Shares of tobacco giant Altria Group (NYSE:MO) fell in trading after the company narrowed its FY23 guidance. The company now expects adjusted diluted earnings to range from $4.91 to $4.98 per share, indicating a growth rate of 1.5% to 3% year-over-year. This was lower than the company’s prior forecast between $4.89 and $5.03 per share and analysts’ forecasts of $4.99 per share.

Elevate Your Investing Strategy:

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

The company’s adjusted earnings came in at $1.28 per share in Q3, as compared to analysts’ consensus estimate of $1.29 per share. Altria’s revenues (net of excise taxes) declined by 2.5% year-over-year to $5.3 billion in the third quarter. This missed analysts’ expectations of $5.4 billion.

Is MO a Good Stock to Buy?

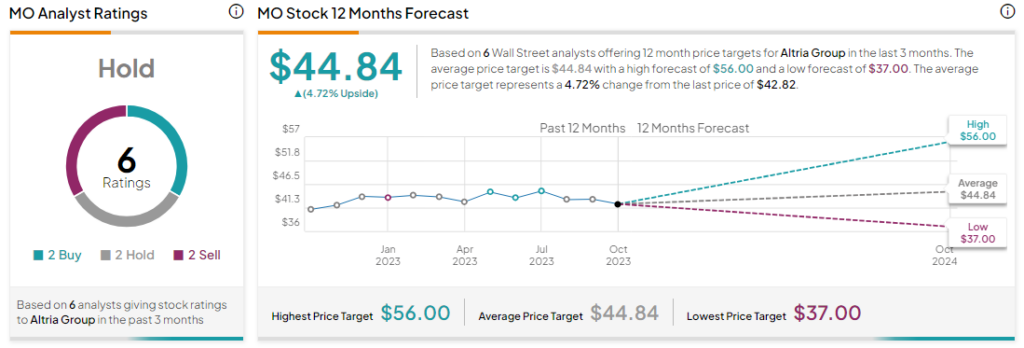

Analysts remain sidelined about MO stock with a Hold consensus rating based on two Buys, Holds, and Sells each. The average MO price target of $44.84 implies an upside potential of 4.7% from current levels.