Tech giant Alphabet (GOOGL) is scheduled to report its Q1 earnings on Thursday, April 24, after the market closes. Investors are watching closely, not just for revenue and profit numbers, but for signs that Alphabet’s aggressive push into AI (artificial intelligence) is starting to pay off. Overall, analysts remain bullish on the company’s AI momentum and ability to navigate economic headwinds.

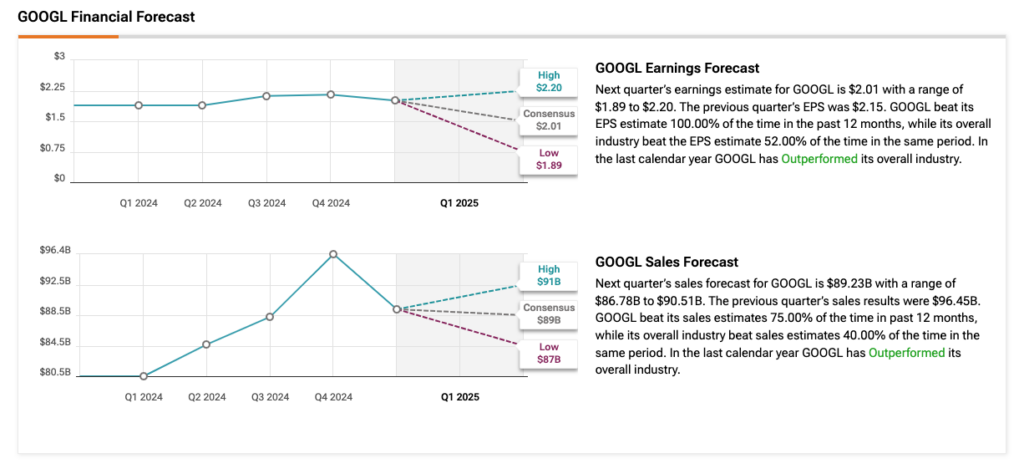

Notably, Alphabet is expected to report first-quarter revenue of $89.23 billion, reflecting an 11% year-over-year increase. Meanwhile, earnings per share (EPS) are projected at $2.01, up from $1.89 per share in the same period last year.

Analysts Stay Bullish

Analysts at Citi and Morgan Stanley recently confirmed their Buy ratings on GOOGL stock ahead of Q1 results.

Citi analysts recently shared their view that Google has great potential for growth with its advancements in AI. They mentioned how tools like Google’s AI Mode in Search and the new version of its Gemini large language model could help improve search results and offer even more valuable services to users. Additionally, Citi pointed out that Google Search will be least affected by broader economic issues, backed by its strong and consistent user base.

Meanwhile, Morgan Stanley pointed to Alphabet’s integration of AI across Google Search and YouTube as a key driver behind its confidence in the company’s long-term growth potential. It added that the company’s new AI features on these platforms makes them smarter and more useful for users, potentially unlocking new growth opportunities.

Earlier this month, CEO Sundar Pichai reaffirmed the company’s $75 billion capex guidance for 2025 despite ongoing economic tariff uncertainties. This investment will primarily fund AI and cloud infrastructure.

A Significant Roadblock

Another key point of discussion in Google’s upcoming earnings report will be its ongoing antitrust battle with the Federal Trade Commission (FTC). Investors will be watching closely for updates, especially after a federal judge recently ruled that Google illegally controlled two major segments of the online advertising market.

The outcome of this case could carry long-term implications for Google’s core ad business, making it a major concern for shareholders and investors.

Is Google a Buy, Sell, or Hold?

According to TipRanks, Wall Street analysts have a Moderate Buy consensus rating on GOOGL stock based on 27 Buys and 10 Holds assigned in the past three months. The average GOOGL price target of $197.45 per share implies a 31% upside potential.