Shares of Applied Materials (AMAT) fell in after-hours trading after the chip company reported earnings for its fourth quarter of Fiscal Year 2024. which included a soft outlook. Earnings per share came in at $2.32, beating analysts’ consensus estimate of $2.19 per share. Sales increased by 4.9% year-over-year, with revenue hitting $7.05 billion. This also beat analysts’ expectations of $6.96 billion.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

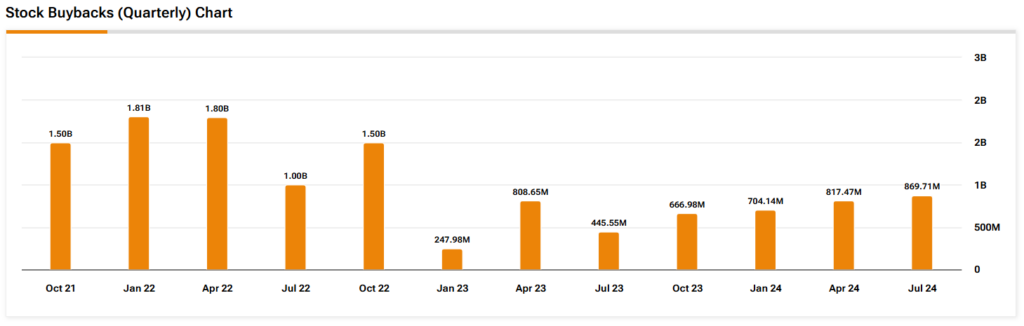

In addition, AMAT returned over $1.77 billion to shareholders during the fourth quarter. Dividends made up $329 million, while buybacks made up the remaining $1.44 billion. This was funded by the $2.58 billion in cash it earned from its operations. The firm has regularly repurchased its shares in each of the most recent quarters (as demonstrated in the image below).

Outlook for 2025

Looking forward to Q1 2025, management provided the following outlook:

- Revenue of $7.15 billion (plus or minus $400 million) versus estimates of $7.25 billion

- Adjusted earnings per share of $2.29 (plus or minus $0.18) compared to expectations of $2.27

As you can see, guidance was mixed, which is likely what contributed to the stock’s after-hours move to the downside.

What Is the Target Price for AMAT?

Turning to Wall Street, analysts have a Moderate Buy consensus rating on AMAT stock based on 16 Buys, eight Holds, and zero Sells assigned in the past three months, as indicated by the graphic below. After a 21% rally in its share price over the past year, the average AMAT stock price target of $238.43 per share implies 28.2% upside potential. However, it’s worth noting that estimates will likely change following today’s earnings report.