portfolio

AMZN stock fell over 4% in after-hours trading yesterday after the company gave one of the weakest guidance in history so far. Interestingly, investors gave more weightage to the disappointing outlook and massive AI spend rather than the healthy Q4 beat. Amazon exceeded both earnings and sales estimates for Q4 FY24.

Amazon and Big Tech’s Big Spend on AI

Remarkably, Amazon was also one of the largest AI spenders among big tech in 2024, with roughly $78 billion spent in capex. In Q4 last year, Amazon spent $26.3 billion on capex. In October 2024 itself, Jassy had predicted that Amazon’s capex in 2025 would surpass the figure of 2024. The bustling demand for generative AI chatbots and technology has compelled companies to accelerate investments in AI data centers and infrastructures. Amazon’s AI spend is targeted toward developing further data centers, networking gear, and hardware for generative AI needs.

Amazon boasts a host of AI products, including its Trainium chips, series of Nova models, shopping bot, and Bedrock, a marketplace for third-party models. Alongside notable investments in AI, Amazon plans to spend on its stores business, aimed at improving the delivery speed and efficiency. The company’s warehouses run on nearly full autonomy with robotic technology.

Meta Platform (META) plans to spend $65 billion on AI this year, while Microsoft (MSFT) and Alphabet (GOOGL) will invest up to $80 billion and $75 billion, respectively.

China’s DeepSeek Not a Threat

Answering questions on Chinese rival DeepSeek’s cheap R1 model, Jassy said that it was not a threat to Amazon. Instead, he believes that the emergence of such models only solidifies the need for enhanced AI infrastructure since the demand will only expand in the coming years.

Meta Platforms (META) CEO Mark Zuckerberg also defended the company’s massive AI spend for 2025. Zuckerberg believes that it is the right time to invest in AI and earn huge benefits and returns from it in the long term. Despite tech companies’ optimism, investors remain concerned about their extravagant AI expenditures and the return potential.

Is Amazon Stock a Buy or Sell?

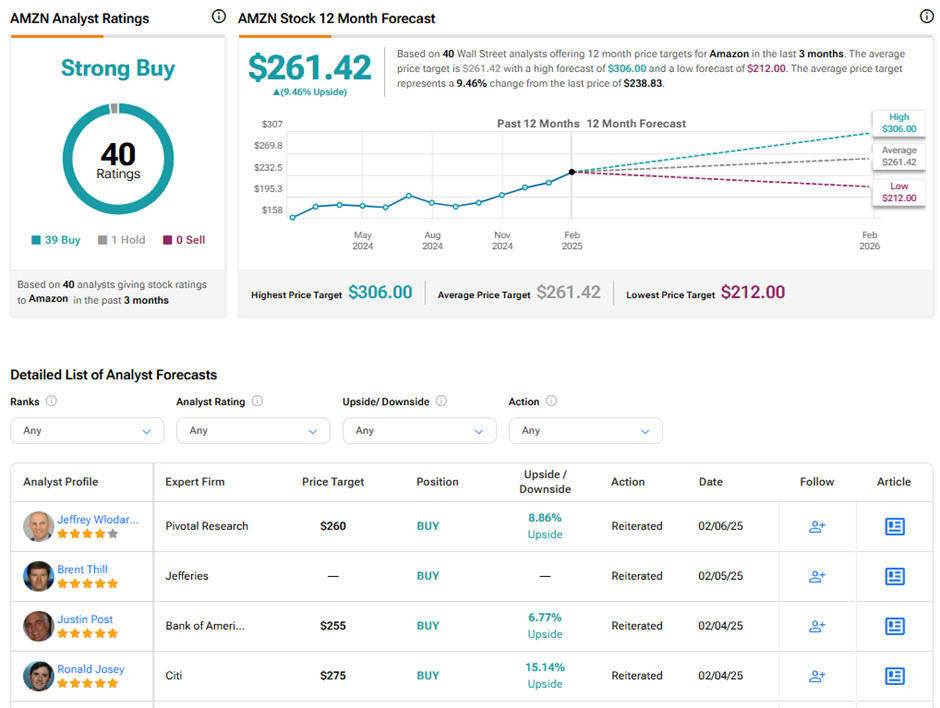

Wall Street remains optimistic about Amazon stock. On TipRanks, AMZN stock has a Strong Buy consensus rating based on 39 Buys and one Hold rating. The average Amazon.com price target of $261.42 implies 9.5% upside potential from current levels. In the past year, AMZN stock has gained over 40%.