Amazon (AMZN), with a fleet of tens of thousands of delivery vehicles on city streets, is eyeing country roads in its latest attempt to grab more market share. The e-commerce giant plans to invest $4 billion to expand its same-day delivery network into rural America.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

Rural expansion has been a formidable challenge to online retail, as it entails logistical complexities such as lower population density and great distances between delivery points. However, Amazon appears uniquely positioned to fill this “vacuum.” In my view, the prospects of retail expansion alongside booming AI and cloud opportunities support a compelling long-term Bullish position.

Beyond the Big City: Essentials Drive Rural Strategy

One of Amazon’s most significant value propositions is its ability to deliver products the same day or within one to two days. While this convenience is widely available in urban areas, it hasn’t yet reached many rural communities. That’s about to change. Amazon is rapidly upgrading its logistics network to better serve less-populated regions, with plans to expand Same-Day and Next-Day delivery to over 4,000 smaller cities, towns, and rural communities across the U.S. by year’s end. This expansion will include more than 200 new delivery stations, covering upwards of 13,000 ZIP codes.

The initiative focuses on what Amazon calls “speed-critical” everyday essentials—items like pet food, cleaning supplies, and diapers—products customers typically want within 24 hours. These categories are playing a key role in Amazon’s retail growth. By building out a logistics network that supports near-instant delivery, Amazon is driving higher engagement and repeat purchases, creating a powerful flywheel that reinforces customer loyalty and boosts sales volume.

Amazon Takes on Walmart’s Heartland

Amazon is setting its sights on reshaping daily life for rural consumers, many of whom have limited access to traditional retail options beyond Walmart (WMT). Walmart currently holds a strong position in these markets, with over 4,600 stores nationwide, many of which are strategically located in rural communities. The company is also investing heavily in expanding its delivery infrastructure in these areas.

However, Amazon’s growing presence and rapid logistics expansion could pose a significant challenge to Walmart’s e-commerce momentum. By offering faster delivery of essential goods, Amazon may begin to erode Walmart’s dominance in rural retail, setting the stage for intensified competition.

Assessing Amazon’s Growth Engines

Amazon’s push into rural markets presents a significant opportunity to unlock tens of millions of new potential customers—an expansion that could meaningfully boost growth in its Online Stores segment. This core business generated $57.4 billion in revenue during the first quarter of 2025, representing a 5% year-over-year increase. While still substantial, this segment represents Amazon’s slowest-growing division, underlining the importance of tapping into new demographics to sustain momentum.

By contrast, Amazon’s high-margin businesses continue to drive overall performance. Amazon Web Services (AWS) posted almost $30 billion in Q1 revenue, up 17% year-over-year, while its Advertising segment grew 18% to $13.9 billion. Thanks to AWS and advertising, Amazon’s profit margins hit an all-time high of 11% in the first quarter.

In the lower-margin, high-volume retail space, scale is everything. That’s why expanding access to rural customers is essential for maintaining long-term growth in Amazon’s e-commerce operations.

A Premium Price: Is Amazon’s Growth Already Baked In?

The market, in all its glorious wisdom, has AMZN priced for significant growth as evidenced by a P/E (forward) of 34.99, nearly double that of its peers in the Consumer Discretionary sector. However, AMZN’s premium valuation appears justified by its growth, which overperformed its peers by 331.41% in the past year (10.08% versus 2.34% sector median).

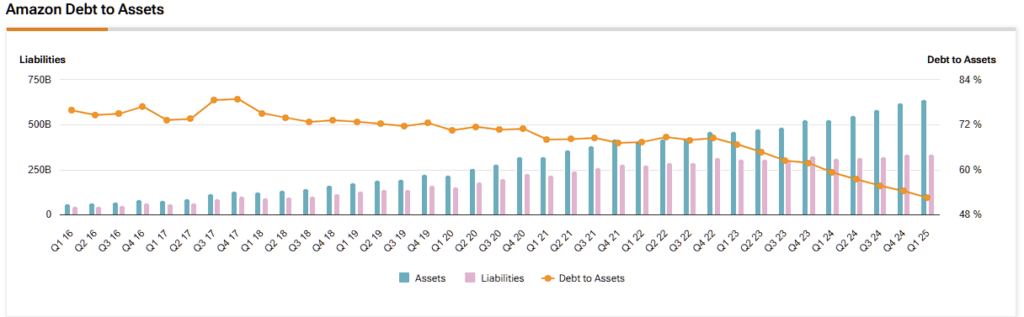

Thankfully, Amazon has plenty of firepower to advance its troops into rural communities, boasting cash and short-term investments of $94.56 billion as of March 2025. The company has also deleveraged itself significantly, allowing it to take on some risks and reduce its debt-to-assets ratio significantly, as shown by TipRanks data.

Is Amazon Stock a Good Buy Right Now?

On Wall Street, AMZN sports a Strong Buy consensus rating based on 48 Buy, one Hold, and zero Sell ratings in the past three months. AMZN’s average price target of $243.24 implies almost 10% upside potential over the next 12 months.

JP Morgan analyst Doug Anmuth recently reiterated his Buy rating on AMZN, setting a price target of $240. Among the key factors supporting his outlook, Anmuth highlighted the strength of Amazon’s logistics network, stating: “Amazon’s regionalization of its logistics infrastructure has driven meaningful efficiency gains, lowering the cost to serve and accelerating delivery times. This strategy has led to a significant increase in same-day delivery volumes, a trend that is likely to continue as the company expands its network of small-package delivery stations.”

Amazon’s Rural Expansion Signals Next Wave of E-Commerce

In conclusion, Amazon’s planned expansion into rural America represents a logical and promising next step in its retail evolution. Despite logistical challenges and increasing competition from established players like Walmart, Amazon is well-positioned to succeed. No longer just a destination for electronics and convenience buys, the company is steadily becoming a preferred source for everyday essentials, fueling meaningful growth in its core e-commerce business.

This rural expansion supports a more sustainable retail growth trajectory, while Amazon’s strong performance in cloud computing (AWS) and advertising adds diversification and resilience. Few companies are positioned to capitalize on multiple trillion-dollar market opportunities the way Amazon is. Given this breadth and depth, it’s understandable that Wall Street remains bullish, even with the stock trading at a premium valuation.