Altria Group (MO) has embarked on a remarkable 42% climb over the past year. Such performance is no small feat, especially for a tobacco company that has long faced unease over declining cigarette volumes and tightening regulations. Over the years, we have seen firsthand how external factors, like an improving regulatory climate and internal strengths, including Altria’s tireless commitment to returning capital to shareholders, have fueled this momentum. As a result, I’m bullish on the stock.

Confident Investing Starts Here:

- Easily unpack a company's performance with TipRanks' new KPI Data for smart investment decisions

- Receive undervalued, market resilient stocks right to your inbox with TipRanks' Smart Value Newsletter

Even though Altria’s dividend yield has dropped from ~10% a year ago to about 7.5% today, following the stock’s price appreciation, it still offers one of the highest yields among large-cap U.S. stocks and stands well above the sector average of 2.5%. In fact, with the Trump Administration pressuring the Fed for prompt rate cuts, a reliable high-yield stock like Altria has become even more appealing for income-focused investors.

The Forces Behind Altria’s Rally

The changing regulatory climate has recently been one of the most critical shifts for tobacco giants. Altria and its peers, including Philip Morris (PM) and British American Tobacco (BTI), have long grappled with mounting restrictions and occasional threats of outright bans on specific product categories. Yet, today’s environment is more productive than just a few years ago. Take the FDA’s intensified crackdown on illicit e-vapor products, for instance, which has given compliant market leaders like Altria a level playing field. Early last year, the FDA proposed requiring tracking numbers on all imported vapor products, which Altria advocated for, as it should reduce black-market competition.

Additionally, state attorneys in multiple jurisdictions and the District of Columbia recently began lawsuits against importers and distributors of illegal e-vapor products. I believe this renewed focus on enforcement could significantly benefit Altria, which has invested heavily in regulatory compliance and brand integrity. Eliminating unauthorized players curtails illicit products and ensures that leading brands such as NJOY remain well-positioned for future growth.

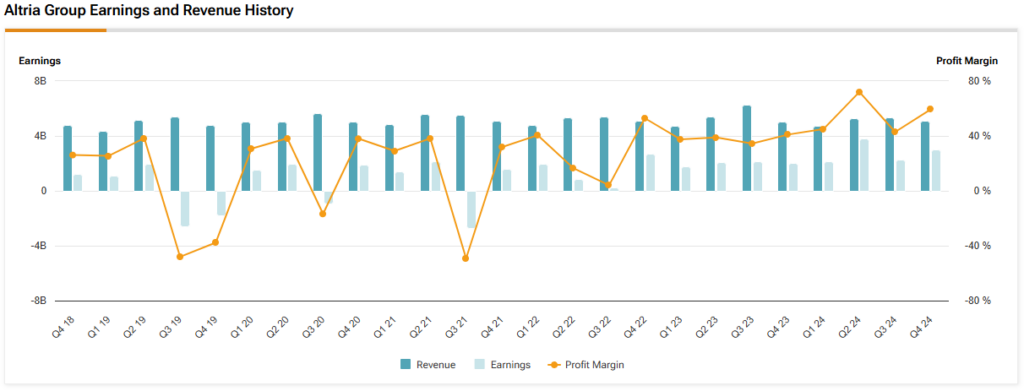

Another Year of Record Profits

Considering that 2024 was another year of record profits for the tobacco giant, along with the factors I just mentioned, you can see why investor enthusiasm remains high.

To begin with, Altria again demonstrated a balanced act of core tobacco pricing and efforts to expand alternative nicotine offerings. Sure, cigarette volumes continued to slide by 8.8%, which aligns with the broader industry’s long-term trend. Yet, Altria’s management easily offsets these volume pressures by increasing prices across its premium smokable products. Note that Marlboro, the flagship brand, remains a category leader in the premium cigarette space, allowing Altria to pass through price hikes without ceding much market share.

At the same time, the company’s foray into the smoke-free arena is paying dividends. NJOY, Altria’s e-vapor business, gained a notable 6.4% retail share by the end of Q4, while its nicotine pouches registered an impressive 44% year-over-year shipment increase. Industry trends indicate that consumers are shifting toward smoke-free alternatives based on a growing health-conscious consumer base, and Altria appears committed to meeting that demand. Importantly, this trend is set to reduce future reliance on traditional cigarettes.

