The first half of 2025 may have been forgettable for Alphabet (GOOGL) investors, but the outlook for the second half appears much more promising. In addition to a potential macroeconomic recovery that could boost tech valuations, Alphabet’s currently compressed valuation stands out, especially given that analysts still forecast double-digit growth for both revenue and earnings, though with slightly more tempered expectations than earlier in the year.

Don’t Miss TipRanks’ Half-Year Sale

- Take advantage of TipRanks Premium at 50% off! Unlock powerful investing tools, advanced data, and expert analyst insights to help you invest with confidence.

- Make smarter investment decisions with TipRanks' Smart Investor Picks, delivered to your inbox every week.

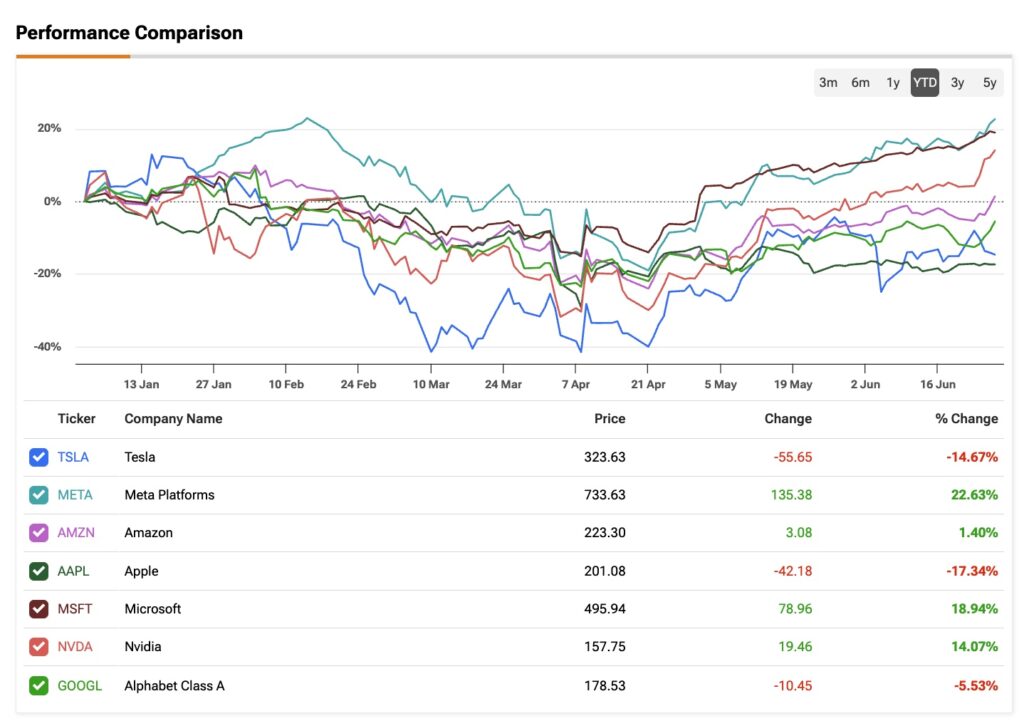

According to market data, GOOGL stock is lagging behind the broader benchmarks, such as the S&P 500 (SPY), by approximately 8%.

However, given the current gloom, today’s market environment presents a compelling Buy opportunity for GOOGL, with a potential rebound likely on the horizon.

Why Alphabet’s 2025 is a Struggle

Just over half of 2025 so far has seen Alphabet’s shares perform quite poorly, lagging not only the broader market but also ranking as the third-worst performer within the Magnificent 7 group, down about 5.5% year-to-date. Only Tesla (TSLA) and Apple (AAPL) have done worse, as Tip Ranks data shows.

Although GOOGL is a stock with a beta historically in line with the broader market, given a correlation of around 1.01, its recent performance has deviated from the norm, mainly due to factors that I would say stem from a perception hit by company-specific concerns.

A significant factor was the substantial increase in capital spending on AI infrastructure. Alphabet announced earlier this year that it plans to spend around $70 to $75 billion on CapEx in 2025. Naturally, this bump in spending has weighed on short-term margins. The same thing is happening with other mega-techs, but the market seems to view peers like Microsoft (MSFT) more favorably — for example, because it’s seen as capturing returns faster (thanks to its OpenAI partnership and Azure integration), which are already highly monetizable.

