Amazon (AMZN) is significantly expanding its logistics and supply chain offerings. The e-commerce giant’s multi-channel fulfillment (MCF) service, which already handles orders from platforms like Etsy (ETSY) and TikTok Shop, is being expanded to include major marketplaces like Walmart (WMT), Shopify (SHOP), and Shein.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

This expansion will allow merchants to manage a single pool of inventory across multiple sales channels, reducing excess stock and boosting inventory turnover. For Amazon, it is a strategic step toward becoming a full-service, end-to-end supply chain partner for businesses of all sizes.

Under the latest expansion, Amazon will fulfill orders placed through select Walmart Marketplace sellers, with similar support coming to Shopify and Shein merchants.

The move is expected to be beneficial for merchants. According to Dharmesh Mehta, Amazon’s VP of Worldwide Selling Partner Services, merchants using both Multi-Channel Fulfillment and Fulfillment by Amazon (FBA) together see a 19% drop in out-of-stock products and a 12% increase in inventory turnover.

AMZN Streamlines Logistics with GenAI

To further simplify global trade, Amazon is using generative AI to streamline the customs clearance process for both its own logistics operations and third-party sellers.

By automating document processing, improving accuracy, and reducing manual effort, this technology helps accelerate cross-border shipments and reduce costly delays.

Moreover, Amazon is launching a new global warehousing and distribution service that will allow sellers to store products in bulk near their manufacturing sites at a lower cost.

This service will enable merchants to ship goods to destination countries as needed, helping them keep products in stock and ready for fast delivery.

The company plans to open facilities in “every major manufacturing location,” with initial sites in China and Vietnam expected to launch later this year. Over time, the network will expand to Europe, Indonesia, and India.

Is Amazon a Buy, Hold, or Sell?

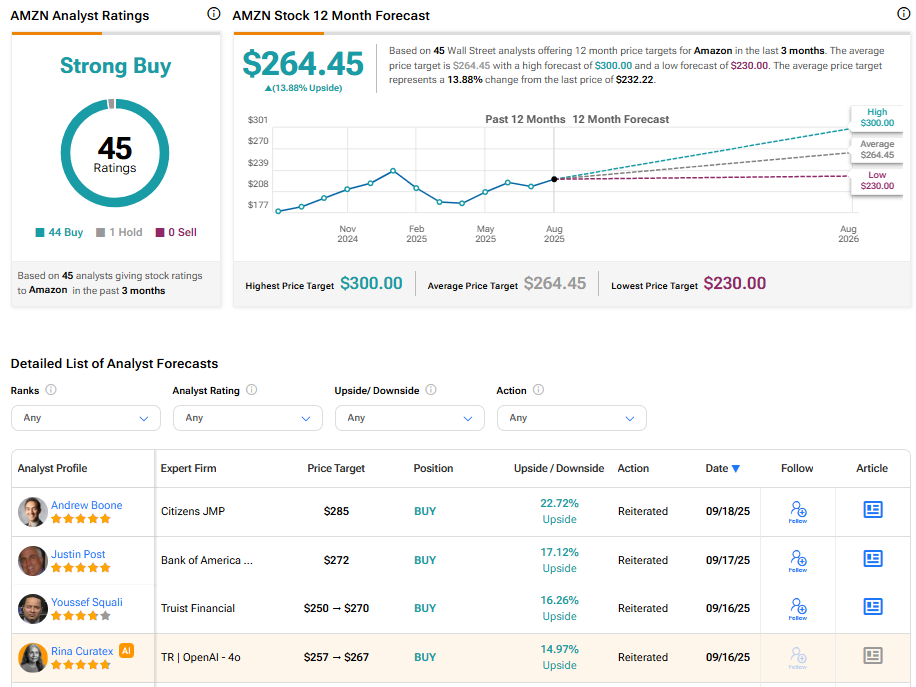

Turning to Wall Street, AMZN stock has a Strong Buy consensus rating based on 44 Buys and one Hold assigned in the last three months. At $264.45, the average Amazon stock price target implies a 13.88% upside potential.