Tech giant Amazon (AMZN) has become a major player in online advertising because many businesses pay to promote their products through ads on its shopping website. Now, Amazon wants to go even further by helping companies buy ads all over the internet, not just on its own platforms. In order to convince advertisers to use its system instead of competitors like Google (GOOGL) and the Trade Desk (TTD), Amazon has lowered its service fees from 5%-7% to just 1%. It’s also offering discounts to companies that use both its cloud services and its ad-buying system.

It is worth noting that although Google is currently the biggest name in online advertising, it is facing a legal battle that might force it to sell parts of its ad business. If that happens, Amazon has a chance to become a bigger player, but that might also draw more attention to the firm due to its growing influence. In fact, what makes Amazon special is the massive amount of data it has on what people buy, which helps advertisers reach the right customers. As a result, while Google and Apple (AAPL) continue to limit the ability to track users with cookies, Amazon’s data becomes even more valuable for targeting ads.

Nevertheless, even with these advantages, Amazon still has some problems it needs to solve. For example, many advertisers say that its system is slower and harder to use compared to competitors like the Trade Desk, which allows companies to launch ad campaigns much faster. Some also worry that Amazon’s ads don’t always appear on high-quality websites. To fix this, Amazon is working to improve its technology by listening to advertiser feedback.

Is Amazon Stock Expected to Rise?

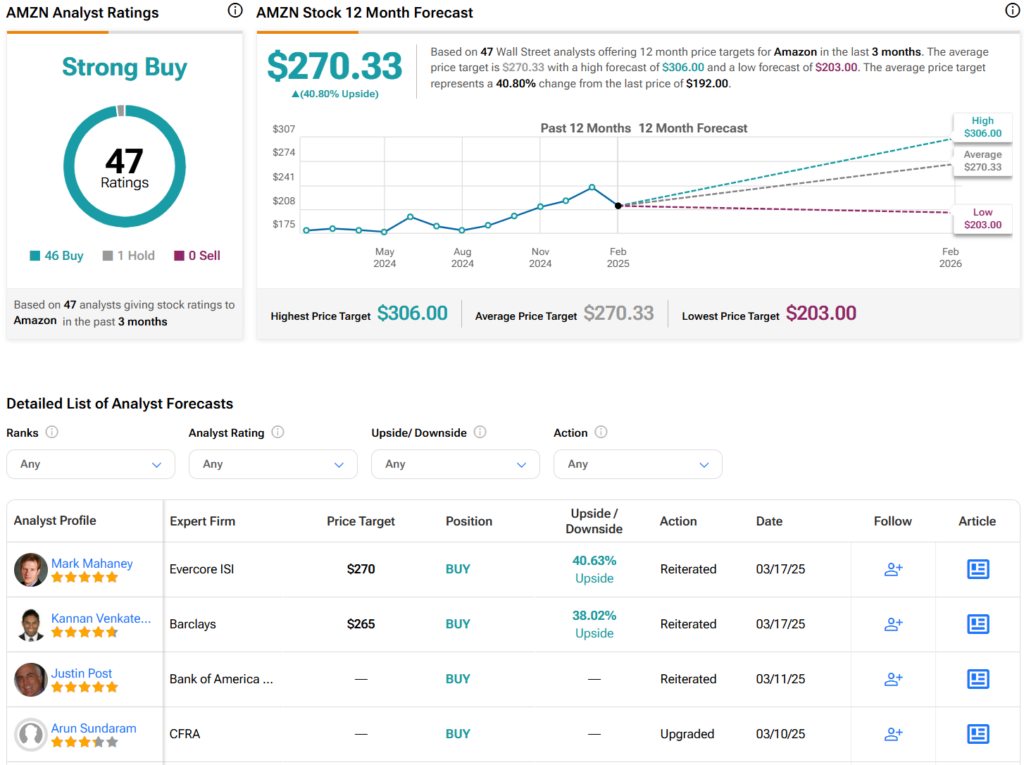

Turning to Wall Street, analysts have a Strong Buy consensus rating on AMZN stock based on 46 Buys and one Hold assigned in the past three months, as indicated by the graphic below. Furthermore, the average AMZN price target of $270.33 per share implies 40.8% upside potential.

See more AMZN stock analyst ratings

Questions or Comments about the article? Write to editor@tipranks.com