Altria Group (NYSE:MO) shares ticked higher in the early session today after the tobacco major announced its fourth-quarter results and a $1 billion share repurchase program.

Claim 50% Off TipRanks Premium

- Unlock hedge fund-level data and powerful investing tools for smarter, sharper decisions

- Stay ahead of the market with the latest news and analysis and maximize your portfolio's potential

Lower sales in the smokeable products segment resulted in total revenue ticking lower by 1.2% year-over-year to $5.02 billion. This impact was partially offset by higher net revenue in the oral tobacco products segment. EPS of $1.18 landed in line with estimates.

At the same time, Altria has expanded the distribution reach of its NJOY ACE products by 40,000 stores to 75,000 stores. These stores make up 75% of Altria’s e-vapor volume and 55% of cigarette volume in the U.S. Since June 2023, the company has shipped 23 million NJOY consumable units and 1.3 million NJOY devices.

Further, Altria has announced a new share repurchase program worth $1 billion. For Fiscal Year 2024, Altria expects adjusted EPS in the range of $5 to $5.15. For its 2028 goals, the company aims to deliver compounded EPS growth in the mid-single digits.

What Is the Future of MO Stock?

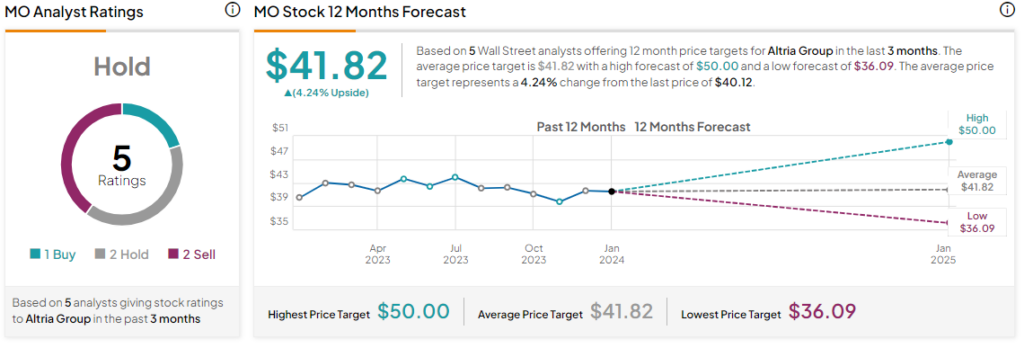

Overall, the Street has a Hold consensus rating on Altria. After a nearly 11% decline in the company’s share price over the past year, the average MO price target of $41.82 implies a modest 4.2% potential upside in the stock.

Read full Disclosure