XRP (XRP-USD), Cardano (ADA-USD), Dogecoin (DOGE-USD) and Bitcoin (BTC-USD) all dropped sharply Monday as traders braced for what some are calling an “economic nuclear war.” Markets are reeling under the pressure of new U.S. tariffs, with Bitcoin now trading under $79,000 and major altcoins slipping past critical support levels. XRP, ADA, and DOGE are all flashing warning signs for investors.

XRP Completes Bearish “Head-and-Shoulders” Pattern

XRP has fallen to $1.90 after breaking below the key $2.00 support. According to CoinDesk, that drop completed a bearish “head-and-shoulders” pattern. This type of pattern often signals the start of a larger move down. The RSI is sitting near 30, which suggests the token is almost oversold. XRP also failed to climb back above its 21-day EMA at $2.20. That level is now acting as resistance. Right now, sellers are clearly in control.

ADA Broke Below its 50-Day Moving Average

Cardano’s ADA isn’t in much better shape. It dropped to 55 cents and broke below its 50-day moving average. That level had been supporting the price since mid-March. The MACD just flipped negative, which usually signals a loss of bullish momentum. If the price slips to 35 cents, that would mark a 30% decline from current levels. That same level was tested back in late 2024.

DOGE Broke Through Support

Dogecoin has dropped nearly 15% in 24 hours, now trading at $0.16. It broke through support at 18 cents. On the 4-hour chart, a death cross has formed. That’s when the short-term moving average crosses below the long-term one. Traders usually see that as a sign of a deeper downtrend. The RSI is at 28, meaning DOGE is deep in oversold territory. But unless it can climb back above $0.21, any bounce might be short-lived.

Bitcoin Dips Under $79K as Fears of 1987 Repeat Rattle Stocks

Zooming out, Bitcoin isn’t immune to this mess. BTC fell to $76,186 as fears over U.S. trade tariffs sent the S&P 500 and Nasdaq down nearly 6%. Cointelegraph quoted Holger Zschaepitz saying, “Trump’s tariff announcement this week has wiped out $8.2 TRILLION in stock market value.” Jim Cramer wasn’t much more optimistic, warning on X that “those who bottom-fished are sleeping with the fishes.”

Hashrate Milestone Overshadowed by Address Scam and FTX Woes

Even a major Bitcoin milestone got lost in the chaos. BTC Frame reported the network hit a hashrate of over 1 Zetahash for the first time—a thousandfold increase since 2016. But security concerns clouded the achievement. According to cypherpunk Jameson Lopp, “address poisoning” scams are ramping up, tricking users with fake lookalike addresses.

On top of that, nearly 400,000 FTX creditors may lose $2.5 billion in repayments if they don’t complete KYC by June 1, according to a U.S. Bankruptcy Court filing. The original deadline passed last month.

Altcoin Carnage Could Continue if Stocks Keep Sliding

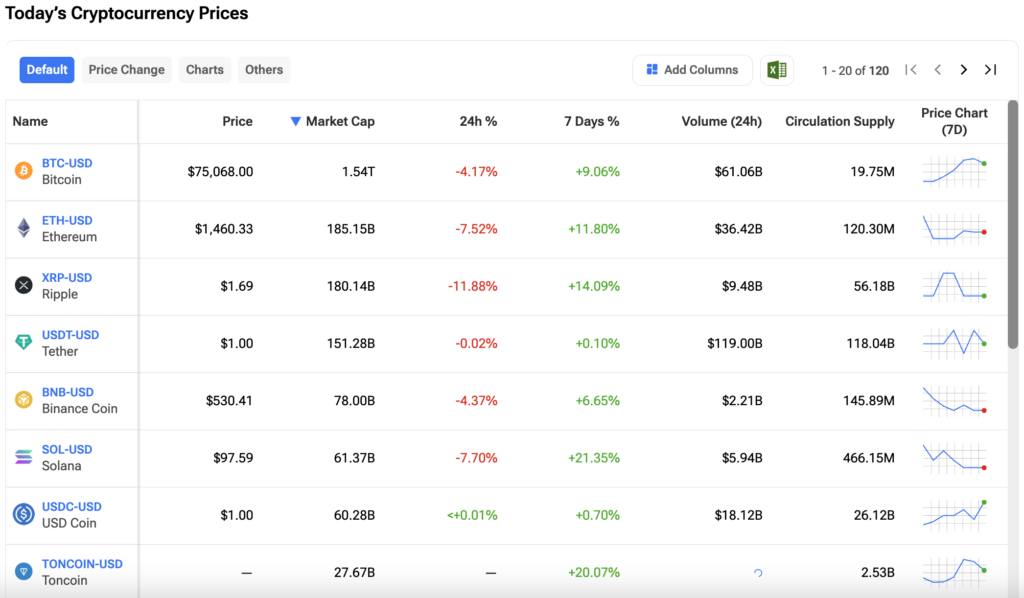

With macro chaos, broken technicals, and bearish sentiment everywhere, altcoins may still have more pain ahead. Traders like Daan Crypto Trades told Cointelegraph they’re expecting a major move soon — but whether that’s up or down depends on how stocks open the week. For investors trying to stay on top of the action, you can track live price changes, performance charts, and technical analysis for your favorite tokens on the TipRanks Cryptocurrency Center.