E-commerce giant Amazon (AMZN) is reportedly laying off around 200 employees in its North America Stores team, according to an internal message seen by Business Insider. The cuts affect workers across the U.S., including a San Diego-based team known as F2. These changes are part of a broader effort to restructure teams for improved efficiency.

Stay Ahead of the Market:

- Discover outperforming stocks and invest smarter with Top Smart Score Stocks

- Filter, analyze, and streamline your search for investment opportunities using Tipranks' Stock Screener

A company spokesperson explained the decision by saying that adjustments were made to the North America Stores team in order to better align with the company’s priorities. However, the company is providing support to affected employees during their transition. The move reflects Amazon’s ongoing focus on improving as it looks to fend off competition from China‘s Temu (PDD) and Shein.

This comes shortly after The Information reported that Amazon plans to shut down its “Prime Try Before You Buy” service, which allowed customers to try clothing before committing to a purchase. Amazon stated that the service had limited reach and that customers increasingly preferred using its AI-powered tools for virtual try-ons and size recommendations.

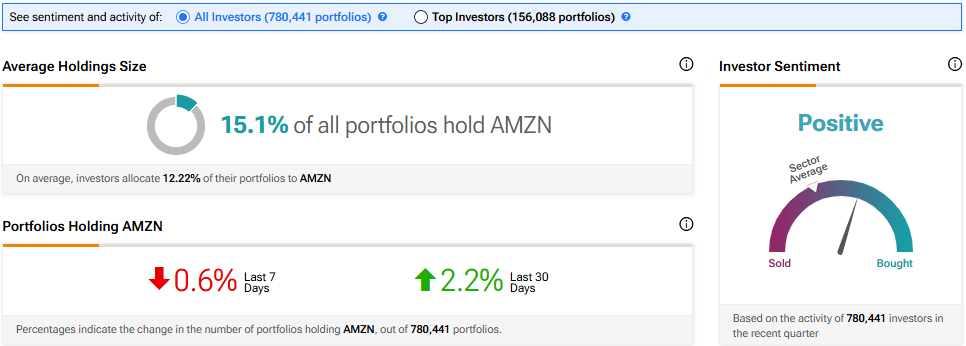

Investor Sentiment

Investor sentiment appears to be Positive at Amazon, as 2.2% of investors holding shares of AMZN increased their positions in the last 30 days. In addition, out of the 780,441 portfolios tracked by TipRanks, 15.1% hold AMZN stock with an average portfolio weighting of 12.22%. This suggests that investors of the company are still very confident about its future.

Is Amazon Stock Expected to Rise?

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMZN stock based on 48 Buys and one Hold assigned in the past three months, as indicated by the graphic below. After a 45% rally in its share price over the past year, the average AMZN price target of $250.67 per share implies 13.6% upside potential.