The stock of Molson Coors (TAP) is down after the Canadian beer maker warned that aluminum tariffs are likely to hurt its profits this year.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

The company, which is co-headquartered in Montreal and Chicago, forecast a bigger drop in its annual profit due to tariff impacts on the cost of its aluminum beer cans. Management also cited macroeconomic uncertainty in the U.S. as a reason for its gloomy outlook.

The company, which produces most of its beer at U.S.-based breweries in Colorado, nevertheless faces a 50% tariff on aluminum metal that’s shipped into the U.S. In June of this year, U.S. President Donald Trump doubled the aluminum tariff from 25% previously.

Alcohol Spending

Molson Coors says that President Trump’s fluctuating tariff policies have pressured consumer spending and led people to pare back their discretionary spending on items such as alcohol. As a result, the company expects its annual earnings to decline 7% to 10% compared to its prior forecast of a low single-digit increase.

For this year’s second quarter, Molson Coors reported that its net sales fell 1.6% to $3.2 billion, but came in ahead of analyst estimates of $3.1 billion. The company posted Q2 earnings per share (EPS) of $2.05, beating consensus estimates of $1.83. TAP stock has fallen 13% this year.

Is TAP Stock a Buy?

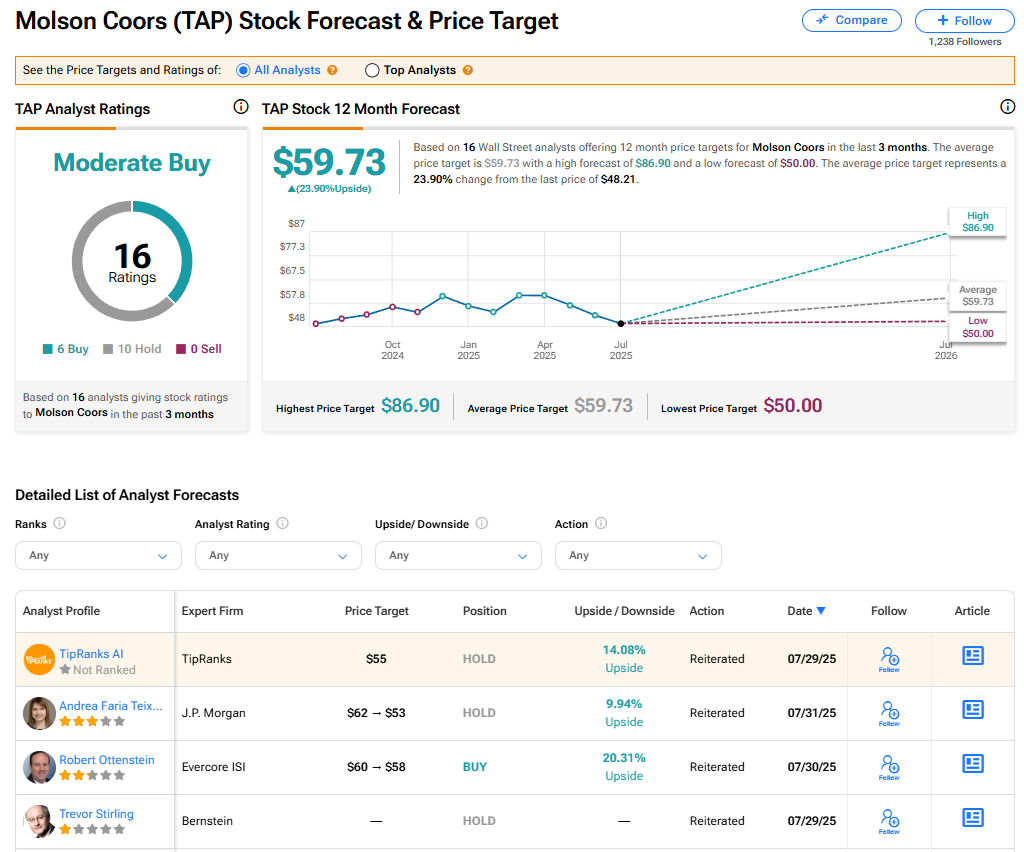

The stock of Molson Coors has a consensus Moderate Buy rating among 16 Wall Street analysts. That rating is based on six Buy and 10 Hold recommendations issued in the last three months. The average TAP price target of $59.73 implies 23.90% upside from current levels. These ratings are likely to change after the company’s financial results.