Another crucial element of Altria’s success in the quarter was its operating margin expansion. Throughout the year, the company implemented cost-control measures that, combined with higher pricing, spurred a meaningful boost in adjusted operating income for both the smokable and oral tobacco segments. Thus, adjusted EPS rose 3.4% to a record $5.12 for the year, demonstrating that Altria can still grow profits in a marketplace that skeptics often dismiss as stagnant.

The Appeal for Income Investors

Importantly, FY2024 was a record year for Alitra’s adjusted EPS. Management’s outlook for FY2025, which targets adjusted EPS between $5.22 and $5.37, implies a growth rate of 2-5% from the previous year. Consequently, Altria is likely to extend its superb dividend record.

Along with Altria’s 55-year streak of consecutive annual dividend increases, which reminds us of management’s unwavering focus on growing shareholder returns and the stock’s lofty yield, I believe that Alitra remains a great pick for income investors. The stock’s forward P/E of about 10 should also provide a meaningful margin of safety.

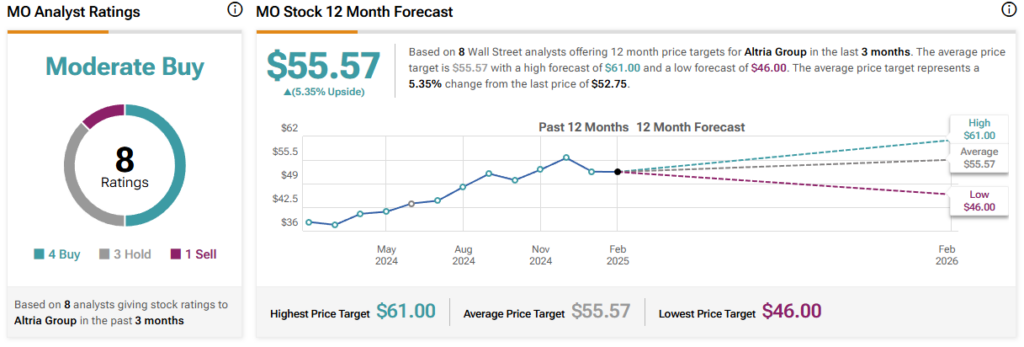

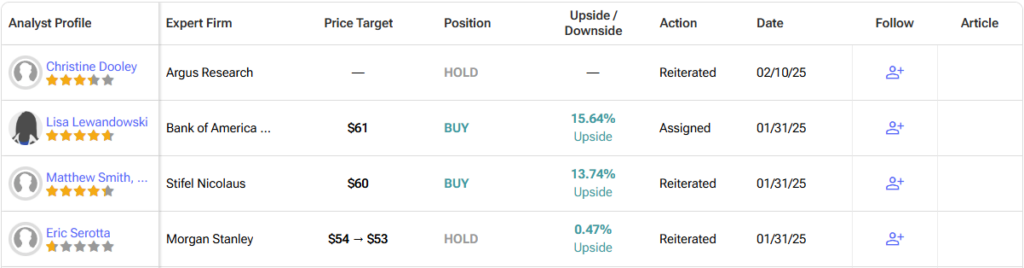

Is Altria a Buy, Sell, or Hold?

On Wall Street, MO stock carries a Moderate Buy consensus rating based on four Buy, three Hold, and one Sell ratings over the past three months. MO’s average price target of $44.57 per share implies approximately 5.4% upside potential over the next twelve months.

Altria’s 55-Year Dividend Record Supports Long-Term Growth

Altria’s dividend growth story remains firm, with a record FY2024 adjusted EPS and further EPS growth projected for FY2025. The company’s 55-year streak of annual payout hikes, combined with a still cheap valuation and its overweight dividend yield, continues to make the tobacco giant one of the most compelling picks for income-oriented investors looking for predictable payouts in today’s market environment.

Looking for a trading platform? Check out TipRanks' Best Online Brokers guide, and find the ideal broker for your trades.

Report an Issue