So, in a sense, I think Alphabet has been perceived as something of a runner-up in the AI “arms race.” I would argue Apple has faced a similar perception drag, and it’s been the worst-performing Mag 7 stock this year.

Another factor weighing on Alphabet is that, unlike Microsoft and Amazon, it’s a hyperscaler with a more concentrated business: about 56% of its revenue still comes from Search. While Google Cloud has been a big part of its growth story in recent years, the rise of AI has raised—and arguably still raises—questions about whether LLM models like ChatGPT could chip away at Google’s search dominance.

Why Minor Slowdowns Trigger Major Concerns

As the market is pricing in what’s most likely to happen with the business one or two years down the line, past performance is a useful benchmark but does not guarantee that the company will keep delivering at the same pace.

Take the outlook for the Search business: concerns are valid, but it’s still growing at a solid rate. In Q1, reported at the end of April, revenue was up 10% compared to the same period last year, marking the seventh straight quarter of double-digit annual growth. That said, this was a slight slowdown from the 12.5% growth seen in Q4 and during the first two quarters of 2024.

The key point here is that the bar is exceptionally high. This is a $200 billion-a-year business that’s still expanding strongly despite new AI platforms competing for the same ad dollars. So even modest signs of a slowdown are enough to set off alarm bells.

The weak share performance over the past six months reflects exactly that—lower projections for the coming years. Since the start of the year, analysts have trimmed 2027 EPS estimates by about 2% and cut 2029 forecasts by as much as 5%. Likewise, revenue projections for 2025 are down nearly 1% compared to the original January outlook, with similar downward revisions extending across the next five years.

What’s Behind GOOGL’s Compressed Multiples

To get a clearer picture of Alphabet’s underperformance this year and whether the stock deserves a higher valuation, it’s worth breaking down a few points. First, trading at 18.6x earnings right now, GOOGL sits about 23% below its five-year average multiple but still roughly 33% above the sector average. In my view, that premium is well justified by its leadership position and rock-solid fundamentals.

However, a reverse discounted cash flow (DCF) analysis can help us better understand what these compressed multiples actually imply and what the market is factoring in.

Based on the latest estimates, the Street expects Alphabet’s revenue to grow over the next five years at a CAGR of about 10.5%, with EPS growing at a CAGR of 14.8%. If we conservatively assume nothing changes in the mix—steady buybacks and stable rates—and use EPS growth as a rough proxy, the operating margin would gradually reach around 40.4% by 2029.

Now, if we assume CapEx continues to take up a big slice of revenue—say, 13% over the next five years—and there’s no major change in working capital, plus a weighted average cost of capital (WACC) of 8.5% and a terminal growth rate of 2.5%, then Alphabet’s implied equity value would be about $2.78 trillion. That’s roughly 30% above its current market cap of $2.12 trillion.

What’s even more interesting is that even if we strip out any bottom-line growth and assume operating margins simply hold steady at the current 32.6% for the next five years, the estimated equity value would still come out to around $2.26 trillion, implying about 7% upside from where the stock trades today.

Is Alphabet a Buy, Sell, or Hold?

Wall Street analysts have a firm bullish consensus on GOOGL stock. Out of the 39 analysts covering the stock, 30 rate it a Buy, and the remaining nine rate it a Hold. GOOGL’s average price target is $200.06, implying an approximately 13.5% upside from the latest share price.

Why Alphabet Could Be Poised to Bounce Back

Based on market growth estimates, it’s hard to argue that Alphabet isn’t attractively priced right now, with a solid margin of safety after this year’s weakness.

While this might seem like a no-brainer, I believe that for the rest of 2025, alongside an improving backdrop for tech stocks in general, Alphabet has room to outperform if it continues to ramp up its Cloud business and shows clear signs of offsetting any slowdown in Search. If that happens, market sentiment should shift accordingly, and positive revisions, combined with today’s depressed valuations, could open the door for significant upside ahead.