The stock of Applied Materials (AMAT) is down 5% after the semiconductor equipment maker delivered forward guidance that left analysts and investors underwhelmed.

Discover the Best Stocks and Maximize Your Portfolio:

- See what stocks are receiving strong buy ratings from top-rated analysts.

- Filter, analyze, and streamline your search for investment opportunities with TipRanks’ Stock Screener.

The Silicon Valley-based company reported earnings per share (EPS) of $2.38 on revenue of $7.17 billion for the quarter ended Jan. 26. That was better than the $2.28 a share in profit and $7.15 billion in sales forecast on Wall Street. Sales were up 7% from a year earlier.

Despite the top and bottom line beats, management at Applied Materials sounded a dour note, saying that escalating geopolitical tensions and soft demand for memory chips used in consumer electronics are likely to negatively impact sales of its chipmaking equipment this year.

Glum Outlook

Furthermore, management at Applied Materials said that revenue from China, the company’s largest market by revenue share, is under threat from tighter U.S. restrictions on exports of chipmaking technology to the nation of 1.4 billion people. Sales to China in the just completed quarter accounted for 31% of Applied Materials’ total sales, down from 45% a year earlier.

Consequently, Applied Materials forecast earnings of $2.30 a share and revenue of $7.10 billion for the current first quarter of the year. The earnings outlook was basically inline with Wall Street forecasts of $2.29, while sales fell short of the $7.21 billion expected among analysts. The stock of Applied Materials, the largest U.S. semiconductor equipment maker, have been flat over the past 12 months.

Is AMAT Stock a Buy?

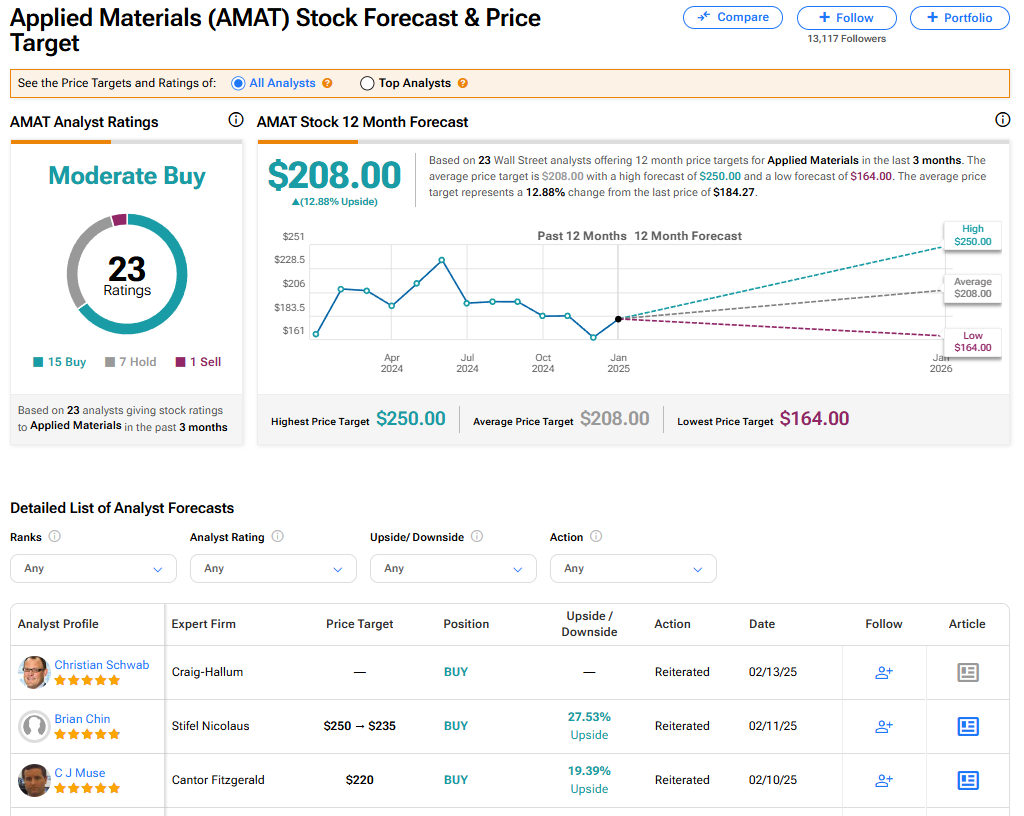

The stock of Applied Materials has a consensus Moderate Buy rating among 23 Wall Street analysts. That rating is based on 15 Buy, seven Hold, and one Sell recommendations assigned in the last three months. The average AMAT price target of $208 implies 12.88% upside from current levels. These ratings are likely to change after the latest financial results.